Welcome series

Welcome new subscribers to your list with an engaging email or SMS flow, reward them for signing up, and help them get to know your brand better.

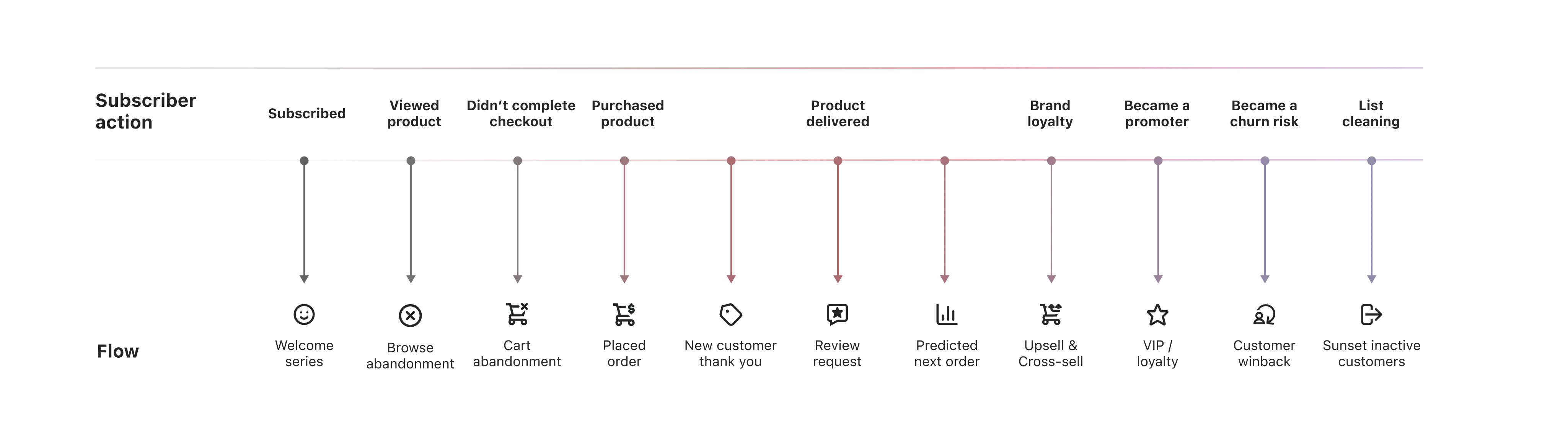

Build the ultimate customer journey. Smart automation sends targeted messages that respond to customer data and real-time behavior.

Create flows in seconds with AI, or choose from 60+ pre-built, customizable templates.

Fine-tune automations with a drag-and-drop builder—no developer required.

Customize flows using customer data in Klaviyo and over 350+ integrated tools and APIs.

