DTC isn’t dead. It’s evolving.

If an amateur medical examiner took the DTC industry’s pulse, they’d probably tell you it’s dead. But the reality is much more complicated.

In 2020, when shopping online became the only option for consumption, a DTC gold rush seemed inevitable. Ecommerce saw a major revenue and market share spike during the pre-vaccine pandemic—one McKinsey report estimated that in 90 days, the ecommerce market grew as much as analysts predicted it would in 10 years.

It didn’t last.

Ecommerce’s overall market share in the US has reverted more or less to the pre-COVID trendline, according to Mastercard transaction data.

But it’s not that DTC died, exactly—it’s just moving unpredictably. That’s the toughest thing about the industry, according to Ari Murray, VP of growth at Sharma Brands.

“The single biggest challenge is that it can all change so quickly, but you have to plan really far ahead,” Murray says.

The single biggest challenge is that it can all change so quickly, but you have to plan really far ahead.

DTC success requires major up-front investment—in inventory and product development—in spite of staggering uncertainty about what the world will look like when the product ships.

Will shipping costs have skyrocketed? Will the top DTC advertising channel have lost its targeting superpowers and become more expensive, basically overnight?

In 2021, the answers were yes to both.

Now, the companies that bet big on a long-term ecommerce are paying for it.

“There’s certainly a reckoning happening,” Orchid Bertelsen, COO of Common Thread Collective, told CNBC.

But that’s not death. That’s life, sometimes.

So where, exactly, does DTC stand in the current climate? What are the pros and cons of the business model, and the core tactics and tools successful DTC brands rely on? (Yes, successful DTC brands still exist!)

What is DTC?

Direct-to-consumer (or DTC) brands sell consumer packaged goods directly through owned online stores. Many DTC brands also sell through wholesalers like Sephora, or marketplaces like Amazon—but to earn the DTC title, a brand should see revenue from an owned ecommerce storefront.

DTC brands often begin online, in the tradition of DTC pioneers like Warby Parker, Dollar Shave Club, and Casper—in part because online start-up costs are lower than in brick-and-mortar retail stores. For $100 or less, entrepreneurs can buy a web domain, an ecommerce platform subscription, and an automation tool to handle their email and SMS marketing.

The pros and cons of a DTC relationship in today’s world

Today, a modern consumer brand can scale with hardly any DTC presence. Skincare brand Hero Cosmetics recently proved it, getting acquired for a whopping $636M by Church & Dwight—all while selling mainly through Amazon, according to CEO and co-founder Ju Rhyu.

DTC isn’t always the default first retail channel for consumer brands anymore. But it’s still creating serious value for a lot of businesses. We asked our panel of experts to walk us through the pros and cons of the DTC model right now.

Pro: You save on fees from big-box retailers and marketplaces

The costs involved in selling through third-party retailers like Target and Amazon can feel…unwelcoming. Just ask Nyakio Grieco, a first-generation American and the founder of Thirteen Lune.

Early in her career, “I would make it into a national retailer and very quickly, it would be shown to me that I couldn’t afford to be there,” Grieco told Klaviyo.

I would make it into a national retailer and very quickly, it would be shown to me that I couldn’t afford to be there.

Amazon referral, fulfillment, and advertising fees chew up 34% of seller revenue, analyst Scott Galloway estimated in 2021—and Amazon can raise that at any time. For the 2022 holiday season, for example, Amazon added an additional $0.35 seller fee per item ordered, citing inflation.

With a DTC model, you avoid the middleman and associated third-party costs, and it can boost your margins. “For most businesses, you have the most advantageous margins if you can work one on one with your customers,” Murray says. “Beauty, jewelry, clothing—it’s so much better at least to be able to have that relationship to push them even into your stores.”

Con: You’re responsible for your own logistics

You have more shipping options when you DIY your shipping than when you ship through Amazon or another wholesaler. But carrier costs fluctuate, too.

FedEx and UPS both announced 6.9% rate hikes in 2022, blaming inflation. In 2021, both carriers kept their holiday surcharges in place long term, citing heavy demand.

It’s not just domestic carriers that can drive costs up. International shipping costs ebb and flow due to factors like the war in Ukraine and China’s COVID policy.

For example: The cost of sending a shipping container from China to the US grew more than tenfold from 2020 to 2021—jumping from $1.5K to $20K.

