Back-to-School Prices Surge Nearly 10%: How Brands are Navigating Tariffs and the Knock On Effect For Consumers

BOSTON, MA — August 21, 2025: Back-to-school shoppers are facing higher prices and fewer deals. Klaviyo platform data shows the typical price paid for back-to-school items in July was up nearly 10% year-over-year, discounts were slimmer, and more orders came from repeat customers as consumers stick with brands they trust.

Klaviyo analyzed same-site sales across U.S. based brands and retailers this year compared with the same period in 2024 to understand how tariffs, promotions, and consumer habits have shifted during the back-to-school season.

Key findings include:

- Consumers are paying more per item. Prices are up across the board, with apparel seeing the steepest climb with an uptick of 9% more per item in July compared to last year

- Discounts are down: Despite July 4th and Prime Day, average discount rates dropped 4 percentage points YoY in July

- Lower-priced brands hit hardest: Value-conscious consumers are feeling the brunt of rising prices, as lower-priced brands face tighter margins and greater volatility

- Repeat buyers are on the rise: They now make up 60% of orders—up 3 percentage points since January—with revenue from this group up 14% as consumers stick to familiar brands.

“This focus on repeat buyers is a smart move in a market where acquiring new customers is increasingly costly,” said Jake Cohen, Head of Industry and Insights at Klaviyo. “For brands with strong equity, customer loyalty tends to increase, giving them more license to offer added value—like expanding into new product categories—based on the trust they’ve built.

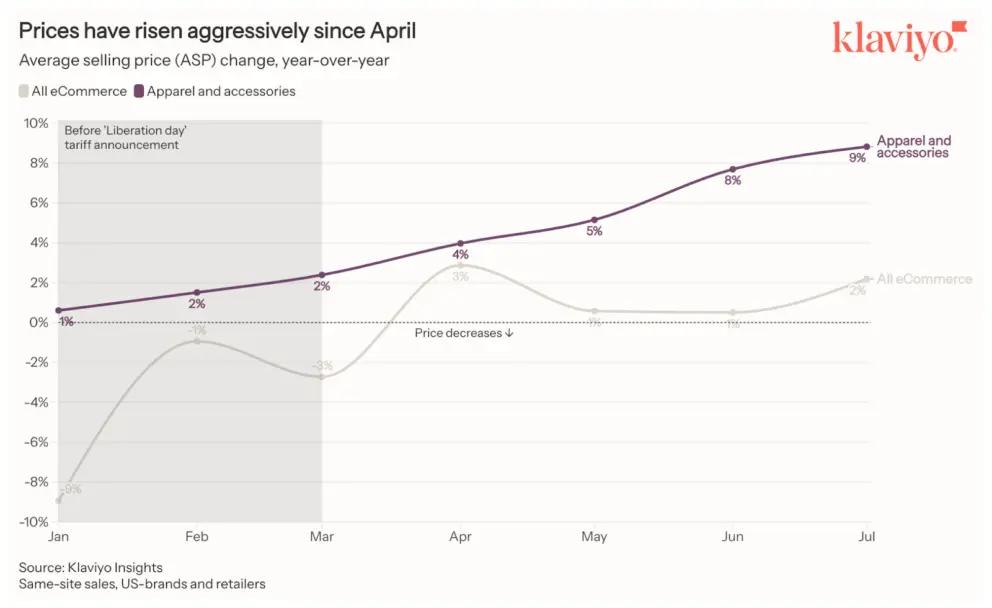

Prices are up

After a dip in Q1, average selling prices (ASP) began climbing in April and have risen every month since. Apparel and accessories saw the sharpest increase at 9% as tariff uncertainty squeezed retailer margins, prompting them to pass more costs to consumers.

