Klaviyo Declares the Death of Panic Buying This Black Friday

New data reveals what the first AI-shopping-fueled BFCM will look like

For decades, Black Friday was the shopping equivalent of a stampede. Doors busted, carts overflowed, and shoppers raced against the clock. But that era is over.

According to Klaviyo’s data platform, nearly half of U.S shoppers plan to buy before Thanksgiving this year, signaling the death of “panic buying” and the rise of a more intentional, omnichannel shopping season.

Economic uncertainty has made consumers more calculated about what they spend and how they spend it, while new AI-powered tools are helping them shop smarter – from planning ahead to comparing deals across channels.

AI tools fuels a browsing boom

This shift isn’t just about timing. It’s also about tools. 56% of U.S. consumers say they plan to use AI shopping assistants during Black Friday and Cyber Monday 2025, and more than half now prefer AI over humans for certain types of customer support.

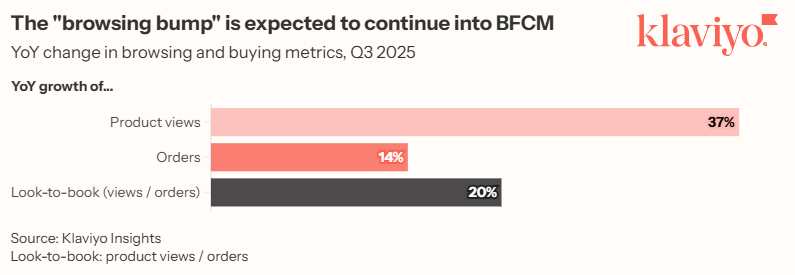

Technology is helping shoppers slow down and buy with greater confidence — fueling a browsing boom. Product views are up 37% year-over-year in Q3, while orders have grown 14%, showing that discovery is accelerating even faster than conversion.

Shoppers are taking their time — exploring, comparing, and evaluating before they buy — often with AI as their guide. This deeper engagement has lifted the industry’s look-to-book ratio by 20%, reflecting a new era of deliberate discovery.

Holiday spending spreads across a 16-day window

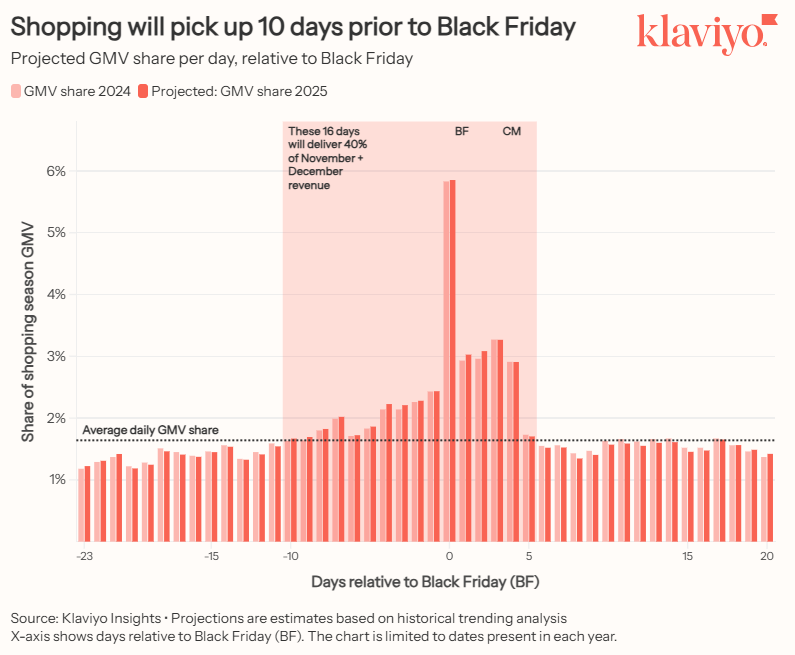

Nearly half of holiday revenue still lands within a 16-day window, a period where attention is scarce and competition is fierce. But instead of one frenzied burst, shoppers now move through two distinct phases:

- The first surge – roughly 10 days before Black Friday, when browsing and discovery spike as shoppers research products and compare deals

- The conversation shift – beginning on Black Friday, when intent turns into action and purchases accelerate rapidly through Cyber Monday

This “browse-first, buy-later” pattern marks a major shift in behavior. Shoppers aren’t hoarding deals in one big burst anymore, they’re cherry-picking offers across days, devices, and channels, spreading purchases out instead of rushing to make them all at once.

But that doesn’t mean the time sensitivity is gone. For brands, that means a single “big bang” moment won’t cut it. They need to show up consistently — in inboxes, text messages, and social feeds — before, during, and after the big weekend.

Loyalty drives nearly half of BFCM growth

Klaviyo data projects repeat buyer revenue will grow 14% this BFCM, 58% higher than the 8.9% growth expected from new shoppers. They spend more, come back faster, and cost less to reach — making them the most reliable driver of growth when the shopping window is tight.

While discounts will nearly double compared to the rest of the year, the smartest brands won’t race to the bottom. Instead, they’ll reward their best customers with early access, exclusive offers, and personalized experiences that deepen relationships while protecting margins.

“At Filson and Shinola, loyalty has always been built on trust and lasting quality,” said Zach Solomon, Director of Ecommerce and CRM at Bedrock. “Black Friday used to be all about speed and grabbing deals before they disappeared. But today’s shoppers are more intentional. They’re taking time to find brands that align with their values and deliver consistent, meaningful experiences. When you combine that mindset with smarter data and AI-driven personalization, you start to see loyalty as the real driver of growth—not just during the holidays, but year-round.”

What this means for brands

“We’re entering the first AI-powered shopping season,” said Andrew Bialecki, co-founder and CEO of Klaviyo. “Consumers aren’t acting on impulse anymore — they’re acting on information. With Klaviyo, brands can move with the same intelligence, turning real-time data into real relationships that last beyond the holidays.”

For marketers, Black Friday isn’t dead – but panic buying is. The season has shifted from chaos to connection, and brands need to evolve with it.