“The supply chain is destroying a lot of these DTC brands,” Eric Bandholz, founder of Beardbrand, told Big Technology. “They’re so heavily dependent on China for their products, and shipping costs of bulk containers have gone up astronomically.”

International shipping costs are currently declining, but it’s a risky business to manage your own logistics—market swings can cut deep into your margins.

Pro: You control the entire customer experience

In DTC, your brand controls the whole customer experience—from ads to packaging to follow-up emails. That creates opportunities for custom touches, like:

- Creative segmentation: DTC brands can “personalize communication in a way that just isn’t yet easily available on other platforms,” notes Grace Clarke, a marketing consultant for DTC brands like Graza. This is especially true for mature brands with years of purchasing data at their disposal.

- Ongoing educational content: Portable stove retailer Solo Stove often emails existing DTC customers educational content, from recipes to DIY backyard tips, to add ongoing value to their hardware.

- CTAs to review the product—on any platform: DTC sellers can solicit verified reviews on a platform of their choice; fashion retailer italist went with Trustpilot. Sell through Amazon, and you’ll only get Amazon reviews.

- Funky packaging: DTC companies can create a TikTok-worthy unboxing experience, use compostable packaging to minimize waste, or simply include a warm note, like DTC olive oil brand Graza. Their message includes step-by-step instructions on taste testing your order.

By contrast, with a wholesaler, all of these touchpoints are in the hands of a third party. If something goes wrong, it could leave a bad taste for your brand in customers’ mouths—even if it’s because of a reason beyond your control.

“Let’s say you sell through a grocery store, and the customer has a bad experience—they’re going to think poorly of your brand,” Murray says. “As the brand, you have no idea that any of this happened. But there’s someone who thinks badly of you for an experience you don’t control.”

This is the power of going the DTC route. “Those are the brands that are going to have a direct way to get in front of their customer—they are going to be able to control how often they reach them and in what format,” Clarke says. “You have a lot of brand experience levers that you can pull.”

Those are the brands that are going to have a direct way to get in front of their customer—they are going to be able to control how often they reach them and in what format.

Con: You have to build your audience from scratch

Acquiring your first customers on your own, without the support of a platform like Amazon—which gets about 2.5B visitors per month—will cost you.

Customer acquisition costs are especially high for brands.

CAC is on the rise, thanks primarily to Apple’s privacy update in 2021, which has weakened brands’ ability to target consumers in their social ads.

“I think the biggest challenge for us has been just an overall increase in acquisition cost,” says Ash Melwani, co-founder and CMO at Obvi. “We’re spending more to acquire fewer customers. It hurts the bottom line.”

Not to mention, once you get shoppers into the funnel, the work still isn’t done—especially for new brands with minimal brand awareness. According to Bryan Edwards, co-founder and co-CEO at Snif, conversion requires 6-8 touchpoints with a customer, so startups have to pay for a lot of impressions before seeing conversions.

It’s a challenge that calls for thinking outside the box. “You can’t use money to solve all your problems,” says Natalie Sportelli, head of content at third-party review platform Thingtesting, of the new DTC landscape. “Brands have had to get a lot more creative.”

Pro: You own more customer data

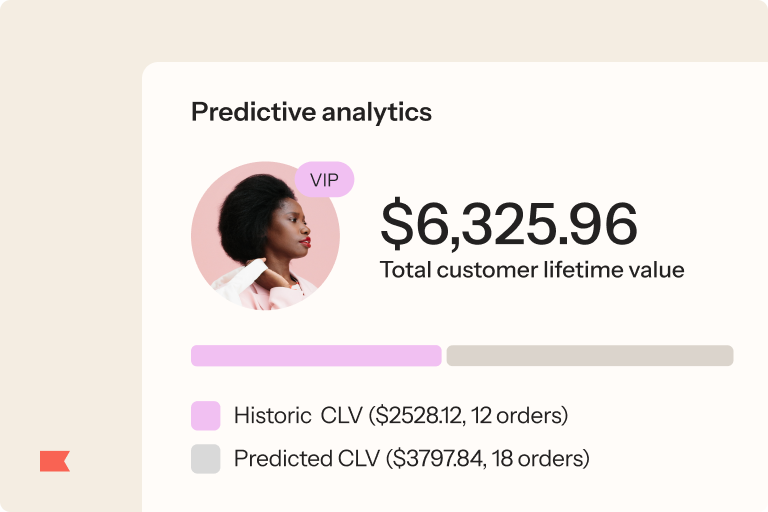

A DTC brand gets total access to their customers’ data—enough to remarket, personalize deeply, and follow up.

