No matter how much you prepare or plan ahead for Cyber Weekend, it’s impossible to know how your strategy will actually perform when Black Friday finally arrives.

You’re most likely left wondering, “Will Cyber Weekend make or break our yearly revenue goals?”

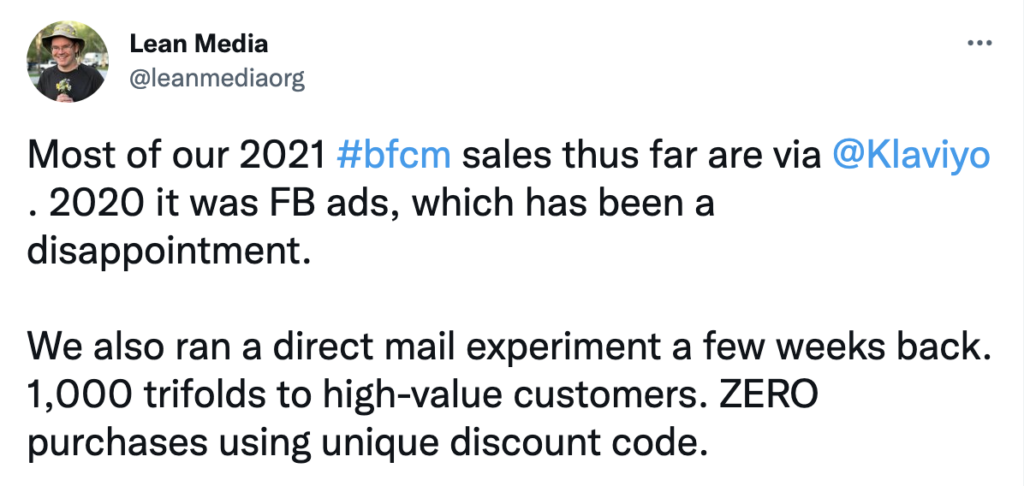

If that’s not enough pressure for store owners and ecommerce marketers, 2021 came with its own set of unique challenges. Data privacy changes forced retailers to rethink their paid advertising strategy and spend as customer acquisition costs (CACs) increased and return on ad spend (ROAS) decreased.

Ultimately, the brands that invested in their owned marketing channels (like email and SMS) and leveraged Customer First DataTM were able to build stronger customer relationships—which means they also had an advantage once Cyber Weekend rolled around.

Meanwhile, many of those who didn’t invest in their owned channels wished that they had.

How did Cyber Weekend stack up for brands in 2021? Nearly 180 million Americans shopped this Cyber Weekend (defined as Thanksgiving through Cyber Monday), according to the annual survey by the National Retail Federation (NRF) and Prosper Insights & Analytics.

And while Black Friday sales were down for many brands, over 160K Klaviyo customers saw major growth.

Cyber Weekend 2021 results

This year, over 160,000 Klaviyo customers drove more than $5.3B in global sales and $3.6B in US sales over Cyber Weekend. These brands drove almost $1.5B globally across owned channels including email and SMS.

This data tells us that Klaviyo customers generated $48K over Cyber Weekend and $15.5K from email and SMS on average.

Adobe Analytics reported that Cyber Weekend drove a total of $33.9B in US online spend. While this is down 1.4% year-over-year (YOY), Klaviyo customers continue to grow as they were responsible for over $3.6B of total Cyber Weekend sales in the US—up from $2.8B last year—and more than $1B of these sales were driven by email and SMS.

Klaviyo powered 3.2% of all US sales compared to 2020, where Klaviyo drove 2% of all US sales—a 60% increase from last year.

Total US sales 2021

Total US online sales (by Klaviyo customers) | Total US sales (according to Adobe Analytics) | % from Klaviyo Customers | |

$ | $13B | $109.8B | 11.8% |

Thanksgiving | $481M | $5.1B | 9.4% |

Black Friday | $1B | $8.9B | 11.2% |

Saturday | $766M | N/A | N/A |

Sunday | $541M | N/A | N/A |

Cyber Monday | $834M | $10.7B | 7.7% |

Cyber Weekend total | $3.6B | $33.9B | 10.6% |

Total sales from Klaviyo customers YoY, global (USD)

Thanksgiving 11/25 | Black Friday 11/26 | Saturday 11/27 | Sunday 11/28 | Cyber Monday 11/29 | Cyber Weekend Total 11/25-11/29 | |

