DISCLAIMER: The information contained in this blog post is intended for general informational purposes only and does not constitute legal, financial, or professional advice. Please seek appropriate professional counsel before making any decisions based on the information provided.

For brands across retail and hospitality, economic volatility is creating daily pressure to make the right decisions.

At Klaviyo, we’re hearing the stress firsthand: brands are being asked to do more with less, while trying to make sense of shifting consumer behavior in real time.

We launched the Consumer Pulse in the spring of 2025 as a weekly snapshot of what consumers were thinking, feeling, and doing. For three months, we shared fresh research on what was driving purchase decisions.

Now, as tariff concerns become headlines again, we are back with more data and analysis so B2C marketers can make smarter, more strategic choices about everything from pricing to messaging to retention.

Because when it comes to earning share of wallet, especially in uncertain times, the brands that win are the ones that truly understand their customers.

This week’s pulse: Consumers are shopping with intention as tariff deadline looms

With new tariffs set to take effect August 1, shoppers are paying attention—but they’re not panicking.

More than half (52%) of consumers say they plan to make a major purchase in the next 30–60 days. It’s a clear signal that people aren’t pulling back—they’re just shopping differently.

At the same time, concern about tariffs is high—87% of consumers believe prices will rise—but only half expect the impact to be immediate. In fact, 37% think it’ll take a while for price hikes to hit, which helps explain why shoppers are still willing to make big purchases right now.

![[CHART: “Major purchases are still on the table”]

Are you planning to make a major purchase in the next 30–60 days?

Yes: 52%

No: 48%](https://cdn.sanity.io/images/6ct6b26e/marketing-prod/9b3eb2d01fbf4e648101a5278d9cb3578587a1bc-3072x1191.jpg)

![[CHART: “Tariff concerns are rising—but the impact feels delayed for some”]

New tariffs are scheduled to take effect August 1. Are you concerned these will lead to price increases?

Yes, immediately: 50%

Yes, but not for a while: 37%

No: 12%](https://cdn.sanity.io/images/6ct6b26e/marketing-prod/1324e980a248afb08614553067edea0af2580fc4-3072x1359.jpg)

While 26% of consumers say they’re delaying purchases, more are adapting than abstaining: 31% are leaning into sales, 17% are switching to cheaper alternatives, and 6% are buying in bulk. Still, nearly 1 in 5 haven’t changed how they shop at all, highlighting a split between cautious spenders and resilient shoppers.

This is a more measured response than we’ve seen in past moments of uncertainty. And brands are responding in kind: using data to pull demand forward, offering value instead of blanket discounts, and being more surgical with their campaigns.

What marketers should do

Right now there is a narrow but important window to connect with high-intent shoppers. Here’s where to focus:

- Drive urgency with intention. 52% of consumers plan to buy soon. Highlight high-value products, bundles, or back-to-school campaigns while there’s still a perception of pre-tariff pricing.

- Segment by strategy. Not every shopper is reacting the same way. Use Klaviyo to identify those delaying, deal-hunting, or sticking to essentials—and tailor messaging accordingly.

- Start pressure-testing holiday strategies. Many shoppers see tariffs as a future concern. Use this time to test offers, capture early interest, and build segments that can be retargeted ahead of Q4.

- Stay in sync across channels. Consumers are being intentional. If someone just abandoned a cart, browsed high-value items, or contacted support, make sure your emails, texts, and ads reflect that context.

Shoppers are watching. They’re not rushing—but they are planning. And with tariffs on the horizon, now is the time to meet them with thoughtful, timely messages that reflect the moment.

Week of July 23: shoppers are watching—closely—but not rushing

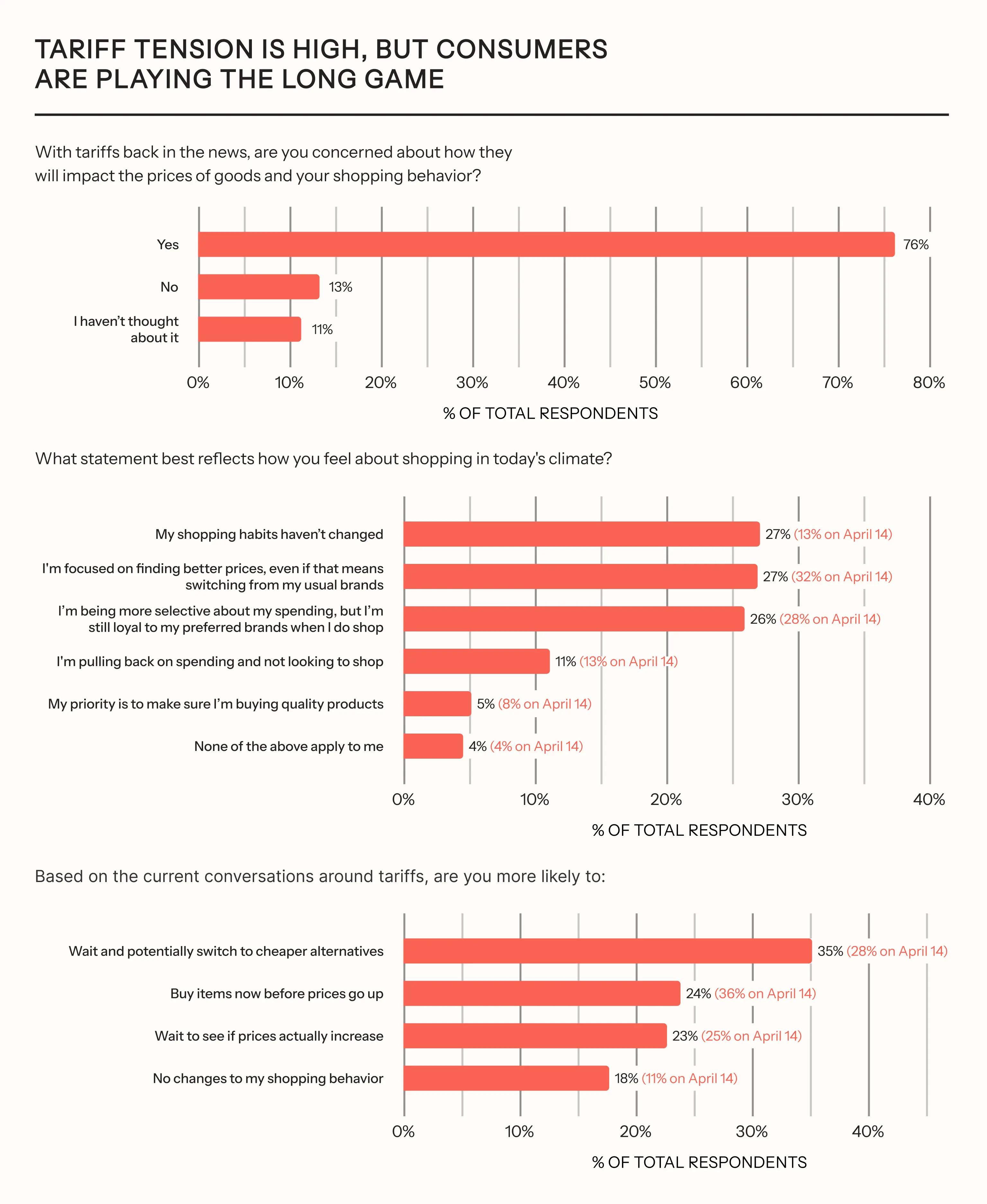

Tariffs are back in the headlines, but the consumer reaction looks very different than it did this spring.

