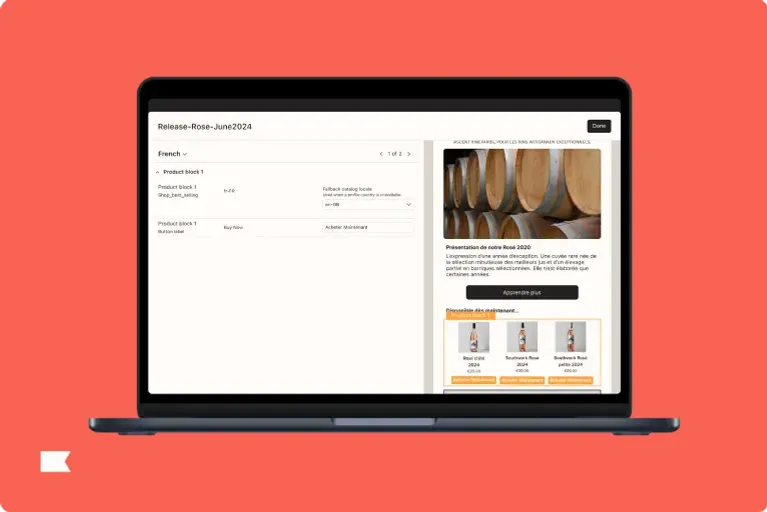

A step-by-step guide to integrating email & SMS

Learn how leading brands orchestrate email and SMS channels effectively to deliver the right message through the right medium at the right time.

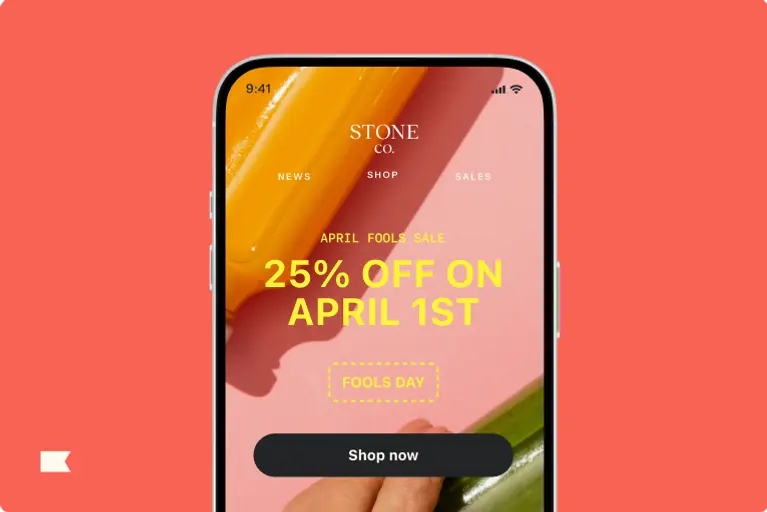

We’ve marked this calendar with 150+ dates marketers need to know for 2026: holidays, seasonal promotions, and even quirky celebrations like National Cookie Day.

Explore Klaviyo's library of resources to help you build smarter digital relationships

Learn how leading brands orchestrate email and SMS channels effectively to deliver the right message through the right medium at the right time.

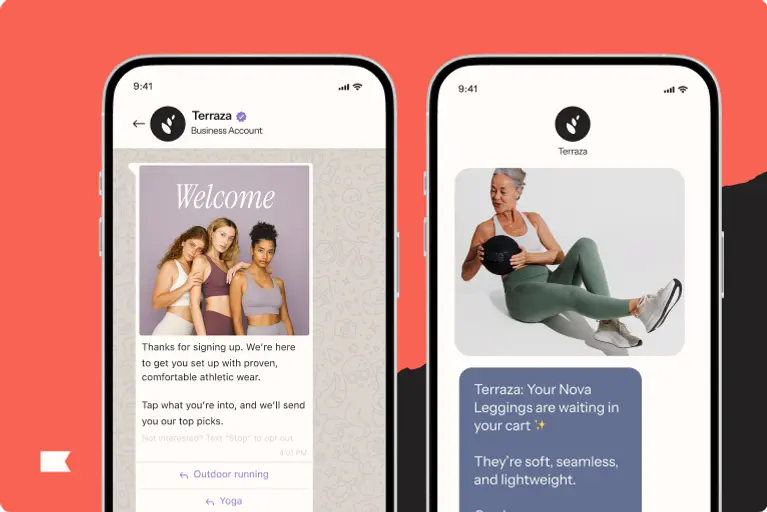

Unlock sustainable revenue growth through SMS with proven strategies and best practices drawn from thousands of successful businesses. Learn how to build and optimize your SMS program.

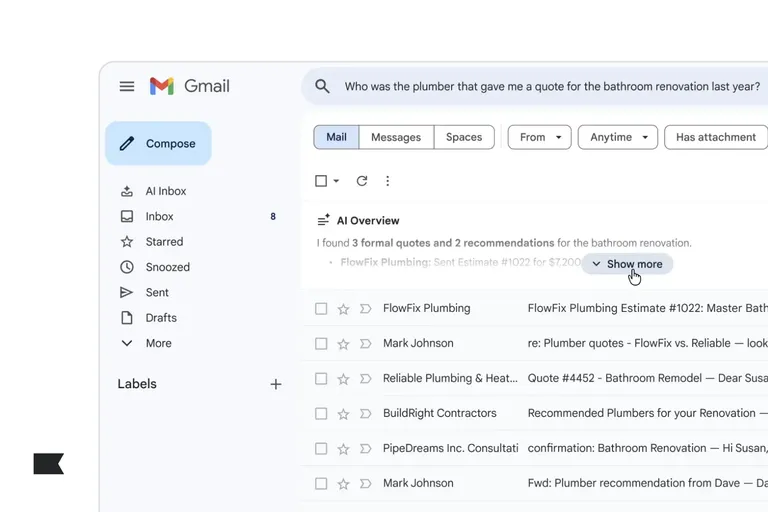

Drawing from thousands of successful businesses, discover core principles and actionable best practices that will help you craft an effective email program that drives sustainable growth and revenue.