Christmas in July isn’t a new concept.

But Amazon reinvented it in 2015 when they celebrated the company’s 20th birthday by launching Amazon Prime Day—the two-day shopping holiday that offers deep discounts and deals to Prime members.

In 2024, Amazon Prime Day saw its most successful year yet, generating $14.2 billion in sales over both days of the event in the US. That’s an 11.8% increase from 2023—notable given that inflation slowed to an average of 2.9% in 2024.

With over 220 million Prime members and an even larger non-member audience, Amazon can help brands not only increase discoverability of their products through its marketplace, but also benefit from two-day shipping through Fulfillment by Amazon.

But this access comes at a hefty price in the form of monthly subscription, referral, closing, and order fulfillment fees. And the biggest price brands pay to sell on Amazon is the lack of data and missed opportunities to create long-lasting connections with customers.

That’s why brands are doubling down on their own data and their own channels to create more personalized customer journeys, from brand discovery to post-purchase and loyalty. Given that 74% of consumers now expect personalized experiences from brands, according to Klaviyo’s 2025 future of consumer marketing report, it’s no longer enough to simply leverage Prime Day to push discounts.

Instead, brands are finding ways to rely less on third-party data, generate more zero- and first-party data, and create tailored offers that reflect the real-life behavioral and preferential data their customers generate through direct brand interactions.

Marketers who do decide to sell on Amazon must go into it with a channel-specific CRM strategy, while also maintaining a strong DTC presence. Keep reading to learn about Prime Day marketing strategies that have worked for 5 real-life brands.

The common thread is that each has had unique experiences with Amazon—whether that means using Amazon as a distribution and discovery tool, deciding the channel isn’t the right fit for their business, or coming up with creative Amazon Prime Day marketing strategies to make the most of the holiday.

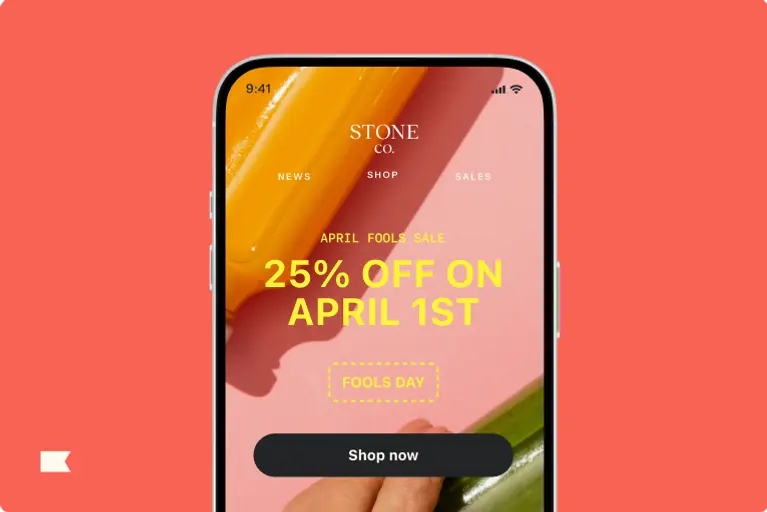

Align your marketing campaigns with relevant holidays and year-round celebrations.

Get your marketing campaign calendar1. Offer a comparable or better Prime Day deal through your own website

According to Klaviyo’s future of consumer marketing report, the biggest frustration consumers have when shopping the same brand in different places is inconsistent pricing and promotions.

If you’re selling products on Amazon, consider attracting customers to buy directly through your ecommerce website by:

- Matching Prime Day pricing on your own website

- Offering an even better discount in exchange for an email address or phone number

- Highlighting subscription or bundling options that empower your customers to save money without discounts

You may find that, eventually, you can wean your brand off Amazon completely. But we realize this might seem like a leap, and you’ll need evidence to back up the move.

If you need some convincing, monitor your onsite performance metrics during and just after the holiday, and compare your third-party revenue to your onsite revenue to make a determination.

Prime Day marketing example: Beardbrand focuses on building their brand off Amazon

Beardbrand, a men’s grooming company, initially used a third party to sell their products on Amazon. It worked well, and the brand thought about bringing that function in-house so they could invest more into selling on Amazon.