“Data-wise, there’s no better place,” Murray says. “You know how much value you get from a customer that’s in Austin, Texas that joined you this year. You know what to predict from that customer. And you’re able to see how they compare to a customer that joined you 2 years ago that lives in Maine.”

You also have the owned connections to gather more data—such as customer demographics, behaviors, and preferences—via vehicles such as surveys and social media posts.

The zero- and first-party data collection opportunities that come with a DTC business help prevent all kinds of missteps—like making decisions based on outdated data reports, Murray notes, or following your competitors’ marketing playbook, Clarke says.

“People who follow other people’s playbooks are going to have less success or a slower path to it, because they are doing what someone is doing for their customer base,” Clarke adds. “You do not necessarily share that same audience.”

People who follow other people’s playbooks are going to have less success or a slower path to it, because they are doing what someone is doing for their customer base. You do not necessarily share that same audience.

Con: It’s harder to build trust

Shopping a new DTC brand, first-time buyers have to buy from a site they’ve never used before. Often, they’re buying a product they’ve never seen firsthand.

Will it look like the pictures? Will it really be made of the materials it claims to be made of? Will it arrive at all?

“People still want to go to the store and shop,” Melwani says. “People still want to hold the product in their hand and see and feel it before they place an order.”

People still want to hold the product in their hand and see and feel it before they place an order.

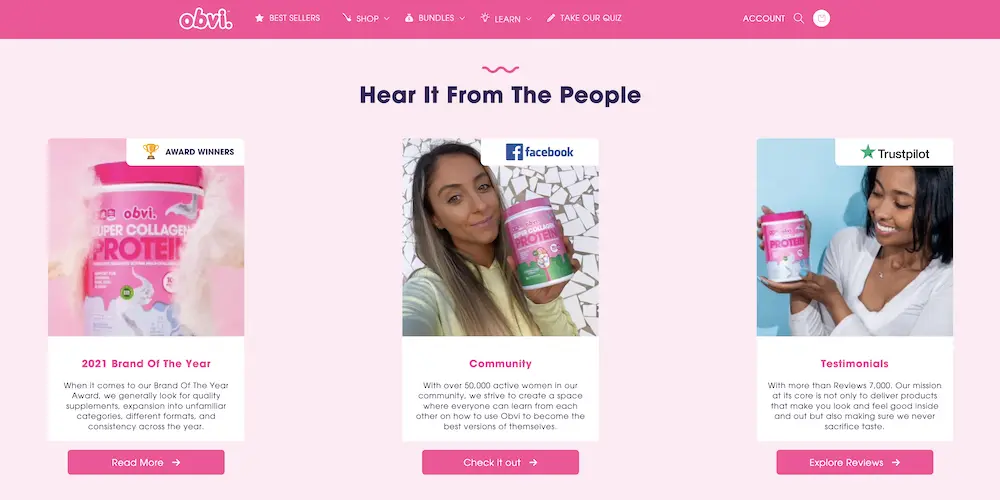

Because of this, it’s important to create trust in your brand as quickly as possible on your DTC site—whether through social proof like ecommerce reviews and customer testimonials, awards and mentions in the press, or offering a type of trial or guarantee around your product.

For example, Edwards’s brand Snif is known for their unique try-before-you-buy concept for all their fragrances—a product that’s traditionally posed a challenge to selling online.

And if your DTC brand is available wholesale, Melwani recommends mentioning it throughout the site.

“Utilizing the fact that you are in retail is proof of concept for your online business,” Melwani says. “It gives that authority to the brand.”

Pro: You can test a new product or brand with minimal overhead

You don’t need glossy storefronts or elaborate infrastructure to set up a slick-looking online store.

“You can start small, look big,” Murray says simply.

“Literally, all you need is a laptop, a Shopify site, product, and you’re off to the races,” Melwani elaborates. “It’s very easy to start direct-to-consumer marketing.”

You can run ads on Facebook or TikTok—or just start by testing organic TikTok, Melwani notes.