Yes, concern is high—76% of consumers say they’re worried about how tariffs will impact prices. But the panic that defined earlier waves of tariff coverage has largely cooled. Today’s shopper isn’t rushing to stock up. They’re weighing their options.

Compared to April:

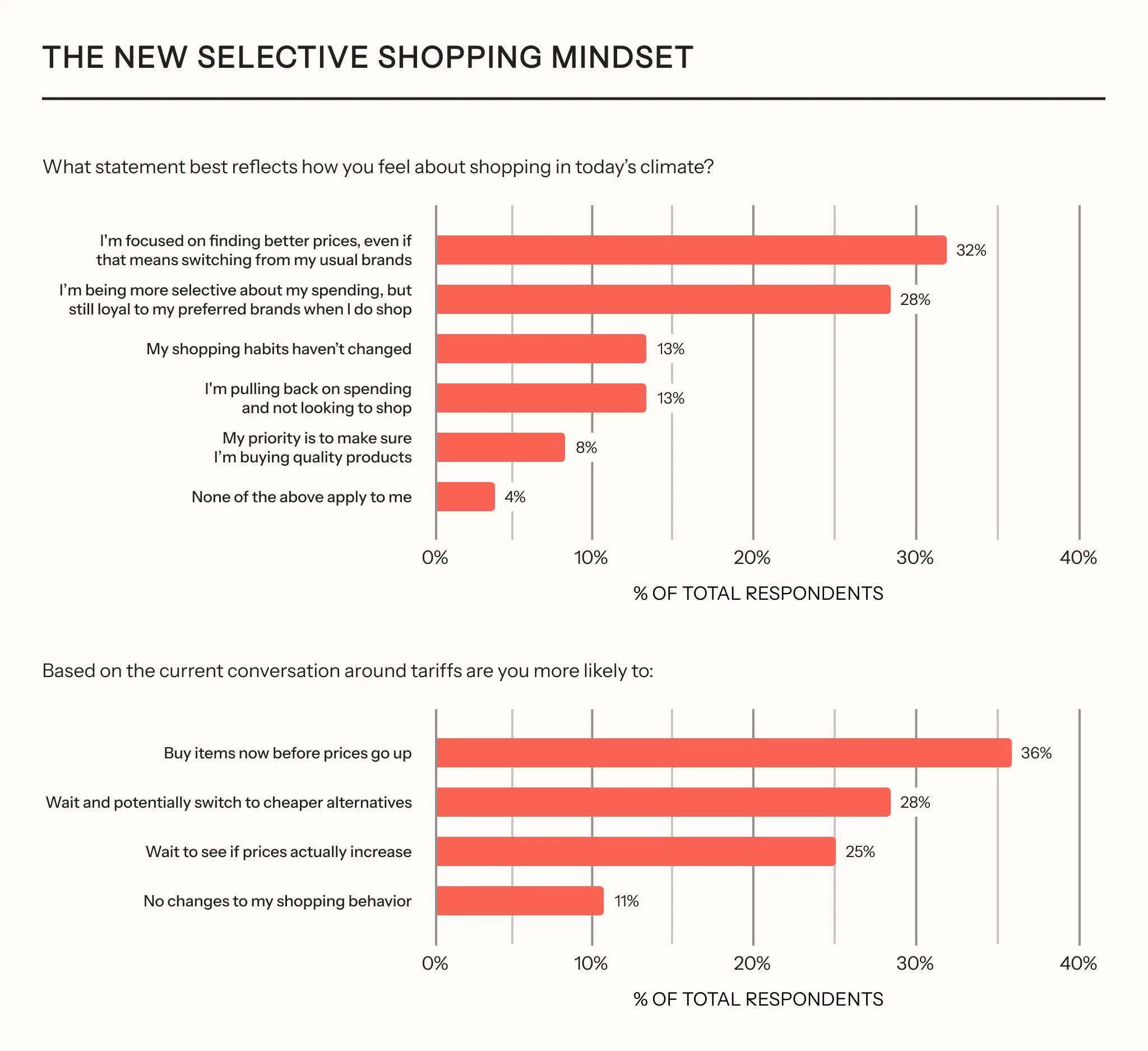

- Just 24% are buying now to avoid price hikes (down from 36% in April).

- 35% say they’d wait and switch to cheaper alternatives if prices rise (up from 28% in April).

- And the share of consumers who say their shopping habits haven’t changed has doubled—from 13% in April to 27%.

Call it the rise of the strategic shopper

People are still incredibly price-sensitive: 3 in 4 would switch brands over a tariff-related price hike of just 5% or more. Only 9% say they’d accept increases above 10%.

But that doesn’t mean consumers are sitting out. In fact, 57% made a purchase during Prime Week or July 4th sales—proving that well-timed deals can still convert, even in a cautious climate.

And looking ahead to the holidays? Two-thirds of consumers say tariffs will affect how they shop—with 43% planning to seek out cheaper alternatives and 23% aiming to shop earlier.

This isn’t impulse—it’s intention. Shoppers are watching. They’re waiting. And they’re planning their next move.

What marketers should do

This week’s data confirms what we’ve seen building for months: shoppers aren’t panicking, but they are recalibrating. That gives marketers a window to act—not react. Here’s where to focus:

- Segment for sensitivity, not just interest. Price sensitivity remains high. Use Klaviyo’s segmentation tools to identify at-risk customers—those who frequently buy essential items, engage with discount campaigns, or browse without purchasing. Serve them messaging that reinforces value, not just price.

- Trigger campaigns at the right moment. 57% of consumers just responded to well-timed sales. That’s a signal. Use back-in-stock flows, price drop automations, and browse abandonment emails to act on high intent the moment it appears.

- Plan early for holiday pressure. With 66% of consumers saying tariffs will impact their holiday shopping, now’s the time to run predictive analytics. Klaviyo customers can use AI-powered Smart Sending and churn risk modeling to plan campaigns ahead of peak season—before shoppers switch to cheaper alternatives.

- Don’t just discount—explain. Transparency still moves the needle. Use Klaviyo’s campaign builder to share clear, personalized updates on pricing, product sourcing, or value propositions—especially for loyal customers. If prices are changing, let your messaging lead with why.

- Sync support and marketing data. If a shopper is waiting on an item or they recently interacted with support, they shouldn’t see a generic product ad or promo email. Klaviyo’s unified customer profiles and integrations make it possible to coordinate messages across email, SMS, and support channels.

This is a moment to market smarter, not louder. Klaviyo’s real-time segmentation and automation tools help you stay in sync with what shoppers are thinking, feeling, and doing right now so you can meet them with the right message before they move on.

Week of June 2: price hikes are testing loyalty, but the basics still matter

Shoppers are feeling the pinch of rising prices: two-thirds (67%) say they’ve seen price hikes tied to tariffs or import fees.

But here’s the nuance: nearly half (49%) of consumers say they’d stay loyal or at least comparison-shop if brands were transparent about those increases. Honesty and clarity matter more than ever.