But when their products sold out on Amazon, Beardbrand noticed an unanticipated surge of sales on their ecommerce site.

“Why bother managing two different channels when we could just focus on one and make it really good?” says founder Eric Bandholz of their decision to change their sales channel strategy.

After realizing that Beardbrand didn’t have to rely on Amazon for sales, Bandholz ultimately decided to take the brand off the platform completely. They haven’t looked back.

“We exited Amazon in January of 2018, and it’s been great. I go to bed with no worries that someone’s going to shut down our listings or that we’ll have to deal with fake reviews—all the things that Amazon sellers are familiar with,” Bandholz explains.

“That said, I don’t think it’s the right move for everyone,” Bandholz cautions. “If you have most of your business coming in through Amazon, you can’t kill it. But because we invested so much in content marketing and brand, we were able to do that.”

Here, see how a product listing on Beardbrand’s website gives shoppers the option to subscribe—and save 20% in the process.

Source: Beardbrand

2. Segment your audience to exceed Amazon-set expectations

Amazon set a new standard for what counts as great customer service. People expect their orders yesterday, but even more importantly, they expect brands to know what they want and to communicate only what’s relevant to them.

The best way to meet or even exceed these expectations is through segmentation. Segmentation is a reflection of what you know about your customers: the marketing messages they engage with, the products they buy, the product pages they visit before buying, and so much more.

Brands that use one B2C CRM platform to gather, house, and act on the customer data they collect are in the best position to segment their Prime Day audiences by:

- Discount shoppers who viewed specific product pages

- Customers who bought on Prime Day last year

- High spenders who go all out during holiday deals

- Customers most likely to buy based on predictive analytics

Better yet, if you can target the right people at the right time before Prime Day, you may be able to shift some sales away from Amazon—and collect even more customer data for next year.

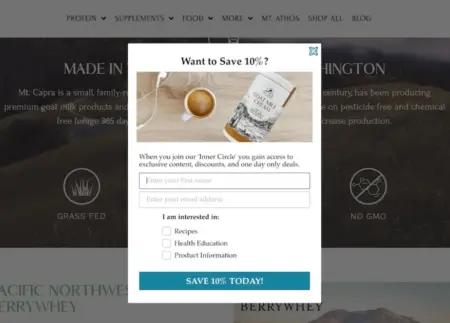

Prime Day marketing example: Mt. Capra course corrects after being burned by third parties

Mt. Capra, a family-owned brand that makes premium goat milk products, has been in business since the late 1920s. They sell their products on a DTC website and Amazon, but they’ve found the latter to be challenging.

“We had our sales almost cut in half over the course of about a month simply because Amazon misunderstood 3 of our top listings,” says Joe Stout, president of Mt. Capra. “They said we were advertising it in a way that was against their terms of service, but it wasn’t. It took a month and a half to get them to turn it back on, and by then, the sales never recovered.”

“What that showed us is that you have to build your own customer list. You have to own the relationship with your customers,” Stout adds.

Since then, the team at Mt. Capra has focused on building their audience, smart segmentation, and creating personalized marketing experiences to drive growth. Here, see how their email sign-up form asks new subscribers to indicate what topics they’re interested in—valuable zero-party data Mt. Capra can use to personalize future marketing efforts.

Source: Mt. Capra

3. Extend Prime Day through SMS and email for people who missed out

It may be hard to believe, but some Prime members miss Prime Day. Those who did will likely appreciate a second chance to get a discount on their favorite products—and your brand could be the one who delivers it.

We know you won’t have data from Amazon to rely on for targeting, but here’s a tip from what we know from our own data: SMS speeds up time to purchase.

According to our latest SMS consumer report, 65% of people who made an SMS purchase in the last year said it was something they were planning to buy in the near future or in a few months—and they ended up buying the item earlier than they planned to because of a promotional text message.

Prime Day could be the perfect reason to buy sooner. Your SMS subscribers are some of your most loyal—and according to that same report, their favorite thing to receive via text is a discount. When you extend Prime Day for that VIP subset of your audience, you’re inevitably going to recapture any lost sales you didn’t get from Amazon.