“The barriers to entry today for creating a DTC business are as low as they’ve ever been,” Edwards says. “It is a second to learn, but a lifetime to master.”

It is a second to learn, but a lifetime to master.

Brick-and-mortar or wholesale retail, by comparison, starts slower. Launching requires leases and employees, or buy-in from wholesaler retailers—not to mention a lot more up-front cash.

Con: It’s really hard to make DTC work for certain products

Starting your brand with a pure DTC presence “depends on the product, the market, how saturated it is, and who you’re trying to reach,” Clarke says.

Canned water retailer Liquid Death is often cited as a successful CPG brand, but they don’t actually sell DTC. On their owned site, the buy button links out to Amazon.

So why aren’t they following the playbook of the DTC darlings before them? And how has this marketing and CRM strategy still worked in their favor?

“They’ve looked at their profit and loss and done the math that selling DTC doesn’t make sense,” Murray explains.

Beverages are one of the heaviest, most cost-inefficient products to ship independently in small batches. This is part of the reason other beverage brands, like Haus and Ugly Drinks, have struggled.

Selling DTC makes most sense for lighter, less bulky products, or weighty, high-priced purchases bought infrequently (think of all the mattress-in-a-box brands). But if you sell a product that sits somewhere in between, DTC might not be the best way to sell.

6 ways successful DTC brands operate

Once you decide to go the DTC route, what should you do next? There’s no set playbook. But there are 6 core priorities successful players in the space, from Obvi to Graza, tend to share.

1. Nail your product-market fit

Think of your early DTC store as an opportunity to iterate towards product-market fit and prove your brand’s viability to investors and future partners—not your one-and-only sales channel, forever and always.

“It’s a great way to understand the potential of a brand,” Murray says of a DTC store. “Because if you could make it online where it’s crowded and where you’re kind of elbowing your way for attention, it’s a really good sign that you could make it as a business in general.”

If you could make it online where it’s crowded and where you’re kind of elbowing your way for attention, it’s a really good sign that you could make it as a business in general.

DTC founders should keep an eye out for key signs of product-market fit, like:

- Accelerating growth

- Solid CAC:LTV ratio (usually 1:3)

- Strong reviews

- Wait lists when a SKU sells out

Retailers view product-market fit as “proof of concept,” Melwani says—proof you’ll help drive awareness to their brand, and they won’t just promote yours.

Sportelli agrees. “A lot of retailers want to see how you resonate with online consumers. What does your email list look like? How many people do you have on your wait list? They want something of a guarantee.”

Just look at truffle hot sauce TRUFF: DTC sales got them “hype and visibility,” explains Calvin Lammers, SVP of ecommerce at TRUFF. Then “rapid growth of DTC and social following” helped the brand break into retailers like Target and Whole Foods.

2. Talk to your customers

DTC retail “provides a testing and innovation platform that enables a direct feedback loop with your audience,” Lammers says.

The business model opens communication channels. Customers share their email addresses when they buy. They’re often leaving reviews, or getting in touch with customer support, to provide feedback on their experience. They’re more likely to follow your brand on social media than some brand they bought through Target.

Successful brands make the most of this and solicit customer feedback on a variety of issues, like:

- Retail feasibility: Snif has surveyed its customers extensively on if, and where, they’d like to buy Snif candles in-person. Would they prefer Target? Sephora? “We want to be where our customers are,” Edwards says.

- Ideal use cases: At Thingtesting, Sportelli worked with a condiment brand on a “Thingdrop,” or product test, for a pre-launch sauce. “They didn’t give a lot of context around what the sauce is to be used for,” Sportelli says, “and what they learned from that was how people were using it and how to frame storytelling around use cases.”

- Product roadmap: Some brands move up new product launches if enough reviewers specifically request a new product to go with an existing one in reviews, Sportelli observes.

Some popular ways to get customer feedback include:

- Email and SMS: Send a survey, encourage subscribers to review your product, or simply ask for a reply.

- Communities: Obvi has built a more than 60K-member Facebook group, Melwani says, and consults them on new product development priorities and beta products.

- Social media marketing: Run an Instagram sticker poll, or simply ask a question and review the comments and replies. Surveys don’t have to look formal—the key is that “it’s easy enough for someone to answer,” Clarke says.

