For months leading into BFCM, many retailers braced for a familiar challenge: rising operating costs, persistent inflationary pressure, and increasingly price-sensitive consumers. The expectation was that shoppers would pull back, and that average order values (AOVs) might follow.

But BFCM 2025 delivered a different story.

Despite cost pressures, shoppers kept spending at nearly the same levels as last year. Across the full season, AOV rose just 3%, buoyed by a 4.8% increase in average selling price (ASP). In other words, consumers bought slightly fewer items per order, but they were willing to pay slightly more for each one.

Discounting discipline could also be responsible for this year’s stable AOVs. Retailers leaned into relevance, loyalty, and convenience during the holiday season, not blanket discounting, which helped protect margins in a year when every point of profitability mattered.

Below, we break down what happened, why this shift matters, and how leading brands can use these insights to shape a more profitable 2026.

Prices nudge up, but only slightly

Across almost every major ecommerce vertical, order values held strikingly steady this BFCM. Apparel, home & garden, health & beauty, and food & beverage all saw modest YoY increases in AOV without any dramatic spikes.

This is meaningful. After several years of heightened promotional pressure, a trend that especially defined the early 2020s DTC wave, brands have pulled back. They’ve raised prices where necessary, but not aggressively. And shoppers haven’t pushed back as much as expected. Price elasticity softened.

Here’s why:

- Shoppers made fewer, more intentional purchases. Product views were up 41% across the weekend, with a 28% increase in product views per order, meaning that consumers scrutinized before they clicked “buy,” but they did click.

- Repeat customers drove more of the growth. Repeat purchases were up nearly 14% YoY. These high-intent shoppers are more resilient to small price increases, and they trust the brands they return to.

- Discount pressure eased. Throughout BFCM, discount rates fell YoY as brands became more precise rather than aggressive. Apparel, home & garden, and sporting goods saw divergent patterns, but the aggregate trend was clear: smaller incentives didn’t deter shoppers.

These factors created the conditions for AOV to remain stable even as ASP climbed.

Brands buy themselves margin, not just revenue

The 3% increase in AOV was almost entirely attributable to the 4.8% rise in ASP. That means shoppers slightly reduced unit quantity per order, but not enough to erode order-level value.

On Cyber Sunday, the highest-growth day of the weekend, the dynamic was even stronger:

- AOV rose 6.4%.

- ASP rose 5.4%.

This is a textbook example of what disciplined pricing can deliver: higher value per purchase without eroding demand. The bottom line is better unit economics and healthier margins.

The inflation story: what worked and why

Retailers still faced rising costs related to goods, shipping, labor, and marketing in 2025. Yet the 4%+ ASP increase shows brands were able to pass some of those costs through without alienating shoppers.

That’s rare during a peak season known for discount dependency. This BFCM, several factors shaped improved pricing power for brands:

Brands moved away from blanket deals

Discounts dropped 10% YoY across the season. Apparel nudged up and home & garden dipped, but overall, retailers held their positions.

The rise of text and cross-channel orchestration reduced friction

With text revenue up ~25% YoY across Black Friday, with text volume up 34%, brands reached shoppers in the moments they were most ready to buy, regardless of price sensitivity. Text messaging also helped clarify shipping windows, promote relevant bundles, and support higher-value purchases.

Better segmentation protected margin

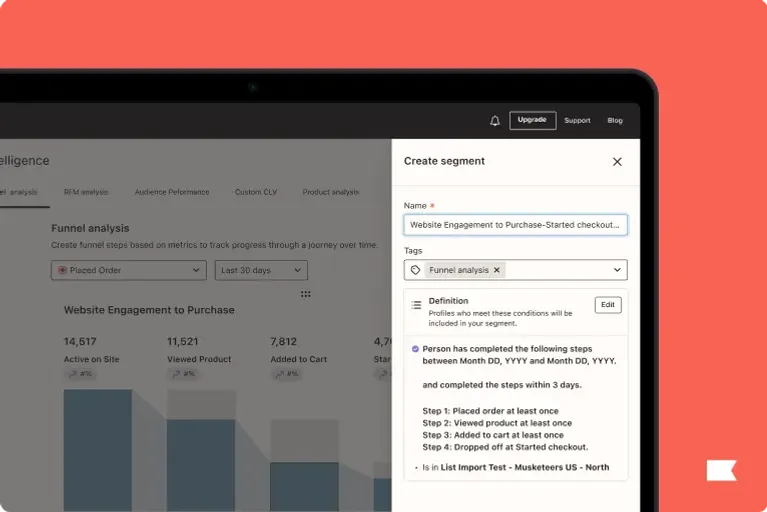

Brands increasingly used predicted-spend and VIP tiers, as well as historical intent, to decide who should receive which discounts.

K:AI Customer Agent and Customer Hub improved conversion efficiency

Shoppers who asked pricing questions or needed guidance got real answers quickly from both humans as well as AI tools that were trained on brand voice and FAQs. That builds trust, and trust supports better margins.

4 ways to turn stability into strategy

AOV stability in an inflationary market is a sign of brand health, but it’s not automatic. Here’s how to continue strengthening order values while protecting margins:

1. A/B test bundles vs. discounts

In many cases, the most profitable lever isn’t lowering price. It’s raising cart size. To find out if that’s true for your brand, run the following test:

- Bundle 2–3 complementary items as a small incentive.

- Test the bundle vs. a standard dollar or percent-off discount.

Bundles often win on both revenue and margin.

2. Use post-purchase cross-sells to increase AOV

The moment after someone buys remains one of the most underutilized opportunities in ecommerce. Use flows to recommend:

- Refills

- Add-ons

- Care accessories

- Adjacent categories

This lifts order value without relying on discounts.

3. Segment by predicted spend

High-spend customers don’t need aggressive offers, but low-spend or price-sensitive customers might. Use predicted lifetime value and predicted AOV to shape:

- Discount depth

- Email/SMS cadence

- Product recommendations

- Shipping threshold prompts

4. Be transparent about pricing

During periods of price sensitivity, unclear fees or hidden shipping costs kill conversion. So do sales you say end at midnight that actually last another two days. Make sure your website and marketing materials contain transparent details on:

- Price and product comparisons and options during browsing

- Pricing, including fees, taxes, and shipping

- Actual discount and sales periods

- Shipping timelines

This is especially important as agentic commerce becomes more prominent in the consumer discovery phase and surfaces pricing earlier in the journey.

Margin discipline is the new growth strategy

The biggest insight from this year’s BFCM wasn’t about discounts, channels, or even AI. It was about discipline.

With inflation still shaping both retailer costs and consumer psychology, the brands that won were the ones that used email, SMS, web, and AI to strengthen relevance rather than slash prices.

The years ahead won’t reward the deepest discounts. They’ll reward the smartest ones. And if AOV’s resilience this season is any indication, shoppers are ready for that shift.

Read Klaviyo’s BFCM 2025 Recap report