2020 | $573M | $1.2B | $798M | $622M | $838M | $4B |

2021 | $813M | $1.5B | $1B | $834M | $1.1B | $5.3B |

YoY Increase | 52% | 42% | 28% | 29% | 34% | 32% |

Total sales driven from Klaviyo customers YoY, US (USD)

Thanksgiving | Black Friday | Saturday | Sunday | Cyber Monday | Cyber Weekend Total | |

2020 | $354M | $850M | $612M | $422M | $628M | $2.8B |

2021 | $481M | $1B | $766M | $541M | $834M | $3.6B |

YoY increase | 36% | 24% | 25% | 28% | 31% | 28% |

Total global owned revenue (total sales attributed to Klaviyo via email or SMS)

Thanksgiving | Black Friday | Saturday | Sunday | Cyber Monday | Cyber Weekend Total | |

Amount 2020 (USD) | $130M | $296M | $176M | $128M | $198M | $930M |

Amount 2021 (USD) | $231M | $455M | $273M | $209M | $316M | $1.5B |

YoY increase | 77% | 54% | 55% | 63% | 59% | 60% |

Percentage of total revenue in 2021 | 28% | 29% | 26% | 25% | 28% | 26% |

Total US owned revenue (total sales attributed to Klaviyo via email or SMS)

Thanksgiving | Black Friday | Saturday | Sunday | Cyber Monday | Cyber Weekend Total | |

Amount 2020 (USD) | $84M | $222M | $145M | $93M | $162M | $708M |

Amount 2021 (USD) | $142M | $328M | $219M | $146M | $249M | $1.1B |

YoY increase | 69% | 48% | 50% | 56% | 54% | 53% |

Percentage of total revenue | 29% | 31% | 28% | 26% | 29% | 29% |

The breakdown for email and SMS

A lot of emails go out over Cyber Weekend—and this year was no exception. Klaviyo customers sent over 7B emails, which is up 41% from last year.

Emails received, global

Pre-BFCM | Thanksgiving | Black Friday | Saturday | Sunday | Cyber Monday | Cyber Weekend Total | |

2020 | 8.6B | 651M | 1.2B | 751M | 673M | 1.1B | 4.4B |

2021 | 15B | 1B | 2B | 1.2B | 1.1B | 1.9B | 7.5B |

YoY increase | 77% | 69% | 69% | 72% | 73% | 73% | 71% |

Breaking this data down into campaigns and flows, you’ll see that 76% of revenue coming from email over Cyber Weekend was generated through email campaigns and 24% was from email flows.

Revenue generated through email: Flows versus campaigns, global (USD)

Thanksgiving | Black Friday | Saturday | Sunday | Cyber Monday | Cyber Weekend Total | |

Total revenue generated through email | $229M | $450M | $270M | $208M | $312M | $1.47B |

Revenue generated through email campaigns (USD) | $174M | $359M | $204M | $151M | $239M | $1.1B |

Revenue generated through email flows (USD) | $56M | $95M | $69M | $58M | $76M | $356M |

While campaigns are the go-to for brands looking to communicate their biggest and best deals over Black Friday Cyber Monday (BFCM), it’s evident that marketers are using flows throughout the holidays. These flows include abandoned cart emails, browse abandonment emails, and welcome series to round out their lifecycle marketing. This brings shoppers through the funnel, and ultimately—drives major revenue.

And although email still reigns supreme, SMS is creeping up to steal the spotlight. This year, Klaviyo customers sent 54.6M text messages—a whopping 10x more than in 2020. As a result, SMS attributed revenue increased by 743% YOY.

No big deal—except this is actually a very big deal for ecommerce brands. SMS has skyrocketed as an owned channel where marketers can communicate their most exciting announcements—in other words, their BFCM promotions—in a way that’s personalized, targeted, and extremely timely. Best of all, it boosts the bottom line.

As marketers choose to go with text message marketing and discover that it’s a viable revenue-generator for their brand, SMS for marketing will continue to increase exponentially in the coming years.

SMS messages sent, global

Before Cyber Weekend | Thanksgiving | Black Friday | Saturday | Sunday | Cyber Monday | Cyber Weekend Total | |

2020 | 6M | 518K | 1.9M | 646K | 423K | 1.5M | 5M |

2021 | 69M | 5.5M | 18M | 7.5M | 7.4M | 16M | 54M |

Total revenue attributed to SMS 2020 | $2.2M | $193K | $524K | $298K | $116K | $283K | $3M |

Total revenue attributed to SMS 2021 | $17M | $1.9M | $4.6M | $3M | $1.4M | $3.1M | $31M |

But email and SMS aren’t mutually exclusive. Luckily, brands that use Klaviyo for both channels know how to strategically use email and SMS with one another instead of using them individually.