- Social listening: Tools can help you understand who your audience follows besides you. Clarke, for example, has learned that a lot of Graza followers also follow Bark. “That tells me that they have pets,” she says. Should Graza do a pet-friendly event? A gourmet dog food? The possibilities are endless.

“Opening the door to more collaboration is the differentiator for successful DTC brands,” Sportelli says.

Opening the door to more collaboration is the differentiator for successful DTC brands.

3. Diversify your digital marketing mix

For a long time, Obvi relied solely on paid Google and Facebook ads for new customer acquisition—but after Apple’s privacy update, that just wasn’t working anymore. The channel became too expensive.

“Spreading our budget across multiple channels is probably one of the biggest ways that we’ve changed,” Melwani says.

New channels Obvi has experimented with include:

- Organic and paid TikTok: “It’s become a more viable platform for acquisition,” Melwani says—especially when you follow ecommerce advertising best practices, like using viral audio clips or user-generated content, so your material feels native to the platform.

- Email and SMS: Social media sites can ban your account anytime, making owned marketing channels like email and SMS a more reliable way to do retention marketing and build your audience.

- Influencer marketing: These don’t have to be celebrities—just anyone with “some type of reach,” Melwani says, and genuine enthusiasm for your product.

Ultimately, Melwani suggests that DTC brands launching today take “a very organic approach.” Paid ads might drive faster growth, but it’s more sustainable to focus on organic social media and owned marketing efforts.

And don’t overlook the most powerful organic channel: good old word of mouth. “My current soapbox is that brands need to refocus on making things that are going to organically powered by word-of-mouth marketing because they’re just really good,” Sportelli says.

My current soapbox is that brands need to refocus on making things that are going to organically powered by word-of-mouth marketing because they’re just really good.

4. Build a retention marketing strategy

Before iOS 14.5, DTC brands could focus on bringing in many shoppers at the top of the funnel. But without a solid retention marketing strategy, there’s no guarantee those existing customers will come back to make repeat purchases—and it’s no longer cheap to replace churning customers at scale.

Today, DTC success requires a marketing plan for the whole customer lifecycle—retention included.

“Now lifetime value, retention, and making your existing list a priority is more of an art form,” Murray says. “Brands that do that well are going to win, because if one customer can be worth $1K versus $40 over 5 years, then you could acquire them for more, and treat them better.”

Here are a few tips for building a funnel that goes deeper than awareness, and generates customer loyalty:

- Shop your own site. Murray does this all the time to get a big-picture sense of the customer experience. “It’s shocking how people will focus on smaller details before they’ll take a second to look at the 17 clicks your customer had to take to become your customer,” she says. “We forget to put ourselves in our customers’ shoes.”

- Invest in unboxing. Make sure your product lives up to (or, better yet, exceeds) what you promise. Melwani recommends investing a little extra in packaging and the unboxing experience to create a lasting first impression of your brand when a customer receives their order.

- Launch automated emails and texts. Automated flows for customers who have already bought can help offset high acquisition costs, Melwani notes. The more segmented and personalized the flow, the better. Hot tip: Send reminders to buy again on custom timelines, based on Klaviyo’s predicted next order date.

- Make your comms beautiful. Edwards emphasizes that the Snif team prioritizes cohesive email marketing design to stand out in crowded inboxes. “We invest a lot into the creative, whether it’s a GIF, product photography, or an email layout,” Edwards says. “You have to make each touchpoint worth it for the customer to engage with.”

Bottom line: Today’s DTC brands will have to “double down on retention to make up for the fact that their acquisition costs are going higher,” Melwani says.

5. Reach a wider audience with partnerships

It’s great to build your own audiences across social media, email, and SMS—but you don’t have to do it alone.

To truly grow, it helps if other people and brands also post about you to their audiences. There are a few key ways DTC marketers can make that happen:

- Incentivize UGC. You can do this by simply reposting customers when they tag you, or by building out a full affiliate program for customers.

- Seed product with influencers. You can gift your product to influencers with no strings attached—if it’s great quality, they’ll often post about it. Seeding was part of Graza’s launch, and the company’s green squeezy bottles ended up in Bon Appetit alum Molly Baz’s stories. “Suddenly, everyone wanted them,” Graza CEO Andrew Benin told Klaviyo.

- Collaborate with influencers on new products. Snif recently launched a pumpkin candle with food creator Tieghan Gerard of Half Baked Harvest, and it was a smash hit. “We basically doubled our email list overnight,” Edwards says.

