CLV calculation is a crucial metric to monitor in your marketing reporting tool when you’re trying to grow your business.

Customer lifetime value (CLV) is a metric that projects the amount of money a customer will spend with your company over the entire time that they do business with you.

CLV calculation is a crucial metric to monitor when you’re trying to grow your business, and a CLV calculator, or a tool like it, can help.

Do you ever wonder about the health of your customer relationships? Or wish you knew which relationships to prioritize—whether some were more important than others? Say hello to customer lifetime value (CLV).

But running a mathematical calculation with a CLV calculator is only the first step. It’s what you do after the calculation in terms of customer engagement that matters.

Why customer lifetime value matters

CLV considers the whole customer journey—and over the course of that journey, the more money a customer consistently spends, the better it is for your bottom line.

Unlike metrics like net promoter score (NPS) and customer satisfaction score (CSAT), which provide generalized indications of customer loyalty or satisfaction, CLV is unique in that it’s explicitly tied to revenue.

It’s not only a measurement of the health and quality of your customer relationships, but it’s also a tool that can help improve profit margins.

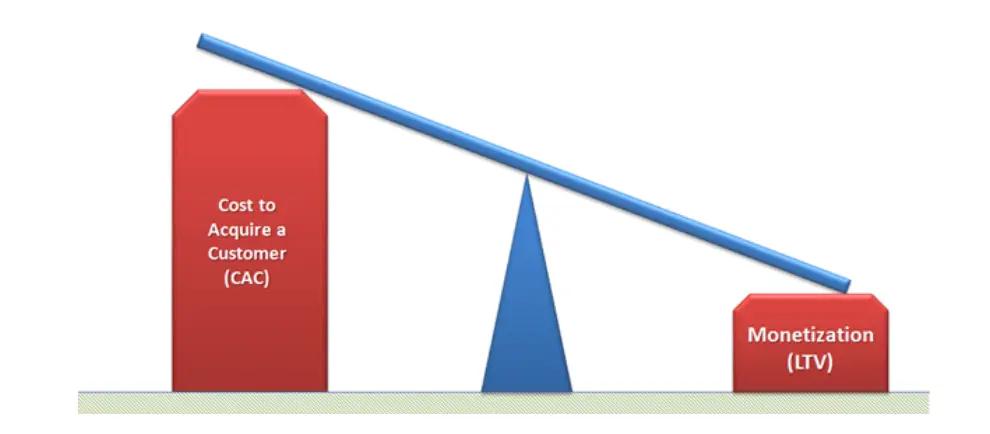

I can’t talk about CLV without also mentioning customer acquisition cost (CAC). It costs companies, on average, five times more to acquire new customers than it does to keep existing ones.

When you compare CLV against CAC, you can calculate how long it will take to recover the cost of acquiring a new customer. Why is this important? Well, not all customers are created equal.

Not every customer is going to generate the same amount of revenue for your business, so it’s imperative that you know how much to spend to acquire different kinds of customers.

Fortunately, it doesn’t have to be an overly complex task to track and understand all of your important business metrics, and tie them back to the metric you care most about: revenue.

What’s the difference between CLV and LTV?

The world of marketing acronyms can be overwhelming. There are a lot of them floating around, and it’s sometimes difficult to pinpoint which ones accurately apply to your business needs.

To make matters more confusing, in some instances, different acronyms mean the same thing and they’re used interchangeably, like how people often use CLV and LTV.

If you’ve ever read an article that references lifetime value (LTV), customer lifetime value (CLV), or lifetime customer value (LCV), rest assured, they’re all referring to the same thing.

For clarity and consistency purposes, I’ll use the acronym CLV throughout this article.

Why is it important to calculate your CLV?

Earlier, I touched on why it’s important to calculate your CLV in previous sections, but to give it to you straight: it helps you boost your profits and grow your business. By understanding your CLV, you can determine which customers to prioritize and reshape your marketing strategy accordingly.

For example, with customer acquisition, I mentioned that it’s imperative to know how much you need to spend to acquire different kinds of customers in order to use your marketing dollars efficiently and effectively.