You’ll notice that Klaviyo customers are sending about half the amount of text messages on Thanksgiving as compared with Black Friday and Cyber Monday. Since SMS is considered a more personal channel, marketers made sure not to overdo it with text message marketing—even during Cyber Weekend.

Cyber Weekend 2021 trends

Digging even deeper into the 2021 Cyber Weekend data, there are a number of emerging trends that give us more insight into the ecommerce landscape and provide hints about what’s to come in the year ahead.

A consumer shift to brand loyalty

In the wake of the recent data privacy changes, much of the advice given about Cyber Weekend this year could be drilled down to one major idea: Focus on your current customers instead of on new customer acquisition.

Why? Because brands are finding that building customer relationships pays off—literally.

While the number of online shoppers hasn’t increased, the same group of consumers is spending 16% more on online purchases with stores they’ve shopped at previously, according to Klaviyo data.

It’s clear that many Klaviyo customers are finding it lucrative to focus on fostering loyalty among their current customers via owned channels during Cyber Weekend.

But what does that look like in practice? Brands that use Klaviyo created unique customer experiences by segmenting purchasers from non-purchasers in their Black Friday Cyber Monday campaigns. OLIPOP, a natural soda company, gave their most devoted customers an extra-special deal over the weekend.

“With Cyber Weekend sales, most consumer-packaged goods brands over-optimize for acquiring new customers and forget about loyal customers who’ve stuck around and paid full price throughout the year,” said Eli Weiss, director of customer experience and retention at OLIPOP. “Because of that, we’ve taken an approach of creating more targeted promotions for some of our VIP customers—and it paid off.”

Meanwhile, Represent, a British luxury fashion brand, segmented emails by Bronze, Silver, and Gold tiers based on customer spend—Gold members received first access to the Cyber Weekend sale, followed by Silver members, Bronze members, and then the rest of the brand’s subscriber list.

Represent’s most loyal customers effectively got first dibs on the best deals so that they could snag all the items on their list before they sold out.

Additionally, as pre-Cyber Weekend emails increased by more than 77% this year and early shopping mentions were up by 11% from last year, marketers may have been experimenting with sending more sneak peeks, early access, and exclusive deals for their VIP customers ahead of Black Friday.

This is just the beginning of an increased focus on retention marketing for brands in an effort to improve loyalty. The real test will be how you use data to keep customers around in the months ahead—well after the deals are done.

The small business surge

Amazon had its day in the sun during Prime Day earlier this year, but it’s small businesses that consumers are shopping with this year—and not just on Small Business Saturday.

According to Klaviyo data, small businesses (qualified as brands making up to $1M in yearly revenue) saw a 41% increase in orders and a 69% increase in order amount across Cyber Weekend—so people are shopping more and spending more with small businesses. AOV also increased by 20% for small businesses across Cyber Weekend as well.

Additionally, Klaviyo customers are ramping up their Small Business Saturday promotions via email and SMS—Saturday saw a 91% increase in owned revenue and a 61% increase in total order amount for small businesses on Klaviyo, suggesting that brands are successfully encouraging consumers to shop small amid mega retailers and doorbuster deals.

One way that small businesses are effectively communicating with their customers over Cyber Weekend? Deviating from the flashy promotions that are typical of Black Friday in exchange for a more personal, human approach.

Three Ships Beauty, a natural skincare brand, did away with fancy graphics and complex designs in favor of a simple note from their team for their Black Friday email. The note feels far more personal to the shopper and gets straight to the point—the brand’s buy one, get one deal.

“As a small business, we’re also competing with hundreds of other brands—some of which are massive brands with lots of marketing dollars,” Lillie Sun, head of growth at Three Ships Beauty, explained. “Our goal was to lean into our ability to feel like an authentic brand and let our customers know that there are real humans behind Three Ships. Sending this plain text email was our way of trying to stand out in the inbox and create a connection.”

The deviation from deep discounts

In total, Klaviyo customers sent over 170M coupons across Cyber Weekend.

While it may come as no surprise that brands are discounting during Black Friday Cyber Monday, those discount offers are decreasing.

The average discount was 27% over Thanksgiving, which is down 7% from last year, according to Retail Dive. Even more surprising is the fact that AOV increased 11% despite the fact that consumers purchased 3% fewer items.