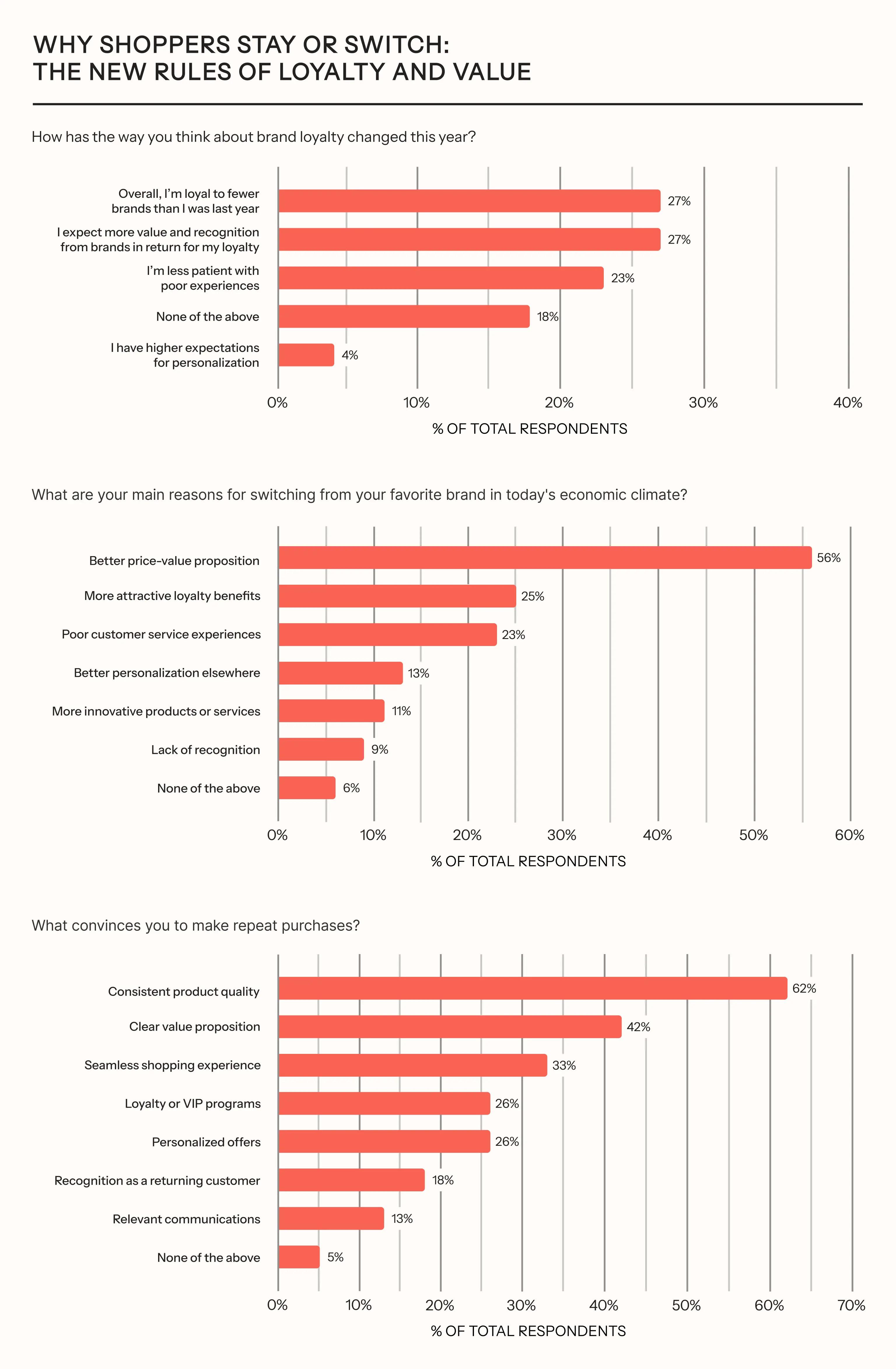

Loyalty is becoming harder to earn and easier to lose

Still, loyalty is evolving fast. 27% of consumers say they’re loyal to fewer brands this year. Another 27% expect more value and recognition in return for sticking around. And 23% say they’re less patient with poor experiences—meaning there’s less room for mistakes.

What’s driving these shifts? At its core, consumers still care about the basics: 62% say consistent product quality is what keeps them coming back. A clear value proposition (42%) also matters more than loyalty perks or personalization alone (both 26%).

Still, to communicate better than the competition, you have to understand your customer better than the competition. You also need the ability to use behavioral data to quickly surface relevant messaging, products, and experiences that win their trust and dollar.

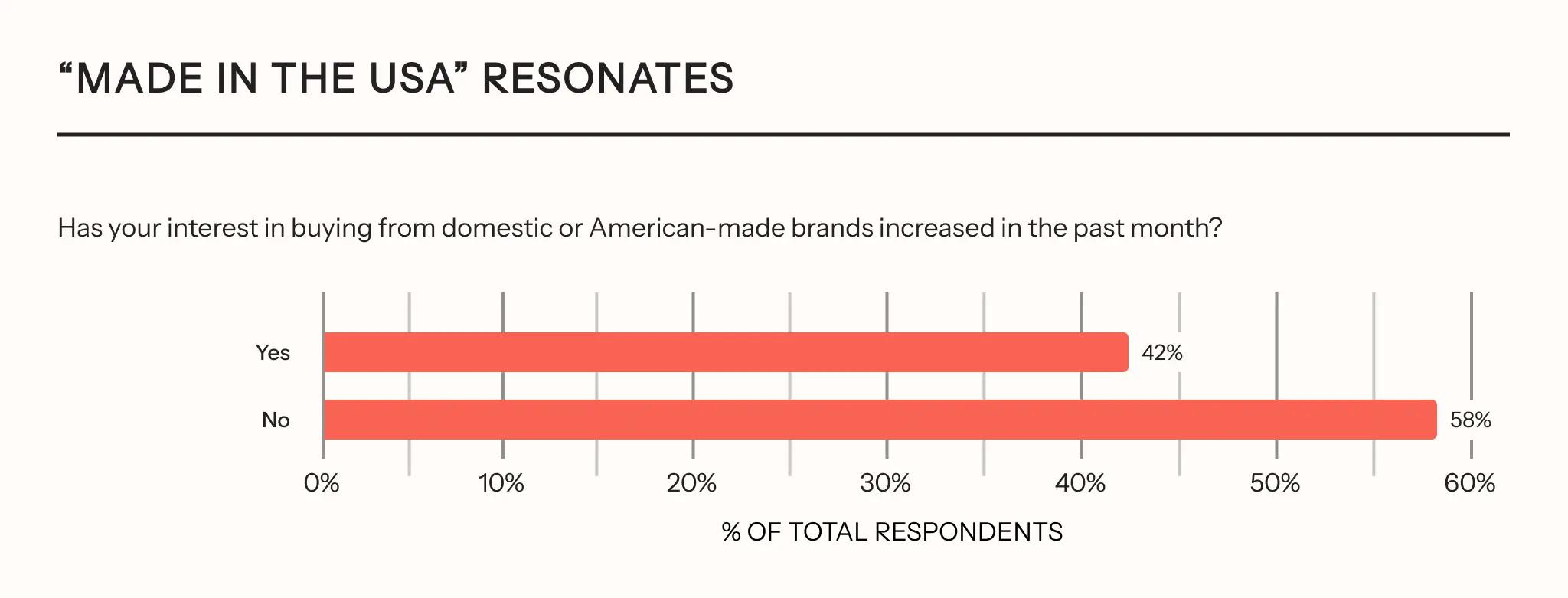

American-made goods are getting a boost

Tariff worries and economic uncertainty are pushing more shoppers to buy American-made. 58% say they’re doing it to support the local economy, while 45% want to avoid tariff-related price hikes. Faster shipping (40%) and perceived higher quality (37%) are playing into the mix, too.