Remember how I also mentioned CLV in relation to your customer acquisition costs (CAC) earlier? When you compare your CLV against your CAC, you can bucket your customers into various groups of profitability.

Your non-profitable customers are those who have a high CAC and a low CLV. Your highly profitable customers are those who have a low CAC and a high CLV.

Segmenting your customers is the first step in managing them.Amy Gallo, Harvard Business Review

Once you’ve segmented your customers based on a sliding scale of profitability, you can tailor your marketing strategy to extract the maximum amount of value from each group.

Your highly profitable segment of customers may be small, but they are mighty. Often, eighty percent of a company’s revenue comes from its most profitable segment of customers, so you may be willing to spend more to acquire customers who are similar.

Conversely, with this data in hand, you may consider reducing your acquisition budget for potential customers who are similar to your less profitable segments and shift your focus to re-engage inactive customers.

Prioritizing the customers who are going to bring in the most revenue and provide a high CLV is key.

A live look at the customer lifetime value formula

If you’re curious about what goes on behind the scenes and want to know how all of these values work together, read on to better understand the math behind the calculations.

Imagine you run an ecommerce store and you sell reusable water bottles stamped with fake quotes from famous individuals. “The problem with quotes found on the internet is that they are often not true” -Abraham Lincoln. “Do or do not, there is no try” -Gandhi.

Each water bottle you sell costs you $5 to make and you sell them for $20. Last year, you sold 2,500 water bottles, which equaled $50,000 in gross revenue for a nice profit of $37,500.

Of the 2,500 water bottles you sold, a one-time sale accounted for 1,500 units. Repeat purchasers bought the remaining 1,000 units.

The first key customer metric to calculate to help you understand your CLV is your average customer purchase frequency.

If you have 2,500 orders and 1,500 unique customers, divide your number of orders (2,500) by your number of unique customers (1,500) to get an average purchase frequency of 1.66.

With that key customer metric, you can predict that a typical customer will buy 1.66 water bottles.

Then, multiply your average purchase frequency (1.66) by the average purchase price ($20), and you have a CLV of $33.33.

With this metric, on average, you can expect to earn $33.33 over the lifetime of a customer.

Armed with this information, you can now make more informed decisions about customer acquisition and customer engagement, and what channels and/or customer segments are likely to yield the greatest return on investment (ROI).

How calculating CLV can help you better understand your customers

Profitability isn’t the only kind of customer segmentation that matters.

Another valuable segment to evaluate is channel entrances, or how your customers found you. This can help you identify whether some marketing channels have a higher CLVs than others.

Here’s an example:

Segment A | Adwords customers

- Total Adwords customers: 500

- Average order value: $20

- Average purchase frequency: 1.89

- Cost per lead: $10

First, calculate your average CLV by taking the average order value ($20) and multiplying it by the purchase frequency (1.89). In this example, your average CLV for this segment equals $37.8.

If your cost per lead for this segment is $10, subtract that amount from your average CLV to get a net CLV of $27.8.

Segment B | Facebook customers

- Total Facebook customers: 300

- Average order value: $20

- Average purchase frequency: 1.55

Just as before, multiply the average order value ($20) by the purchase frequency ($1.55) to calculate the average CLV ($31) for your Facebook customer segment.

If your cost per lead for this segment is $8, subtract that amount from your average CLV to get a net CLV of $23.

By strictly evaluating cost per lead (CPL), you could reason that you get more bang for your buck with Facebook and then choose to allocate more of your marketing budget there.

But adding your CLV calculation to the equation changes things.

Because your Adwords customers tend to purchase more frequently, they have a higher CLV and, consequently, they’re worth more to your business in the long run.

How to improve your customer lifetime value

Maybe what’s running through your head right now is, “Calculating CLV is critical for my business. I know I need to improve my CLV, but how can I do it?”

If so, you’re bringing things full circle. Implementing ways to improve your CLV directly correlates to growing your business.