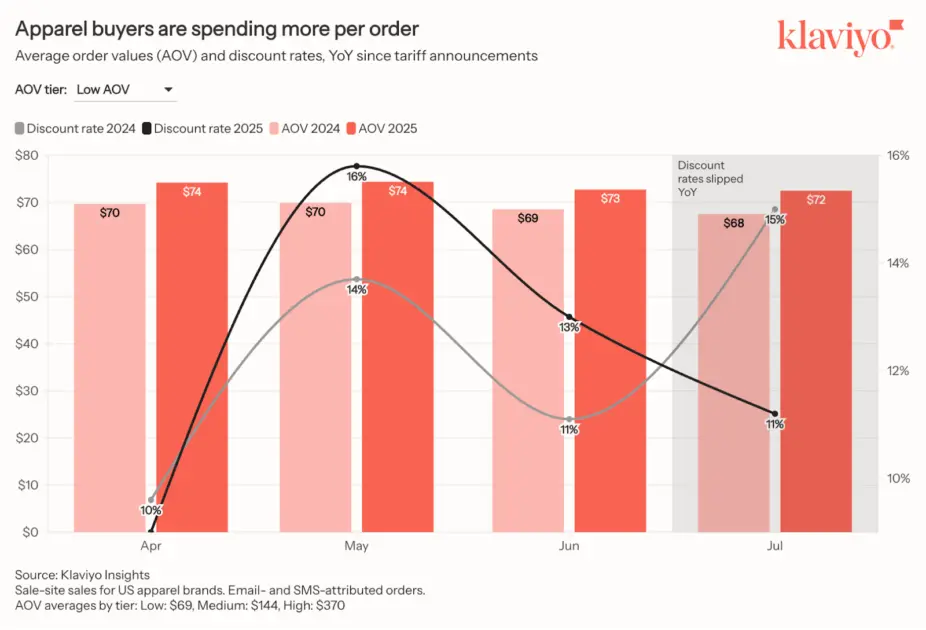

Value conscious consumers feel the heat the most

Apparel brands with an AOV of $70 have seen a surge in both order sizes (+7%) and average selling prices (ASPs). These lower-AOV brands—often serving families during back-to-school—tend to operate with the tightest margins. Mid-tier brands ($140 AOV) saw more modest AOV growth (+4%), while high-end brands ($370 AOV) barely budged (+1%). The tariff ripple effect clearly hits the value end of the market hardest.*

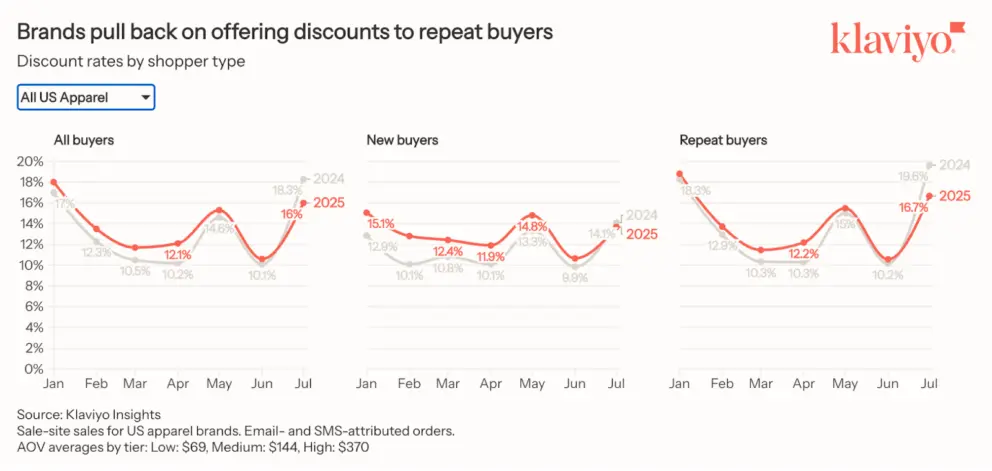

Discounts are slimmer

Even with back-to-back sales events in July, discount rates dropped in July compared to the same time last year. In April, many brands front-loaded promotions to boost cash flow ahead of potential tariff-related cost increases. Now, with margins under pressure, they’re pulling back on promotions, a trend that could foreshadow a leaner discount environment heading into Black Friday and Cyber Monday.