Now is a good time to evaluate your supply chain and communicate updates to your audience.

What marketers should do

This week’s data is a clear message: loyalty isn’t static—it’s conditional. And that’s actually an opportunity.

Here’s what to do:

- Communicate with clarity. 49% of shoppers say they’d be more forgiving of price hikes if brands were upfront about why. Don’t bury the lead—tell the story behind the changes.

- Double down on the basics. Consistent quality and a clear value proposition aren’t optional—they’re non-negotiable.

- Rethink loyalty. Loyalty in 2025 isn’t just about points and perks. It’s about being the brand that listens, delivers on promises, and recognizes customers as individuals.

The bottom line? Brand loyalty isn’t dead—it’s evolving. And, so is this Consumer Pulse report. We’ll be moving to a monthly cadence for now as tariff news slows. Until July, stay focused on what really matters: clarity, quality, and experiences that keep shoppers coming back.

Week of May 26: sales may be shrinking, but opportunity isn’t

Memorial Day is usually the unofficial kickoff to summer shopping. But this year, many consumers felt the spark was missing. Nearly a third (28%) said discounts were smaller than in past years, while 19% noticed fewer items on sale. It wasn’t just perception: shoppers are recalibrating what value looks like, and brands are recalibrating how they promote.

But make no mistake: this isn’t a sign of apathy. It’s a sign of strategy.

Value matters more—and so does how it’s delivered

Shoppers are becoming more intentional. 39% say they’re being more cautious about spending. 1 in 5 are actively prioritizing value over brand loyalty. And only 14% say they’re sticking to their favorite brands—a signal that affinity alone isn’t enough.

The good news? 88% of consumers still consider sales and discounts important, and 41% are specifically waiting for the right promotion before they commit. That’s a wide-open invitation for brands to meet shoppers with smart timing, meaningful value, and messaging that makes people feel seen.

The experience gap is a loyalty risk—and a solvable one

Nearly half of shoppers (45%) say they’ve abandoned a purchase in the past 6 months due to a clunky experience. And it’s not just a check-out issue: 89% feel frustrated when they have to repeat information across channels. Meanwhile, 70% of consumers say they’d rather interact with fewer, more personalized brand touchpoints than expanded communication options (which may feel disjointed).

This is where brand experience becomes brand advantage. In a world full of messages, the brands that win are the ones that coordinate—across teams, tools, and touchpoints.

At Klaviyo, our point of view is clear: omnichannel doesn’t mean more messages. It means smarter ones. It means showing up at the right moment, on the right channel, with context that feels personal—not programmatic. And as this week’s data makes clear, that’s exactly what shoppers are asking for.

What marketers should do

This week’s data is a wake-up call. Memorial Day showed us that promotions alone won’t win the season. Coordinated, intentional experiences will.

So ask yourself: Are your summer campaigns meeting shoppers where they are? Are they easy to navigate? Are they helping or overwhelming?

The brands that make it simple, consistent, and personal will be the ones shoppers come back to. Until next week: prioritize quality over quantity. Your customers already are.

Week of May 19: tariff concerns shift the holiday clock

Memorial Day is shaping up to be more than a long weekend—it’s turning into a test case for how consumers will approach the rest of the retail year.

While 68% of respondents are aware of the temporary tariff pause, just 15% say it’s made them feel more optimistic. In fact, nearly half of shoppers are just as anxious—or more—about pricing and product availability than when the tariffs were first announced. And 72% are concerned costs will rise during Black Friday Cyber Monday, too.

The implication? Holiday shopping behaviors are shifting now. We’re not just seeing early signals—we’re seeing a new calendar take shape.

Holiday shopping might start…now

Nearly one third of consumers (31%) say they’ll shop Memorial Day sales specifically to get ahead of potential price hikes and inventory issues. Half say they’re considering early holiday purchases. The traditional Q4 rush may be kicking off now as consumers start to spread their spending across multiple shopping holidays rather than concentrating on traditional peak seasons.

Consumer confidence is fragile, and price isn’t the only concern

Tariffs are no longer just a supply chain issue. They’re a psychological one. Shoppers are adapting in real time, but without long-term confidence. 69% are concerned about inventory shortages later this year, and 72% expect price increases during key sales moments. These aren’t fringe concerns. They’re shaping shopping strategies.

What marketers should do

Memorial Day might feel early to talk holiday strategy, but this year, it’s right on time. Consumers are watching inventory, pricing, and communication closely and reevaluating where it makes sense. The brands that win this season will be the ones that show up early, speak clearly, and plan ahead.

This isn’t just about starting sales sooner. It’s about messaging smarter. Acknowledge the uncertainty. Highlight what’s in stock. And most importantly, meet consumers where they’re headed, not where they’ve been.

We’ll be back next week with more signals from the road ahead. Until then: don’t just prepare for peak season. Redefine it.

Week of May 12: price pressure pushes consumers to practical choices

Tariffs may be on pause, but shoppers aren’t waiting for official policy to drive their decisions. This week’s pulse signals a deeper shift underway. We’re entering an era of mindful consumerism, where loyalty is earned, not assumed, and value is measured in more than just discounts.

Price sensitivity is real, but so is intention

Take price sensitivity: yes, it’s real. Nearly half of consumers say a price increase beyond 5% would prompt them to consider switching brands. Another 32% of consumers say any price increase at all will have them switching to a cheaper option.

This doesn’t necessarily mean people are unwilling to spend, though. It means they’re setting new expectations. They’re weighing quality, brand values, and long-term trust alongside price, and they’re making more deliberate choices about where their money goes.

Shoppers are planning ahead, not pulling back

That same mindset is driving how people plan. Three-quarters of shoppers say they’re stocking up on products—not out of fear, but as a thoughtful way to stay ahead. Non-perishables, household goods, and personal care items top the list.

And notably, people are budgeting for these decisions rather than relying on credit: 51% say they avoid flexible payment options altogether.

Travel plans shift as shoppers weigh the cost

People are even reconsidering travel. Two-thirds of consumers expect to adjust their plans this year to account for rising international costs—another signal that ongoing economic volatility has consumers choosing differently.

What marketers should do

The takeaway? People aren’t pulling back—they’re getting smarter. They’re reassessing what matters, investing where they see alignment, and holding brands to a higher standard. And that’s good news for marketers who are ready to meet them there.

This isn’t a call to offer more for less. It’s a reminder to lead with clarity, consistency, and care. In moments like this, your messaging isn’t just marketing—it’s a reflection of your values. The brands that thrive won’t be the loudest. They’ll be the ones that listen, respond with empathy, and show customers they truly understand the road ahead.