There’s a mix of factors that could be contributing to this. For example, inflation is likely contributing to a higher price per item, so people are spending more on less.

But there’s also been a renewed focus on quality amid emerging direct-to-consumer (DTC) brands—think about the companies selling everyday products (olive oil, razors, socks, luggage, etc.) at a premium because they offer better ingredients, more durable materials, or superior craftsmanship.

You’ll be hard pressed to find many of these DTC brands offering a discount on the remaining 360 days a year, so when Cyber Weekend rolls around, consumers are willing to both accept a lesser discount and spend more than they would otherwise find at big box retailers because the perceived value is higher.

As a result, DTC brands are increasingly avoiding the deep discounts that are typically associated with Black Friday—which is especially effective for brands that instilled this perceived value in consumers’ minds prior to BFCM.

Instead, they’re offering more modest discounts between 20-30% off—or even ditching the discount altogether. In an effort to drive meaningful loyalty instead of price sensitivity, some brands are offering alternative promotions.

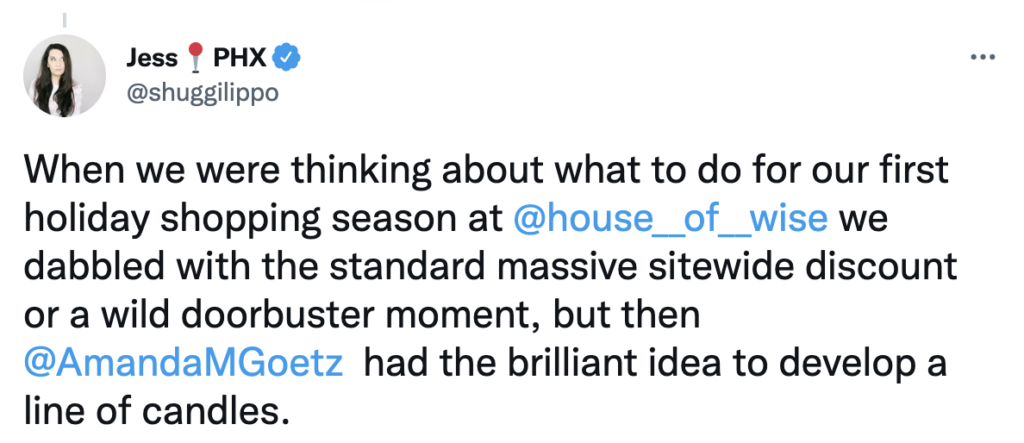

House of Wise, a CBD brand, gave their customers a free, full-sized candle with every Black Friday purchase.

With this promotion, House of Wise enjoyed the highest sales day since launch in the company’s history, despite not offering any discounts off of their core product line.

How brands salvaged supply chain issues

After a long year of supply chain issues and shipping delays, many brands encouraged consumers to shop early this holiday season. By shopping early, customers avoided getting an out-of-stock message in their inbox or having their gifts arriving after the holidays.

Klaviyo customers sent 77% more emails leading up to Black Friday and Cyber Monday compared with last year, suggesting that Cyber Weekend became a month-long event for many.

With the ongoing supply chain issues, gift cards have become an increasingly popular option with consumers. This year, the average spend on gift cards increased by 8.7% and the number of gift cards sold increased by 14.6% from the previous Black Friday Cyber Monday event. Consumers also spent 30.9% more on gift cards, while the purchase of gift cards increased by 12.8% from the previous Cyber Weekend.

“We saw a massive uptick in gift card purchasing over Black Friday and Cyber Monday,” Rhian Beutler, co-founder of Govalo, a customizable gift card builder software, explained. “We expect gift card spending to increase as we approach the holiday season. Gift cards are no longer considered the ‘last minute’ gifting option—they’re an easy way to personalize a gift to a preferred store for someone you love.”

A very customer-first Cyber Weekend

Brands that invest in their owned channels and put their customers first with their marketing strategies are coming out on top this Cyber Weekend.

As the paid advertising space continues to get murkier with the new data privacy restrictions, it’s more important than ever for marketers and ecommerce store owners to form relationships and develop loyalty with their customers.

Whether you exceeded your goals—or were left feeling underwhelmed after Cyber Weekend—now’s the time to think about how you’re going to nurture your customers going into the new year.

The brands that focus on building trust with their customers will see growth despite the current market challenges. If you actively listen to your customers, collect customer first data, and send personalized messages—not only will your customer lifetime value increase, but so will your Cyber Weekend revenue year-over-year.

Ready to own your growth?

Try Klaviyo today