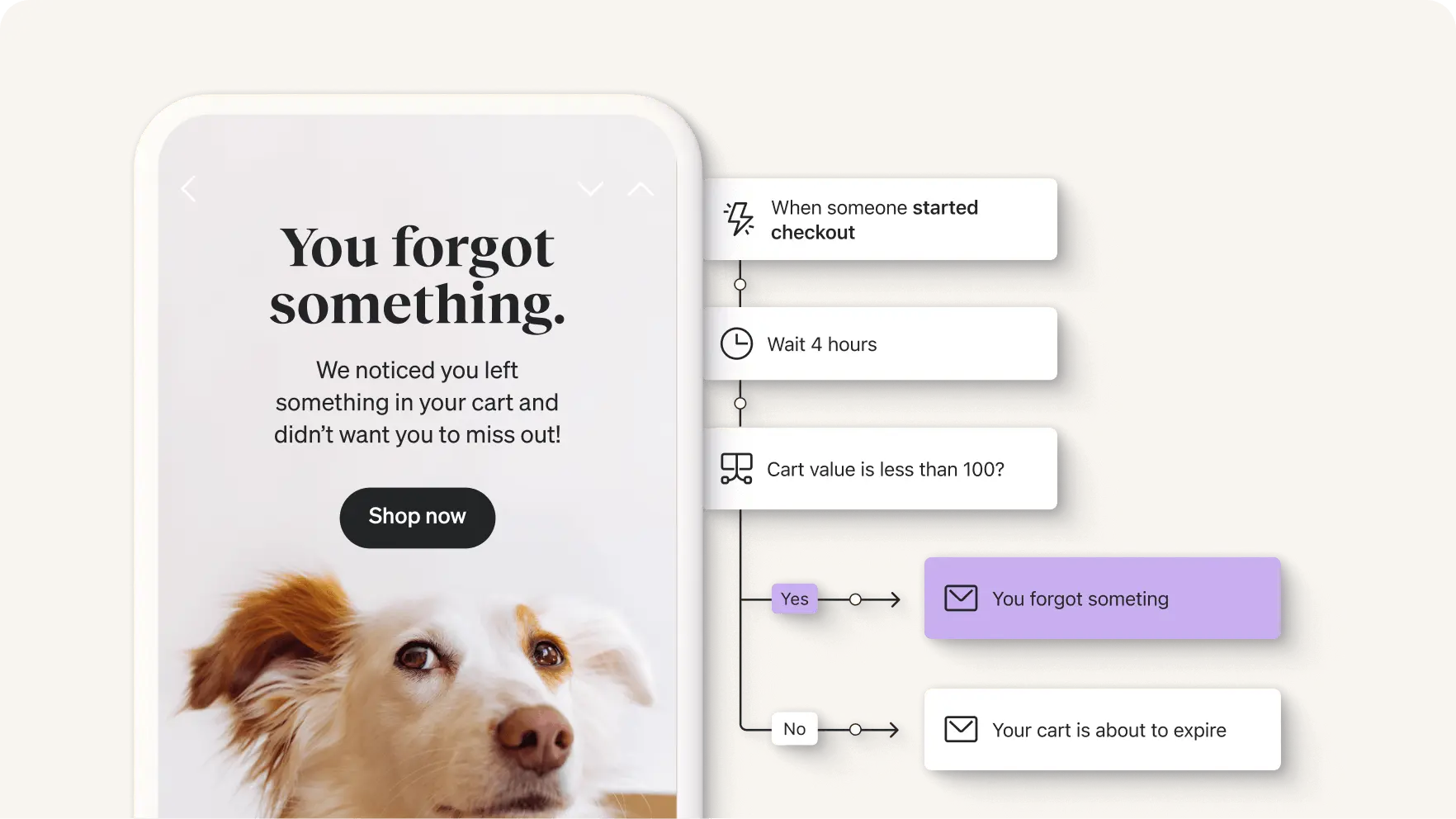

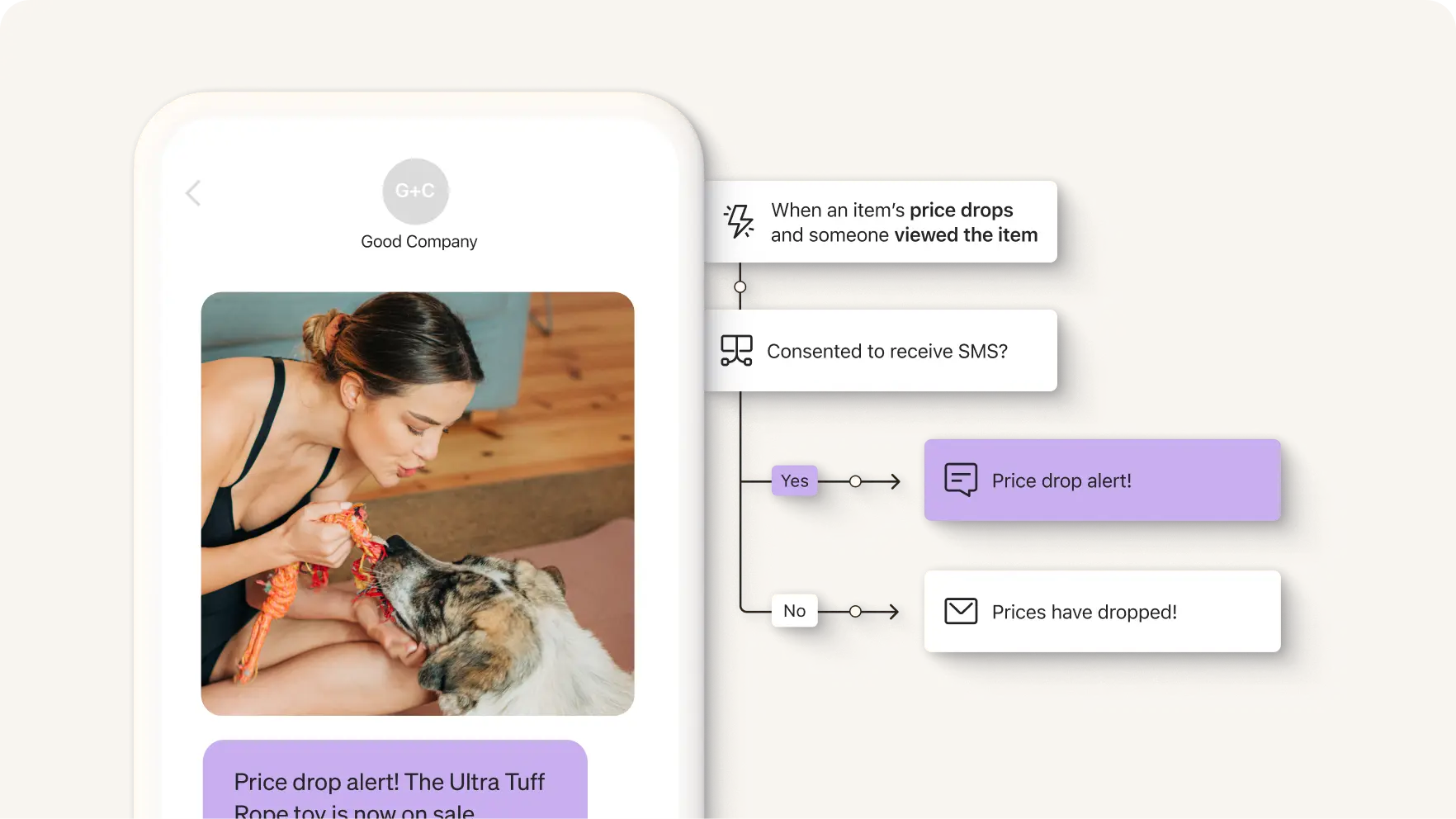

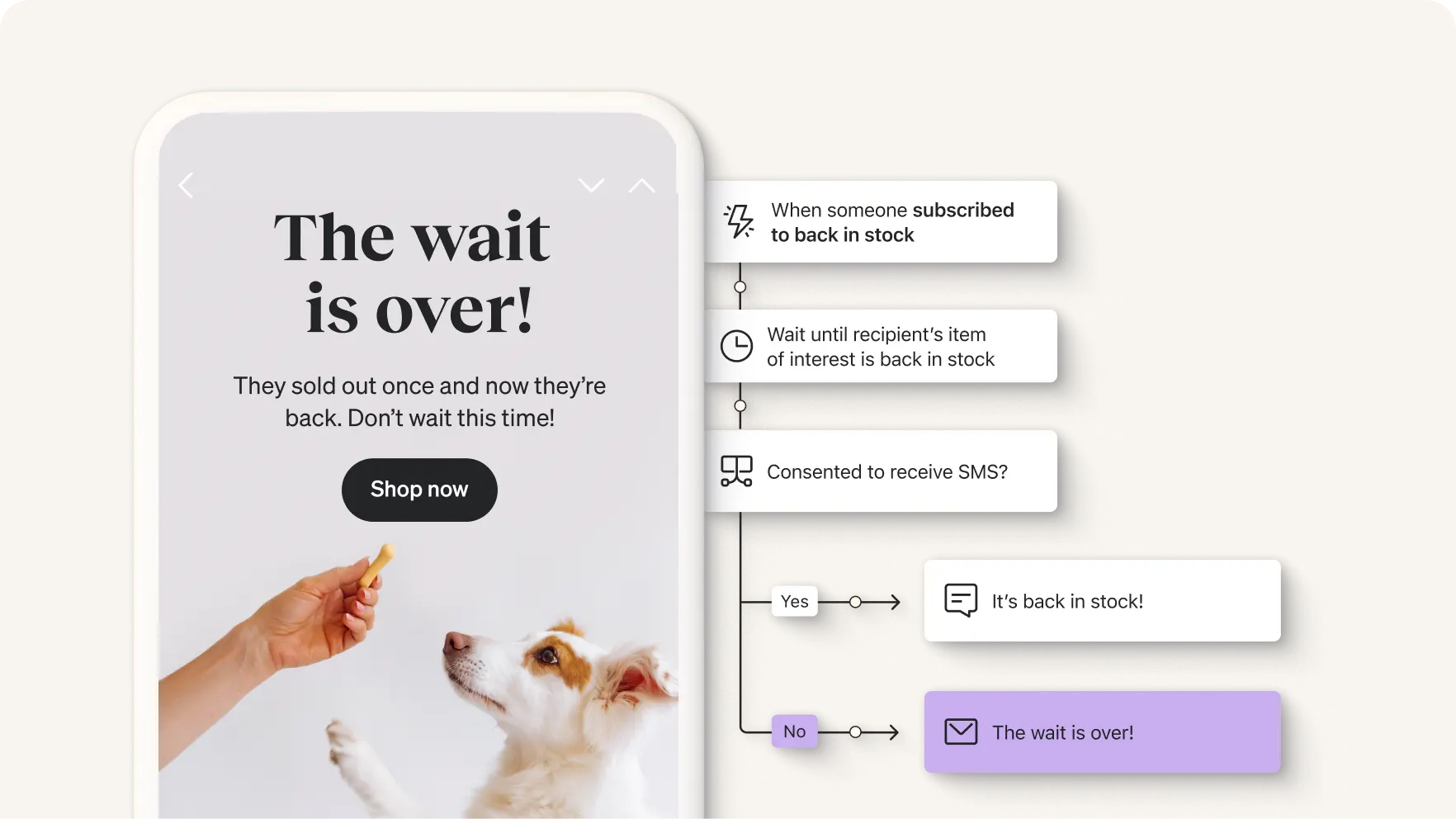

Build cross-channel experiences with email, SMS, and push notifications in a single flow.

Automate responses to customer behavior with easily customizable pre-built and AI-created flows.