“While the new pause on tariffs represents an improvement, the impact on costs remains significant enough that we need to continue exploring ways to manage it effectively,” says Zach Scheimer, sr. marketing manager, Criquet Shirts. “Given all the uncertainty, we’re maintaining our pragmatic approach of preparing for tough scenarios, but hoping for the best.”

We’ll be back next week with more real-time insights. Until then, keep leading with intention.

Week of May 5: tariff concerns aren’t fading and loyalty is up for grabs

For the third week in a row, we’re seeing signs that consumers are not just reacting to headlines—they’re adjusting their behavior in lasting ways.

Tariff anxiety is here to stay, and it’s reshaping consumer behavior

Let’s start with tariffs. More than half of consumers (54%) say they’re just as concerned about tariffs today as they were when the news first broke. That tells us this isn’t a temporary blip. It’s a persistent pressure shaping how people shop—and how they expect brands to respond.

Consumers are leaning on loyalty programs and research to find the best deals

So what are shoppers doing about it? They’re getting scrappier.

Nearly one-third (29%) of consumers say they’re leaning more heavily on loyalty programs than they were just 3 months ago. That’s a big signal: people are hungry for ways to stretch their dollar, and they’re rewarding the brands that help them do that.

They’re also doing more homework. Over half (51%) of consumers report spending more time researching before buying than they did 6 months ago. This shift points to a more deliberate shopping mindset—one where impulse takes a backseat to value, trust, and clarity.

Brands are adapting, and their messaging is shifting fast

Meanwhile, we’re seeing brand behavior evolve right alongside consumer behavior. Email subject lines mentioning “American-made” jumped 48% on Klaviyo last week, mirroring a 42% increase in shopper interest in buying domestic products.

Messaging that mentions tariffs is also climbing fast—up 450% since the initial announcements. The smartest brands are responding in real time.

What marketers should do

Here’s the takeaway: loyalty isn’t static. It’s up for grabs. In moments like these, the brands that win are the ones that make value clear, reward long-term relationships, and communicate with consistency—not panic.

This week, ask yourself: Are you showing your customers that you’re worth their research, their trust, and their loyalty? If not, now’s the time to start.

We’ll be back next week with more signals from the road ahead. Until then, keep listening and keep leading.

