In my role as director of retention at digital marketing agency Kulin, I’m based in Canada and work mostly with US brands. I’m sure it won’t come as a surprise that I’ve developed a very SMS-first mindset.

If you had asked me a year ago which mobile channel to prioritize, I would have said, “Klaviyo SMS, obviously.” WhatsApp felt like something my friends used when they were travelling, not a serious marketing channel.

Then I started working with more global brands.

One client in particular sells in the US, but also has major markets in the UK, Germany, and France. When we signed them, we did the usual: optimized email, then identified an opportunity for text message marketing. As we were planning their international rollout, WhatsApp became available in Klaviyo.

Here are the 3 guiding questions I use to determine when a brand should use WhatsApp for a certain region.

Guiding question 1: What are people actually using?

I’d love to say that, when working with my US client who was expanding into Europe, I immediately suggested WhatsApp for their European audiences. I didn’t.

I pulled up the pricing page and looked at credits. My first instinct was to recommend SMS because it was cheaper than WhatsApp in certain regions. Thankfully, the client pushed back.

Their feedback was blunt and helpful: “No one here uses SMS. Everyone uses WhatsApp.”

So we did what good partners should do: we listened, tested, and launched WhatsApp alongside email for their UK and German audiences.

The results over Black Friday Cyber Monday (BFCM) were incredible, especially considering how small the list was at the beginning. Revenue from WhatsApp quickly proved that my “but SMS is cheaper” mindset was the wrong starting point.

The real first question is: “In this region, what channel do people actually use every day?” You should only look at cost after you answer that question.

Yes, credits matter. But a cheaper channel that no one pays attention to is not cheaper in practice. It’s just waste.

Yes, credits matter. But a cheaper channel that no one pays attention to isn't cheaper in practice. It's just waste.

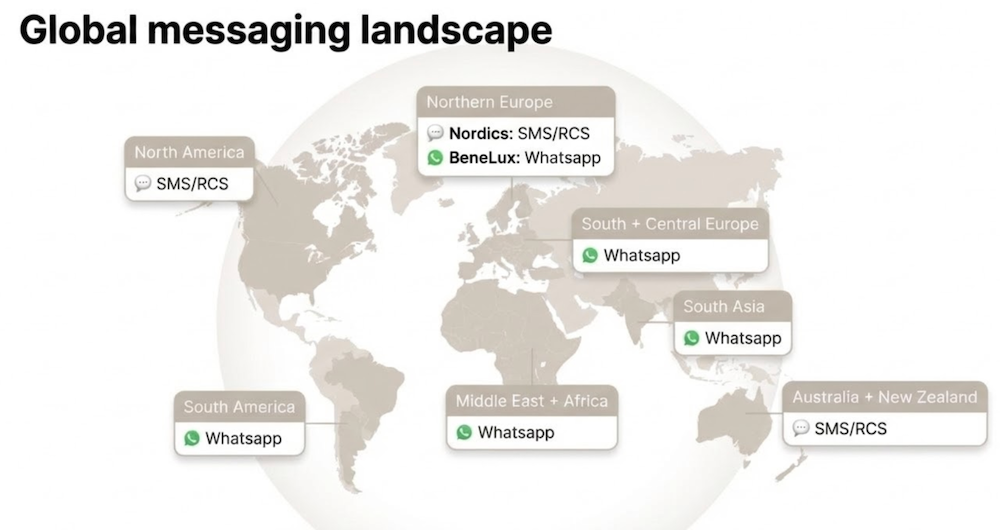

For most brands I work with, the rule that guides our decision-making looks like this:

- North America: Start with text messaging.

- Many parts of Europe and Latin America: Strongly consider WhatsApp.

“WhatsApp use is relative to the target markets,” says Christian Nørbjerg Enger, co-founder and CPO at Segmento, a fast-growing, full-service marketing agency based in Denmark. “Countries like Germany, the UK, Spain, and Italy are very WhatsApp-native, whereas the nordics are using SMS and Messenger more.”

There will always be nuances and edge cases. But if you lead with penetration and preference instead of price, you will make better decisions.

Guiding question 2: What’s the cost, given your sending cadence?

Once you’ve chosen the right channel for the region, cost becomes the next filter.