Prime Day marketing example: The Honest Company extends Prime Day themselves for more direct sales

One day after Amazon Prime Day, clean baby product and skincare brand The Honest Company sent this email offering 20% off if readers ordered directly from their site.

Source: Milled

It’s a smart move—not only because the timeline of their sale is longer than Amazon’s, but also because they’re offering a big discount. If subscribers miss buying Honest products through Prime Day, they get a second chance directly from the brand’s site.

This is a win-win: the customer still gets the discount, and the brand gets to collect data they wouldn’t otherwise on Amazon—not to mention, keep more of the profit from the sale.

4. Use Prime Day keywords in email subject lines

Subscribers are, shall we say, primed to notice Prime Day keywords in their inboxes during the holiday. Amazon doesn’t have dominion over all related keywords, and your brand should feel free to use them to capture attention during the event.

If you want to be especially pointed with your language, send an early access email to your VIP audience—referring to them as your “prime” audience, of course. You may even want to generate dynamic discount codes that are personalized to each subscriber.

Prime Day marketing tip: If you’re wanting to A/B test subject lines across many audience segments, you can use an AI subject line assistant to help you generate many variations. Just prompt the AI with the specific Prime Day keywords you want to use, and let the AI work its magic.

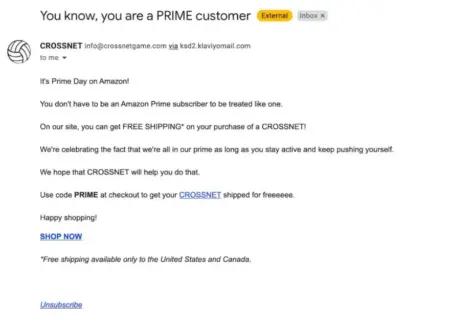

Prime Day marketing example: CROSSNET capitalizes on Prime keywords

In this email, sports gear brand CROSSNET strategically incorporates the word into their own subject line: “You know, you are a PRIME customer.”

Source: CROSSNET

The brand then takes the opportunity to present a free shipping offer to all their subscribers—regardless of whether they’re Amazon Prime Members or not. The discount code is “PRIME,” an homage to the ecommerce holiday.

And the cherry on top? Customers are shopping on their DTC website, so CROSSNET isn’t giving up a percentage of sales to Amazon.

With this email campaign, CROSSNET presents a simple way to make the most of Prime Day—without directing shoppers to Amazon to purchase.

5. Ask your customers to shop direct as a show of support

Finally, you don’t get what you don’t ask for. And with American businesses still figuring out how to keep up with changing news about tariffs, you may find your subscribers are more receptive than they ever have been to the importance of supporting small B2C companies.

So, our final marketing strategy: ask your customers to support you instead of Amazon. Develop messaging that speaks to how Amazon affects your business, and what customers’ direct support means to you. If your brand tone is on the serious side, be earnest. If your tone allows for more levity, feel free to make some jokes.

Prime Day marketing example: TONIC gets cheeky about Amazon in their ask for support

CBD brand TONIC sent out this cheeky email around Prime Day, with the subject line “The savings live on! But not for long.”

Source: TONIC

Here, TONIC nods to Jeff Bezos and the summer shopping event while also encouraging readers to celebrate “Vibe Day” instead. It’s a clever interpretation of Prime Day as an opportunity to encourage consumers to shop small—and save big—by buying from small businesses instead of billionaires.

“Giving your customers a reason to be loyal to your brand is so important if you’re a small business because the cost to keep a customer is going to be a lot less than the cost to gain a new one,” says Brittany Carbone, founder of TONIC.

Gather customer data you can act on with Klaviyo B2C CRM

The best way to reduce your reliance on third-party channels like Amazon—and own more of your customer relationships—is by gathering and acting on customer data from the same place.

Klaviyo B2C CRM—the CRM built for B2C—makes it easy for brands to collect the zero- and first-party data they need to deliver personalized experiences for their customers. As a data platform with email and SMS automation, customer service, and analytics under one roof, Klaviyo B2C CRM is making it possible for brands to scale personalization for thousands or even millions of customers.

Boost sales and engagement all year long with Klaviyo.

Sign up