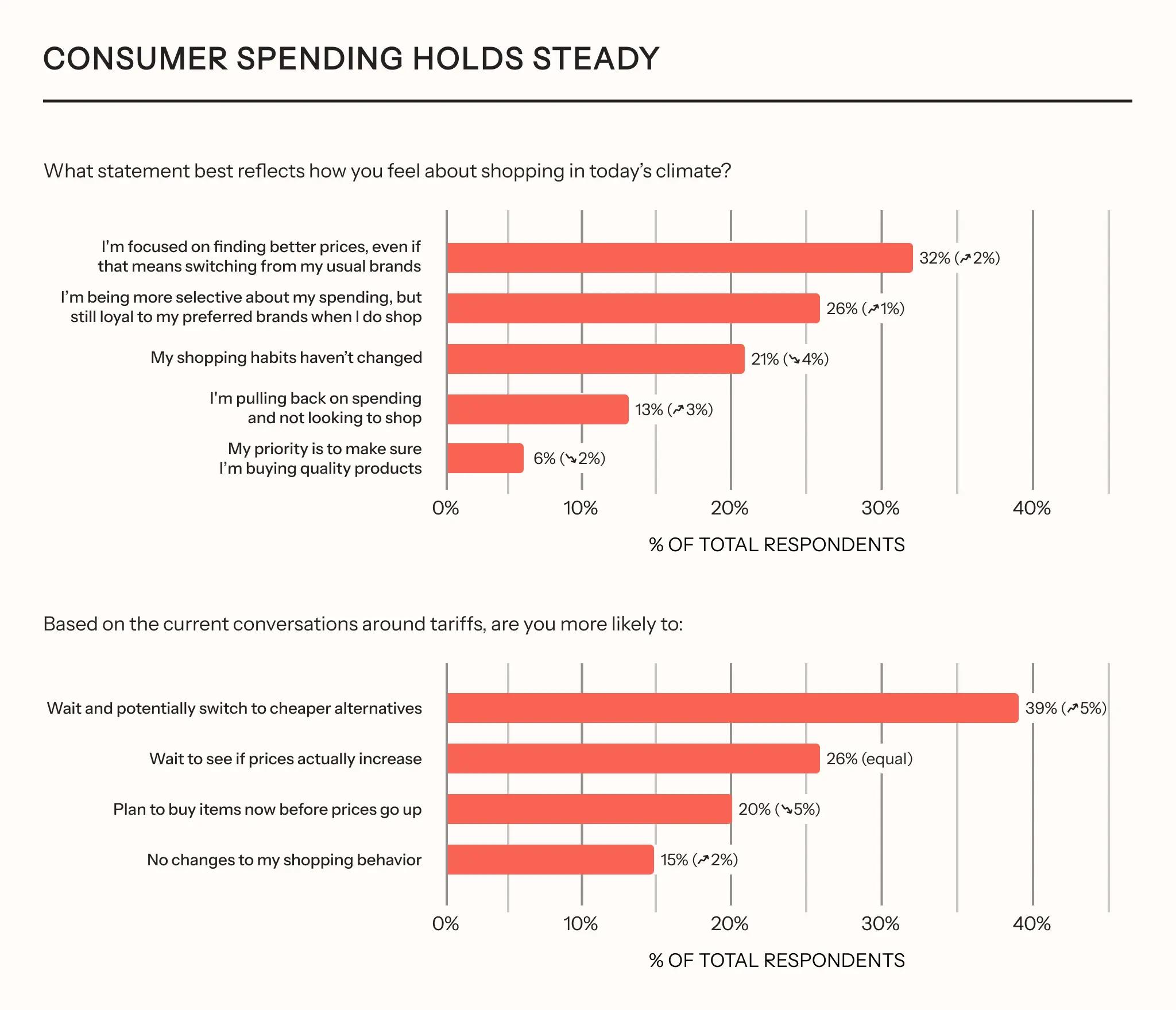

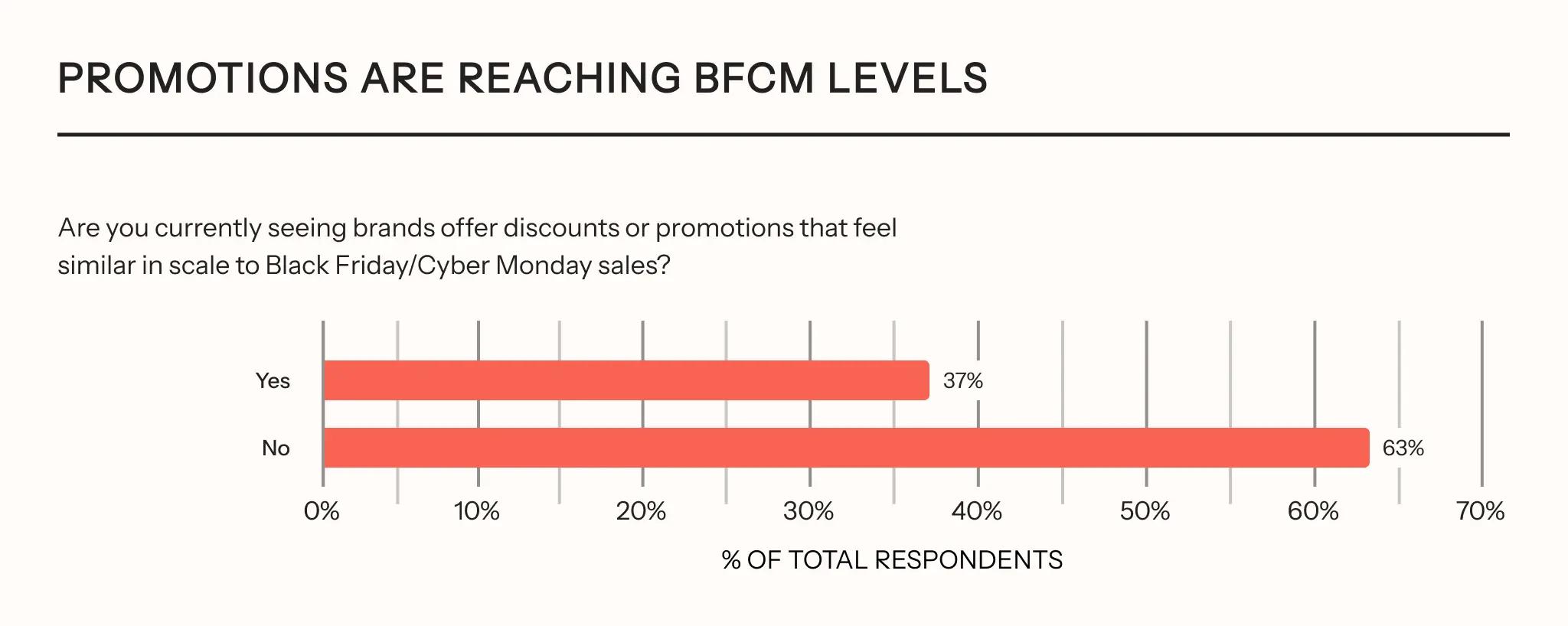

Week of April 28: sales are heating up—and so is support for domestic brands

Consumer spending sentiment stayed fairly steady this week, but two new signals are worth your attention. A meaningful slice of shoppers are spotting unusually deep promotions, and interest in buying American-made products is climbing—creating fresh opportunities for brands ready to act.

Consumers are seeing BFCM-level discounts and promotions

First, promotions are everywhere—and consumers are taking notice. Nearly 4 in 10 shoppers (37%) say they’re seeing Black Friday-level discounts and sales right now, as brands race to respond to rising price sensitivity and tariff concerns.

While these promotions are helping brands maintain momentum, they also hint at bigger questions ahead: will brands have enough inventory left for peak holiday periods?

If you’re offering steep discounts today, it’s worth taking a strategic look at how you’ll balance pricing, inventory, and consumer expectations through the end of the year.

Consumers are seeking out “Made in the USA”

Second, domestic shopping is gaining steam. In response to tariff concerns and supply chain uncertainty, 42% of consumers say they are intentionally seeking out American-made products.

It’s a clear signal that “Made in the USA” messaging could resonate more strongly this season, particularly among shoppers eager to support local businesses and avoid international shipping delays.

Together, these trends suggest that while price sensitivity remains a dominant force—77% of consumers say price is their top purchase driver—other factors like brand trust, shipping speed, and even the origin of goods are starting to weigh more heavily in decision-making.

What marketers should do

For marketers, the takeaway is simple: stay agile.

- Lean into real-time signals to refine your messaging and promotions.

- If you’re running sales, pair them with stories that emphasize value, trust, and transparency—not just discounts.

- And if you source or manufacture domestically, don’t be shy about sharing that with your audience.

In uncertain times, customers are telling us exactly what they value. Brands that listen—and respond with clarity and care—will be the ones that win loyalty for the long haul.

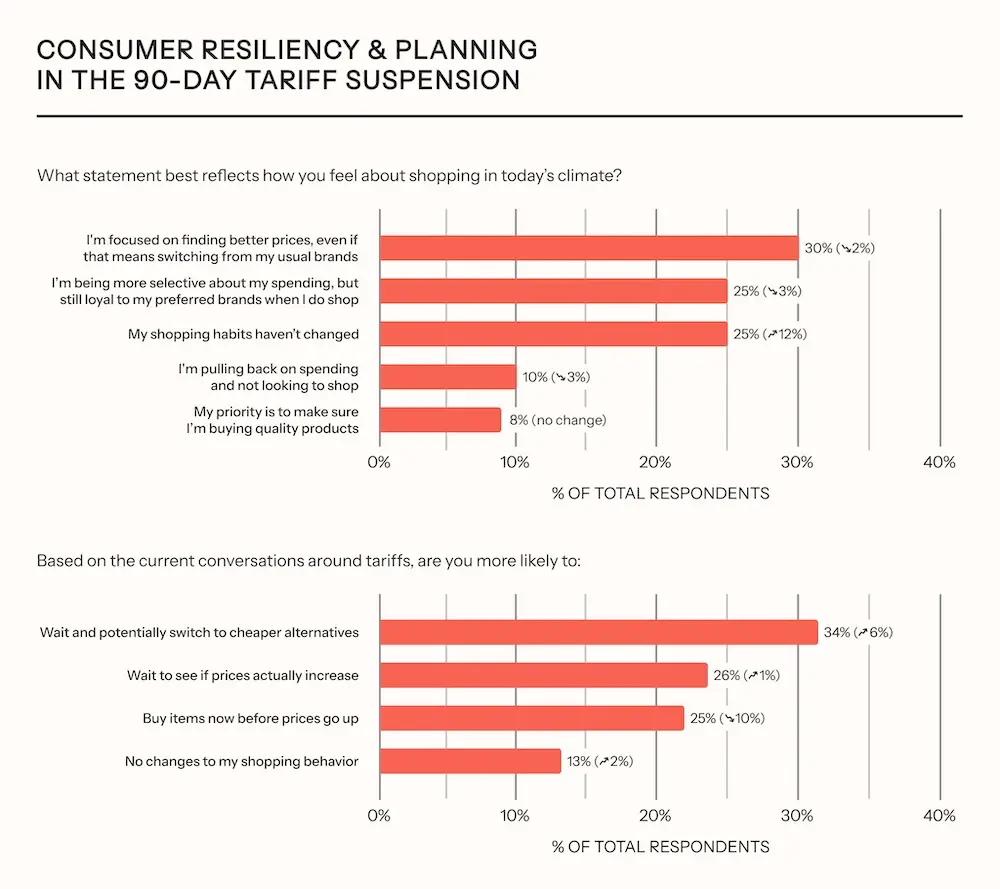

Week of April 21: caution is rising and your competitors are moving—are you ready to respond?

New survey data shows consumers are growing more hesitant in the face of tariff chatter and economic uncertainty—but they’re not disengaging. They’re scanning the road ahead, weighing options, and holding brands to a higher standard before making a move.

For marketers, that means one thing: now is the time to earn trust, not just clicks.

Let’s look at the signals.

