This year, BFCM was defined less by the size of the discounts and more by the sophistication behind them. For years, brands have relied on heavier promotions to capture attention in an increasingly noisy holiday season. But this year marked a shift: retailers held the line on discounts, focused more on loyalty than liquidation, and still delivered record-setting performance.

From Klaviyo’s point of view, with billions of daily customer interactions and tens of billions in annual revenue flowing through customer campaigns, the story is clear: brands that understood their customers didn’t need to race to the deepest discount. They needed to offer the right incentive to the right shopper at the right moment.

A record season without record discounts

Even with a more disciplined approach to promotions, this BFCM was the biggest ever for Klaviyo brands. Same-site sales were up 11% YoY, driven in part by rising average selling prices (+4.8%), which lifted average order value (AOV) 3% across the weekend. On Black Friday alone, Klaviyo customers had generated more than $1 billion in sales—a first.

And it wasn’t just big brands hitting new highs. Nearly 20,000 Klaviyo customers recorded their best sales day ever between Thanksgiving and Cyber Monday this year. That breadth of success underscores the importance of brands prioritizing strengthening relationships with their best customers.

Repeat purchases were up nearly 14% YoY, compared to a 9% lift among new buyers. Early-access drops, segmented VIP offers, and tailored experiences helped many brands accelerate ahead of the discount surge.

What shoppers really responded to: context-driven discounts

Across ecommerce, overall discounts fell nearly 10%, from 29.6% last year to 26.2% this year. This may seem slight, but it breaks a multi-year trend of rising promotional intensity. Some verticals held firm: apparel discounts, for example, nudged up slightly. Food & beverage, however, saw some of the steepest YoY declines in discounting.

But the real insight lies in how shoppers responded across price points.

In the heat map from our subject line discount analysis, shoppers behaved differently based on the AOV of the brand:

- Low-AOV brands saw the strongest open rates when discounting in the 20–29% range.

- Mid- and high-AOV brands performed best in the 30–39% range.

In other words, discount elasticity isn’t universal. It’s contextual, and it’s shaped by price point, category, customer expectation, and the perceived value of the product. Many brands found that moderate discounts were enough to drive engagement and sales because their audiences were already primed through personalized marketing leading up to the holiday.

Cyber Monday was the discount peak, but not the whole story

Small Business Saturday took the crown for deepest discounts of the season. Discount rates peaked at roughly ~28% on SMB Saturday in the US, compared to ~24% on Thanksgiving and ~26% on Black Friday.

Brands weren’t blanketing consumers with steep promotions all weekend. Instead, they rewarded early BFCM shoppers over the weekend, pairing them with segmented offers, inventory drops, and time-sensitive reminders.

Why discounts performed differently this year

Several macro dynamics shaped discount behavior this season:

1. Prices are higher, and consumers know it

The average selling price rose 4.8% YoY, meaning that for many retail categories, a smaller discount still delivered meaningful savings for the consumer.

Consumers also compared more, clicked more, and waited for deals that felt personalized, not generic. Product views were up 28% across the BFCM.

2. Brands invested earlier in their best customers

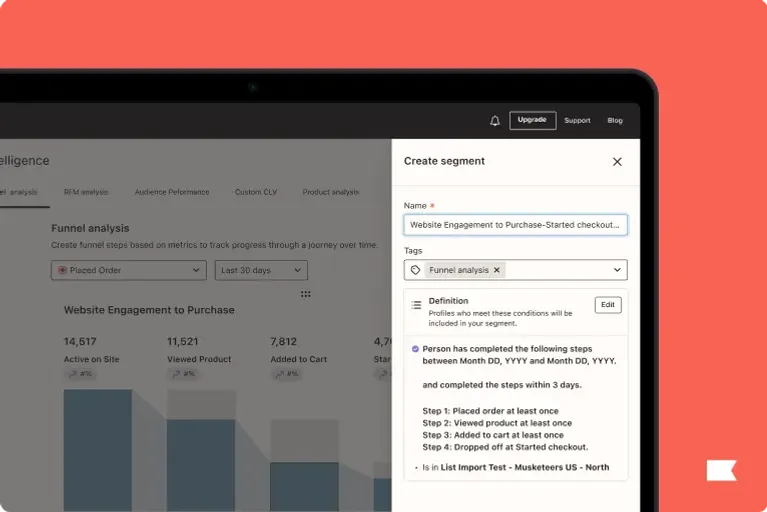

Repeat buyers drove the largest YoY revenue growth. Brands used segmentation, early access, and VIP programs to front-load demand.

A fashion retailer that cleaned up their data and targeted repeat customers saw a 79.3% lift in revenue and doubled unique conversions, for instance. An athletic apparel retailer that used Klaviyo’s RCS messaging and K:AI Customer Agent saw a 30% lift in revenue per recipient, and dramatically reduced friction for shoppers who were unsure about what to buy.

When customers feel seen, discounts don’t need to be deep. They just need to be relevant.

3. Light discounters saw some of the strongest growth

One of the most counterintuitive findings from this year’s data is that brands offering the smallest discounts saw some of the healthiest sales growth. These brands relied more on personalization, lifecycle timing, and AI-powered recommendations to drive intent, not aggressive markdowns.

When demand is strong and customer understanding is deep, steep promotions aren’t the growth lever. Precision is.

A more disciplined, more data-driven BFCM

Across the board, BFCM 2025 was a story of restraint and results. Brands pulled back on blanket promotions and leaned into relationships, personalization, and AI-assisted engagement. Consumers, meanwhile, were more intentional, more price-sensitive, and more willing to browse before buying.

Get Klaviyo’s BFCM 2025 Recap report