Inside Klaviyo, SMS, MMS, WhatsApp, and RCS, and mobile push all roll up under mobile messaging. Different countries and channels use different numbers of credits per message. In the UK, for example, the SMS message we were planning for my client cost roughly half the number of credits of the same WhatsApp message.

That sounds like a strong argument for SMS, until you remember almost no one in the client’s UK audience is reading texts in the first place.

Here’s how I think about cost now:

- Penetration first: If the channel isn’t part of people’s everyday habits, I don’t care how cheap it is.

- Then, message strategy: Once you’re using the right channel, cost should shape how often you send messages and what kind of messages you send.

Once you're using the right channel, cost should shape how often you send messages and what kind of messages you send.

For higher-credit regions, especially with WhatsApp, that means being more selective. For one brand, we sent several WhatsApp campaigns to subscribers in the UK during BFCM, but only one to subscribers in France, because the cost per message was significantly higher.

The rule I use with clients: if the message isn’t important enough to justify the credits, it should probably be an email instead.

Audience segmentation factors in as well. You can think of WhatsApp as a premium marketing channel for exclusive offers. Consider targeting VIPs, repeat purchasers, and/or highly engaged customers to help maximize the ROI of each send.

Sale launches, major product drops, genuinely high-value alerts: those belong on mobile. Small, routine updates might be better suited to email, especially in higher-cost regions.

“We’ve seen huge success in Germany and the UK for a large fashion retailer by using WhatsApp in our welcome series with quiz funnels, and also as follow up for added-to-cart and abandoned check-out flows,” shares Nørbjerg Enger.

We've seen huge success in Germany and the UK for a retailer by using WhatsApp in our welcome series.

Guiding question 3: What features are available?

Cost and reach are the first two lenses. Features are the third.

From a shopper’s perspective, WhatsApp feels richer and more conversational because:

- You can include images and multiple call-to-action buttons without changing the underlying cost structure.

- The format itself is built for back-and-forth communication, so it feels natural to reply, ask questions, and get help.

With standard SMS, rich media often pushes you into MMS, which can be more expensive. That’s where RCS is starting to bridge the gap in supported markets, giving you more visual, app-like messages over the same underlying phone number.

In practice, my experience so far looks like this:

SMS, MMS, and RCS, where available | |

|---|---|

|

|

If you’re just looking at a static pricing grid, you can miss this completely. The right question isn’t just “How much does this cost?” It’s “What kind of experience can I create here that customers will actually engage with?”

For example, “an amazing feature in WhatsApp is the ability to make quiz funnels from start to finish,” says Nørbjerg Enger. “You can use that to gather qualitative data about your customer and show relevant products in relation to what they want.”

An amazing feature in WhatsApp is the ability to make quiz funnels from start to finish. You can use them to gather qualitative data about your customer and then show relevant products.

How to combine SMS and WhatsApp in one Klaviyo flow

One misconception I hear is: “If we add WhatsApp, we’re managing a whole new channel.”

But if you’re using Klaviyo to its full capacity as a CRM, it’s simpler than that.

- Web forms: Collect consent for text messaging and WhatsApp in the same form in a single step. You can also personalize forms for visitors based on location, or based on lists and segments.

- Omnichannel campaigns: Segment audiences by channel for each campaign.

- Channel affinity: This AI functionality helps you identify which channel a subscriber is most likely to engage with next, then automatically route messages there in sequence.

In one client’s abandoned cart flow, we use the following logic:

If country=US | Send SMS |

If country=UK | Send Whatsapp |

You’re not rebuilding your strategy from scratch. You’re choosing the right delivery channel for each audience, then swapping in the appropriate message block.

From a process perspective, that feels much more like optimizing a single mobile strategy than juggling separate platforms.

Reference map

If you’re thinking of expanding your reach, here’s a quick reference you can share with your team to decide between text messaging and Whatsapp.

WhatsApp vs. text messaging: a simple decision framework for 2026

At the end of the day, the most important mindset shift for me has been this: The question isn’t “How do we manage another channel?” It’s “Do we want to reach our customers on the channels they’re already using?”

When you frame it that way, the choice between WhatsApp and text messaging stops being theoretical and starts being obvious, one region at a time.