Fewer shoppers are rushing to buy before prices go up

Just 25% of consumers are rushing to buy this week before prices go up, down 10 points from the last survey. Instead, more are adopting a wait-and-see approach (26%) or actively looking to switch to cheaper alternatives (34%). At the same time, the share of consumers reporting no change in behavior ticked up slightly, from 11% to 13%—suggesting some normalization, but with continued caution.

Your competitors are making moves—and consumers are noticing

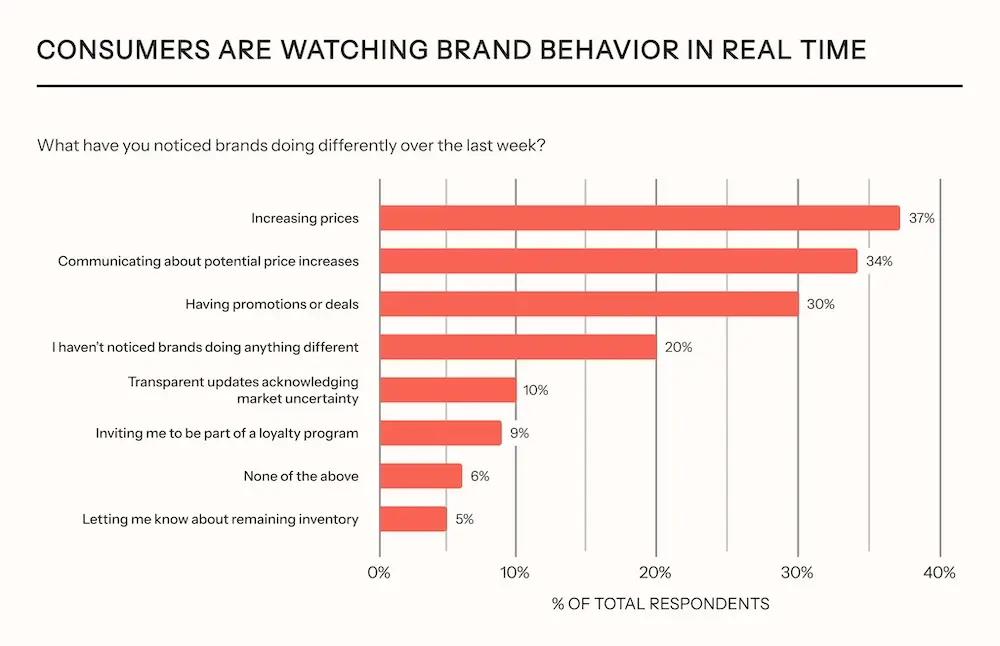

Even so, shoppers are paying close attention to how brands respond: 80% of consumers have noticed brands taking some kind of action in the past week.

That includes price increases (37%), communication about potential hikes (34%), and new deals or promotions (30%). A smaller—but meaningful—group noticed brands offering loyalty perks (9%) and transparent updates about market conditions (10%).

Here’s why that matters: if your competitors are already communicating about the impact on their business, you can’t afford to be the brand that stays silent. Your customers are watching, and they’re using what they see to make spending decisions. Keeping tabs on peer brands, partners, and your own messaging cadence isn’t just smart marketing—it’s risk management.

This isn’t a sign to pull back. It’s a cue to get sharper

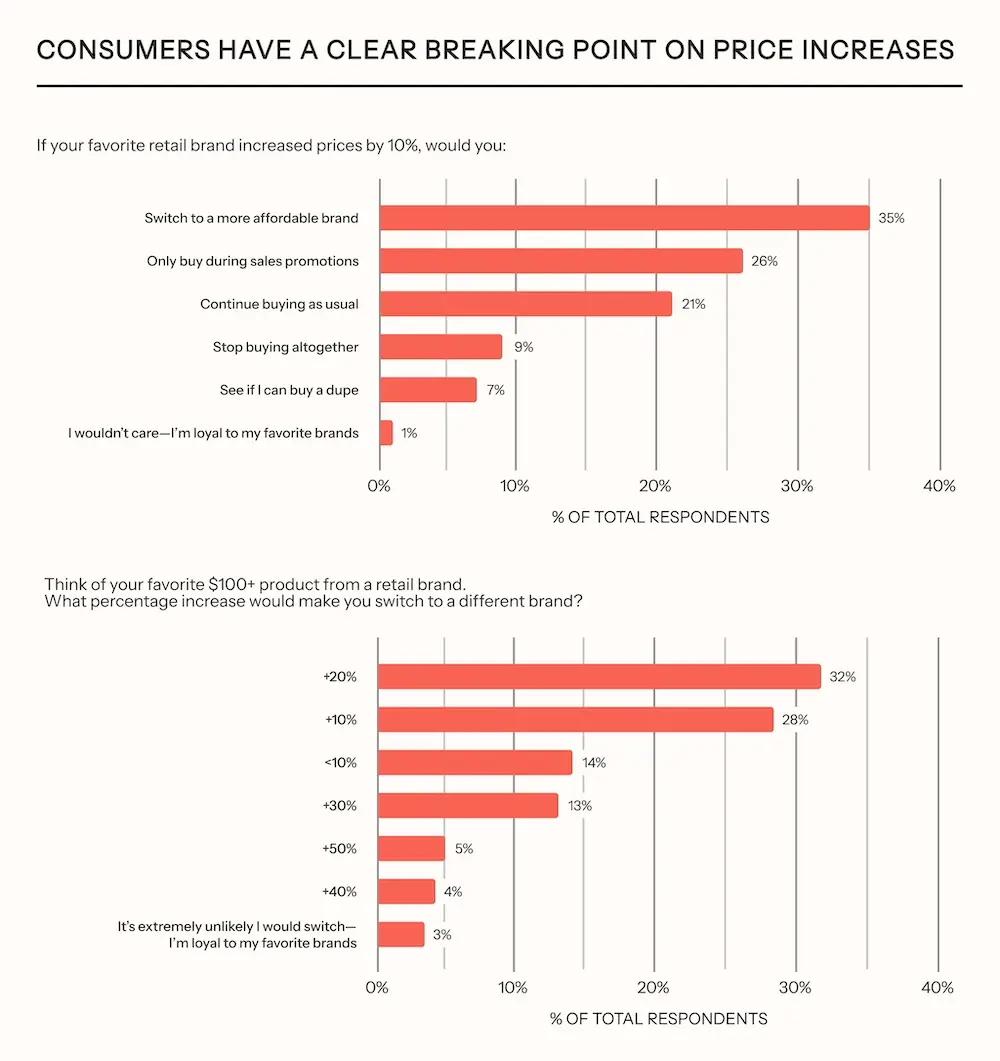

Price sensitivity is growing, yes, but consumers are still making luxury purchases. 35% of shoppers say they’d switch to a more affordable brand if their favorite increased prices by just 10%. But 21% say they’d keep buying as usual, and nearly 1 in 5 would still invest in luxury items—if the brand feels worth it.

That’s the opportunity. In today’s climate, price isn’t everything—perceived value is. And value isn’t just about discounts. It’s about trust, clarity, and the strength of your relationship.

What matters most to consumers right now?