- Partner with other brands. That was Clarke’s plan when she made Graza’s November 2022 content calendar. “Every single piece of content had a brand partner,” she says. “There were 21 other brands that I got to partner with us because I wanted to increase our surface area.”

One note on partnerships: Make sure to serve custom messaging to subscribers and leads that come in through partners, and build out those specific customer journeys to consider the fact these customers likely have different intentions and buying behaviors than your normal target audience.

“I would never do a partnership with an email capture without giving someone a different welcome flow experience,” Clarke explains.

I would never do a partnership with an email capture without giving someone a different welcome flow experience.

Customization can be as simple as a co-branded landing page, or as complex as a personalized post-purchase program.

Snif is taking the latter approach to create a more personalized experience for customers. “We have our original Snif subscription list, and then we have all of these people that came to us because of Tieghan, and we have to talk to them in a different way,” Edwards says.

Ultimately, with any partnership, Clarke emphasizes it’s important to “have a very strong understanding of what you want out of it” before you jump in. “Think about how it will set you up to learn more about your customer, speak about something you might not have credibility to speak about, or reach a new audience.”

6. Aim for omnichannel success, not just DTC dominance

Is mastering your DTC presence the ultimate goal for founders in the consumer goods space, or is expanding the only way for modern brands to ensure lifelong success?

Modern DTC brands often also sell through wholesalers, marketplaces, brick-and-mortar stores, and any other channel, digital or not, where they can profitably move product. And many ecommerce experts agree that going omnichannel is becoming increasingly important.

“It’s next to impossible to continue to thrive and grow as a pure DTC business as you reach a certain scale,” Lammers says. “Even the most successful DTC brands out there, at a certain point, needed to venture into retail or other marketplaces to meet the consumers where they’re at.”

Selling in a traditional retail environment—like the Vitamin Shoppe or Target—is “a cheat code,” Melwani says, for 2 reasons:

- Better margins on first-time orders: Obvi sees 50% margins on retail purchases. Depending on what retailer you sell through, when you factor in customer acquisition cost on first-time DTC purchases, “you’re basically breaking even or losing a little bit of money,” Melwani says.

- Free awareness boost: “It’s eyeballs,” Melwani says. “How many people are walking down the aisles of a Walmart or Target on a daily basis?”

That’s especially true when you have an existing DTC presence, and you’re investing in paid ads, branding, and PR. Customers are more likely to recognize your brand on the shelf—or click it in an Amazon SERP.

Snif recently launched on Amazon after starting out pure DTC: “We sold out all of our inventory in 10 hours,” Edwards said. “It was supposed to last us a month.”

(It can’t hurt that their Old Saint Wick holiday candle was recently named one of Oprah’s Favorite Things.)

“There’s a lot more flexibility when you keep things in-house,” Sportelli says, “but to actually break out and scale and reach new customers, wholesale is a big unlock.”

There’s a lot more flexibility when you keep things in-house, but to actually break out and scale and reach new customers, wholesale is a big unlock.

A DTC operation is an important foundation that can serve as a proof of concept and help support your brand across retail channels—but for many brands, omnichannel retail is a necessary path for scalable, long-term growth.

Follow your instincts, not your competitors

DTC isn’t dead. But seemingly foolproof DTC playbooks are.

“Many brands can become unicorns without ever having a retail presence,” Murray says. For other brands, omnichannel makes the most sense—or retail only. “It isn’t one size fits all.”

Plus, in today’s market, you get more of an edge from doing things differently and standing out.

Maybe that’s by shutting off paid ads entirely, like Beardbrand. Maybe it’s by acting like a direct-to-consumer brand, but selling through Amazon, like Liquid Death. Or maybe it’s flipping the playbook upside down, like Hero Cosmetics.

Find the playbook that fits your brand through data, customer conversations, creativity, and constant testing. The DTC landscape is in flux, and no one knows the right next move for your brand better than you do.

Related content

See how Customer Hub, Customer Agent, and Helpdesk powered faster support, reduced tickets, and boosted revenue during Klaviyo Service’s first BFCM.

Post-purchase experiences are where customer loyalty begins. Learn how to automate and personalize them to grow your B2C brand

Discover how lifecycle marketing transforms your CRM into a growth engine, driving retention, automation, and personalized B2C customer experiences.