So how can you improve your CLV? There are two primary levers you can pull when trying to improve your CLV:

- Increase customer loyalty by enhancing the customer experience

- Increase the average order size and frequency of orders

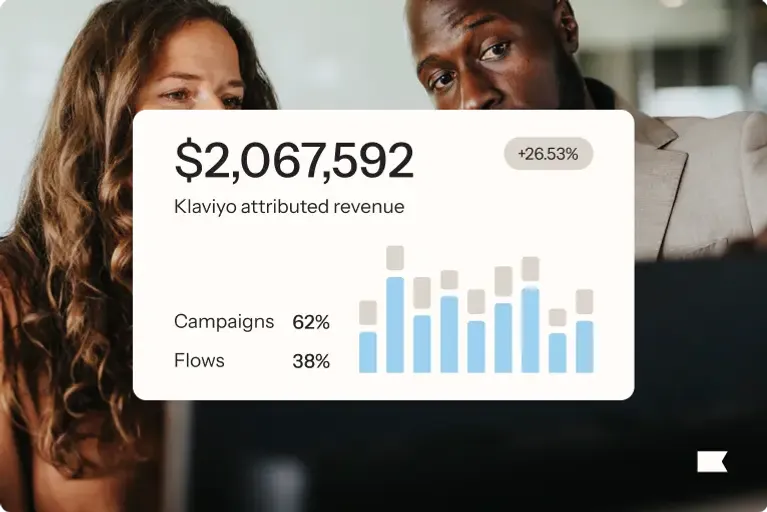

Tackling the second bullet point first, there are some easy opportunities, or quick wins, that you can leverage to quickly drive an increase in average order value (AOV). Some of these quick wins include offering free shipping, upselling and cross selling items, and running targeted email marketing campaigns.

Another consideration is to reconnect with inactive customers or customers who have only made one purchase.

Typically, one-time purchasers fall into the “unprofitable” customer segment since the revenue that comes from a single purchase often doesn’t match the cost it took to acquire that individual customer.

If your customer acquisition cost is consistently higher than your customer lifetime value due to a high discount rate, for instance, then your return on investment will be unbalanced.

Drew Sanocki, an ecommerce expert, took a deep dive into why one-time buyers are problematic and provided an actionable solution.

Drew highlighted how cross-selling can turn a one-time buyer into a repeat buyer. Once a customer makes a purchase, he recommends sending them an email offering a “high-margin, low-priced, best-selling product…in brick-and mortar-terms: it’s the classic McDonald’s ‘You want fries with that?’ cross-sell.”

Another strategy to help balance the scales? Winback email campaigns.

Winback emails are a highly effective means of re-engaging customers who have gone silent. With these emails, you can highlight new products, offer discounts, or include social proof that speaks to how awesome your brand is in efforts to bring previous purchasers back to your online store.

Back to the first bullet, increasing customer loyalty requires a more long-term, nurtured approach. You can’t just snap your fingers and have a devoted, loyal customer base in a matter of weeks.

The biggest driver behind customer loyalty is trust. Eighty-two percent of consumers say that they will continually buy from a brand they trust, even over other brands that become trendy at the moment.

Trust is built the same way professionally as it is personally—through consistent, responsive, and personalized customer interactions.

From the unboxing experience to the customer service you provide, create moments that foster a positive customer experience.

Proactive customer support, loyalty and referral programs, VIP offers, and personalized email marketing are all ways to strengthen the trust a customer has in your brand and increase your overall customer lifetime value.

A CLV calculator is only the first step

As business owners and marketers lean more heavily on technology and automation tools, customer data will be easier than ever to capture. As a result, your effective understanding and improvement of your CLV will play an ever-increasing role in the growth of your business.

Yes, calculating CLV is a step in the right direction, but as I mentioned at the start of this article, that’s just the first step.

Take the CLV values you calculate (or that your marketing automation platform calculates for you) and use them to better understand your customer base.

Then, segment your customers and extract the maximum amount of value from each bucket. Zero in on retention strategies to improve customer loyalty and increase your AOV by bundling products in a multi-pack, offering coupons, and sending thoughtful post-purchase emails.

Get a better understanding of your customers and communicate with them on a personalized level. Your profit margins will thank you.

Want to improve your customer lifetime value? Learn how to effectively use your CLV data.

Ready to segment your customers and improve your CLV?

Try Klaviyo today