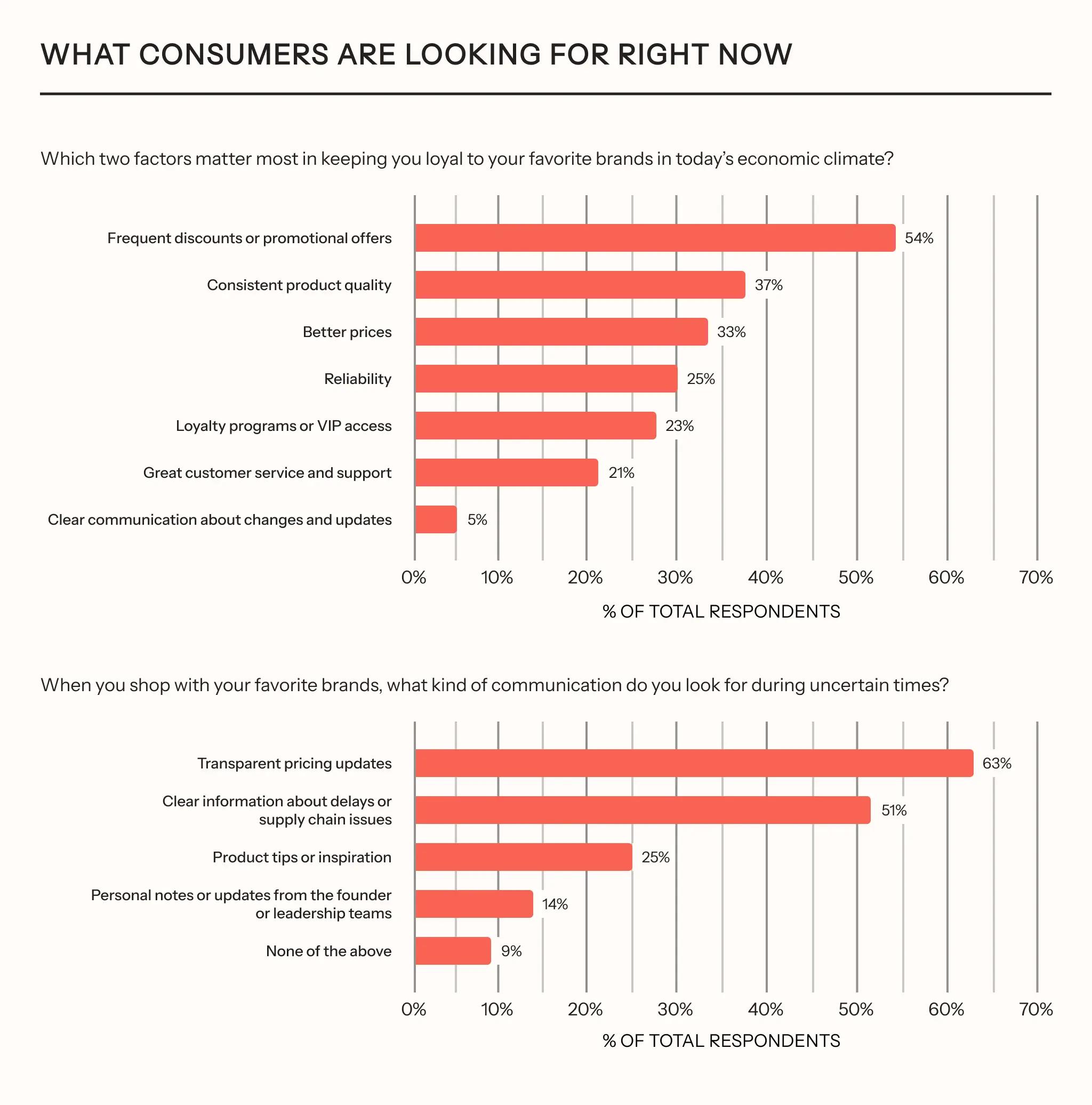

It’s the same playbook we saw last week: consistent product quality (37%), personalized discounts (54%), and transparency around pricing and supply chain challenges (63%). These aren’t trends—they’re expectations. And Klaviyo helps you meet them.

This week, use your data to act with precision.

- Segment your audience by loyalty and price sensitivity.

- Test messaging that reassures, rather than just promoting.

- Run predictive flows that get ahead of drop-offs.

If you’re a Klaviyo customer, you’re already equipped with tools like RFM analysis, price drop automations, and campaign testing to move faster than the market shifts. And if you’re not? This is your reminder: marketing shouldn’t guess. It should guide.

In times of uncertainty, the brands that win won’t be the ones that shout the loudest. They’ll be the ones that listen hardest—and respond in kind. That’s what your customers are waiting for. Don’t make them wait too long.

We’ll be back next week with more signals from the road ahead. Until then: drive with intention.

Week of April 14: priorities are shifting—are your campaigns keeping up?

We just wrapped our latest consumer pulse check, and here’s what we’re seeing: shoppers aren’t shutting down—but they are thinking about shifting gears. They’re spending more intentionally, being choosier about who they buy from, and reassessing what loyalty means to them.

Restaurants may see the biggest pullback (61% of consumers say they’re planning to cut spending there), followed by apparel and travel. Even grocery spend is tightening. We expect these spending cuts are likely due to recent periods of high inflation and tariff conversations.

But let’s be clear: this is not performance data—it’s consumer sentiment. These responses are signals, not proof. Still, they’re worth listening to. What we do know: when consumers shop, they’re leaning into the brands they already trust.

That’s a window of opportunity for marketers—if you act on it.

If you’re a marketer, this is your moment to meet people where they are—and Klaviyo gives you the tools to do exactly that. Here’s what this week’s consumer survey found, and what to do about it.

- Consumers want deals—specifically from brands they trust. 54% of shoppers say discounts are key to brand loyalty. With Klaviyo segmentation, you can target price-sensitive shoppers with personalized discounts—without discounting across the board. Use price drop flows to automatically notify customers when items they’ve viewed go on sale.

- Loyalty is a competitive advantage. 28% of shoppers are sticking with brands they already love. Klaviyo helps you identify VIPs using RFM analysis and CLV metrics. Build loyalty automations that reward your best customers with early access, exclusive drops, or personalized thank-you notes.

- Shoppers expect transparency. 62% of shoppers want clarity around pricing. Don’t wait until changes hit to communicate. Send an email today explaining where your brand stands, and commit to sharing updates as they come. Klaviyo’s campaign builder makes it easy to segment and send those messages across email and SMS.

- Consumers aren’t cutting back yet—but they’re signaling caution. Especially if you’re in restaurants, apparel, or travel, now’s the time to double down on retention. Klaviyo’s win-back and post-purchase automations, powered by predictive analytics, help you re-engage high-value customers before they churn.

- Doing more with less starts with smarter segmentation. Klaviyo’s RFM modeling and customer insights help you understand who’s loyal, who’s at risk, and who needs attention now. Combined with lifecycle automation and predictive analytics, you can turn that insight into action—automatically.

- Think less founder speak, more data. In uncertain times, customers aren’t looking for empty reassurances. They want information they can trust. 62% say they want pricing transparency and updates, but only 14% say personal notes from founders resonate. That’s a clear signal: prioritize relevance over sentiment.

Consumers are adapting fast. But that doesn’t mean you’re at the mercy of the market. With the right insights and the right platform, you can build marketing that adapts just as quickly—and turns uncertainty into opportunity.

We’ll be back next week with fresh data. Until then, keep listening, keep optimizing, and keep putting your customers first.