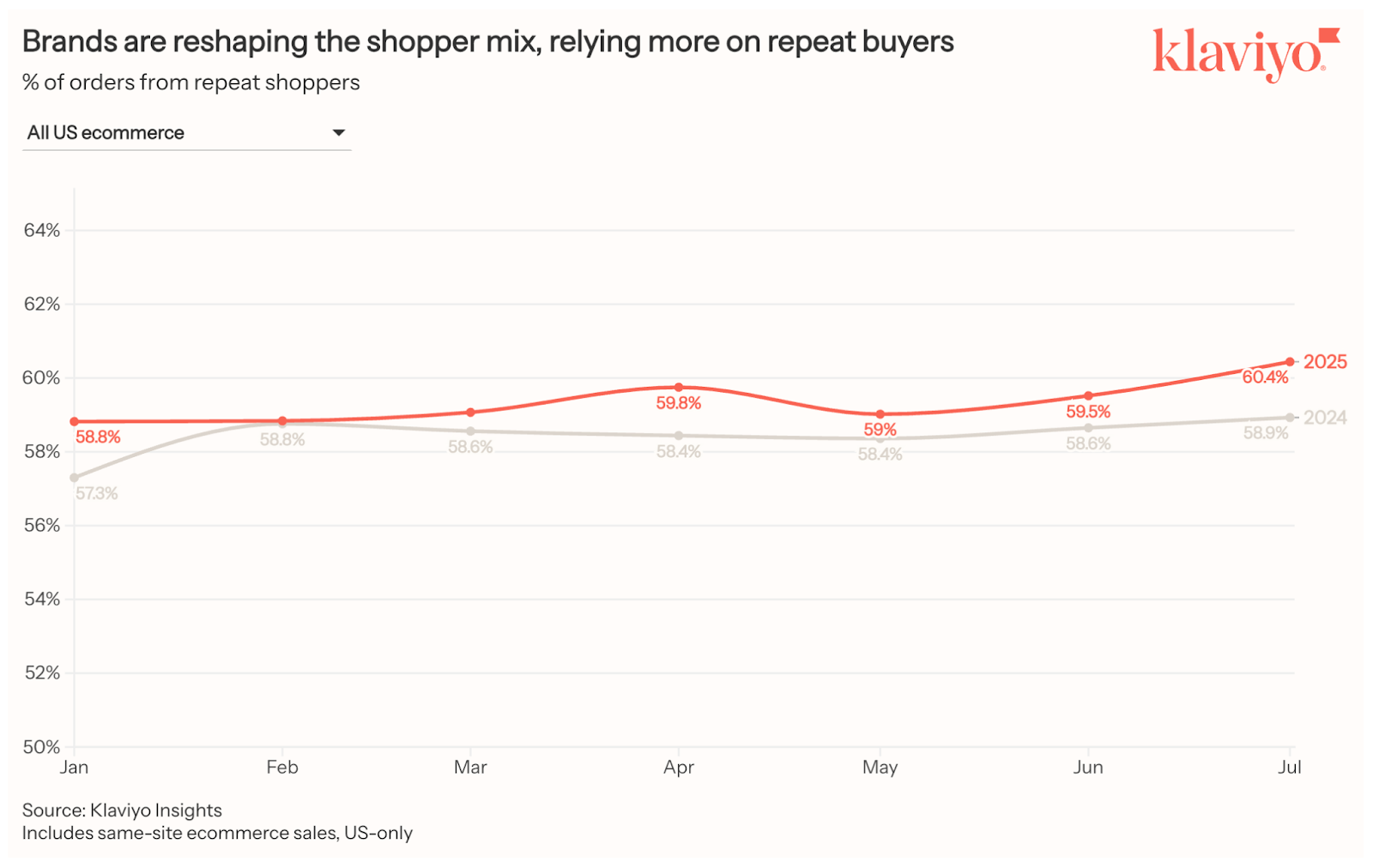

Repeat buyers take center stage

Repeat customers now account for 60% of orders—up 3 percentage points since January and 1.5 percentage points year-over-year. In apparel, the gain was even sharper, with a +3 percentage point YoY increase in July.

Revenue from repeat buyers climbed 14% overall and surged 21% when driven by email and SMS, suggesting consumers are gravitating toward the brands they know and trust, and are hesitant to try new ones.

Discounts for new buyers have stayed relatively flat, but average discount rates for repeat buyers fell 4 percentage points compared to last year as brands become more selective in how they use promotions to keep loyal customers engaged.

With new customer acquisition harder and more expensive, brands are leaning into multi-channel marketing to strengthen existing relationships—proving that in today’s market, retention may be the smartest growth strategy of all.

*Methodology: Klaviyo analyzed the same-site sales across U.S. based brands and retailers this year, compared with the same period last year. Apparel brands were grouped into three tiers based on their average order values (AOV). The lowest AOV group averaged about $70, mid-tier AOV was considered ~$140 and high AOV brands was ~$370.

Source: Klaviyo, Inc.