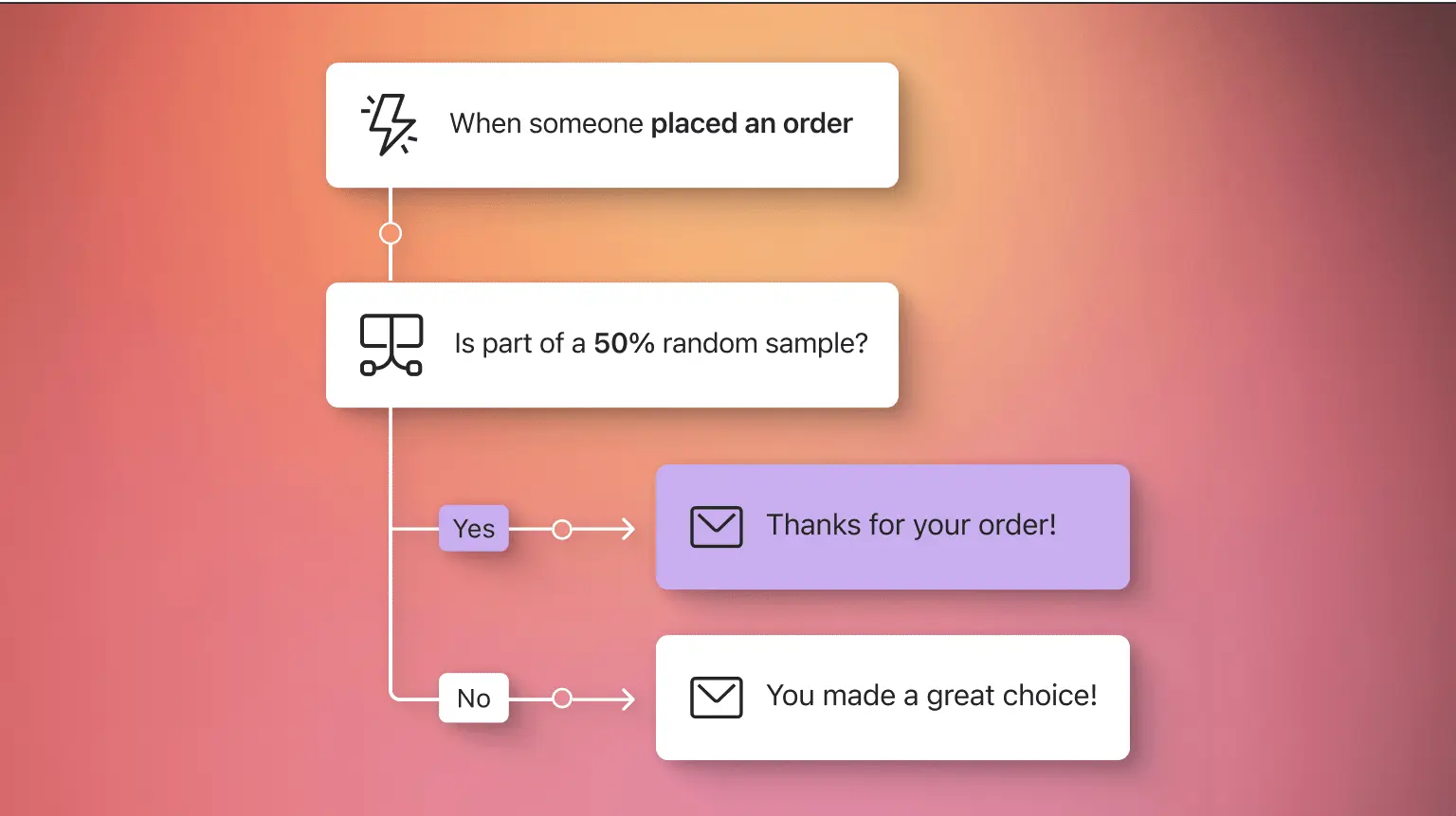

Simply select an existing flow template and customize your branding and content. Then create different flow paths and journeys with our drag-and-drop builder.

Welcome new subscribers to your list with an engaging email or SMS flow, reward them for signing up, and help them get to know your brand better.

Send subscribers a heads-up when they leave a product in their shopping cart, so they can swing by and finish checking out (and boost your bottom line).

Automatically ask customers how their shopping experience went. Recommend additional products they’ll like, and see if they’ll leave you a good review.

Nudge subscribers about specific products that caught their eye. See if they’re still interested. Maybe throw in a coupon code or free shipping to sweeten the deal.

Let subscribers know about sweet deals on products they’re interested in.

Alert subscribers when an item they’ve been waiting for is finally back in stock.

Create custom flows that trigger timely experiences in response to a subscriber action, event, or milestone of your choice. Then, you can build branching conditions (“split logic”) for more relevant customer journeys.

Webhooks let you add processes from integrated apps and servers to your flow. Use them to automatically trigger processes like:

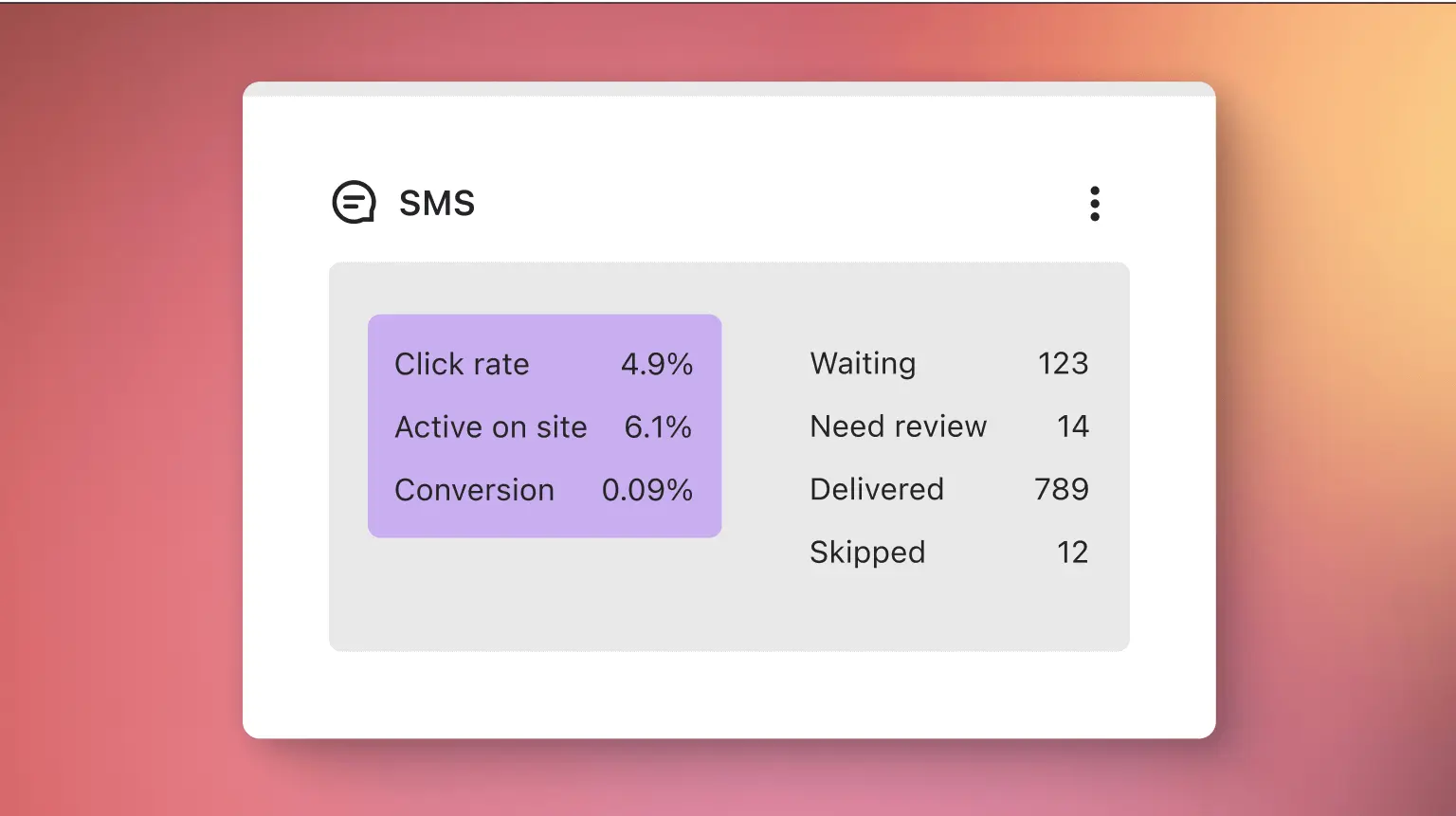

View key flow performance metrics directly in the flow builder.

Improve your results by testing send times, channels, message content, and discount offers.

Get scheduled flow reports that measure performance by time period and engagement metrics.

Need a complex flow? Simply type a description and let Klaviyo AI build it out in seconds.

We retarget people based on what they’ve clicked within an email. After they click, we send them another email that’s directly related to what they expressed an interest in. Through that we get really high open rates—around 60 percent—and also a really strong conversion rate.”

See the best automated flows for boosting revenue and customer experiences.

Make the most of email marketing automation with these tips.

See your marketing automations are performing and find ways to improve them with these tips.

In Klaviyo, an automated flow is a feature that triggers a specific action or experience in response to a particular behavior, milestone, event, or subscriber data. If you’ve used other marketing tools, you might also know automated flows as “automations” or “drip campaigns.”