Email benchmarks that drive marketing success using automation and segmentation

What are the most successful companies doing with email marketing? And what kinds of results are ecommerce companies getting across the board? To answer these questions, we looked at the emails that approximately one thousand U.S.–based companies sent in Q4 of 2016 — a total of 1.5 billion emails, or 1,501,929,496, to be exact.

Using specific email benchmarks we found that success comes down to two factors: segmentation and automation. By segmentation, we mean being deliberate about who you email instead of relying on blasts that go to the entire list. And by automation, we mean setting up emails that are automatically triggered by customer behavior to bring revenue into your store.

Read on to discover how much email contributes to store revenue, why sending targeted messages pays off big time, and what kinds of revenue-driving results you should actually be aiming for with email automation.

How Email Drives Store Revenue

What role does email play in a company’s success? In the aggregate, the companies we looked at made over $230 million from purchases attributed to email in Q4. That amount represents over a quarter of their overall store revenue (27%) on average during that time.

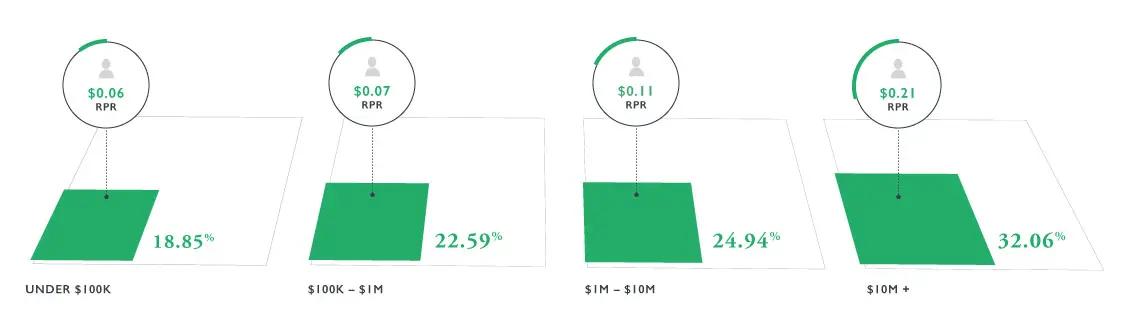

To look at the impact of email marketing on revenue in Q4, we divided the ecommerce companies up by 2016 annual store revenue. We found that the companies with greater annual revenue have a greater percentage of their revenue coming from email — and that’s not all. They also make more revenue for each email they send, with higher revenue per recipient.

As you’ll see, the largest stores we looked at — those with annual 2016 revenue of $10M or more — had an average revenue per recipient of just over twenty cents, bringing in nearly a third of their store revenue via email in Q4.

As you’ll see, the largest stores we looked at — those with annual 2016 revenue of $10M or more — had an average revenue per recipient of just over twenty cents, bringing in nearly a third of their store revenue via email in Q4.

Let’s take a closer look at the practices that successful stores are using to get these results. It starts with collecting the emails of interested shoppers and customers — but it doesn’t stop there.

Divide and Conquer with Segmentation

Getting the most revenue out of your list isn’t about sending emails to people who aren’t interested. That’s why it’s not about buying lists or sending to people who don’t want to receive emails — it’s about growing your total number of engaged contacts. These are people who are happy to get your emails and have a track record of opening them.

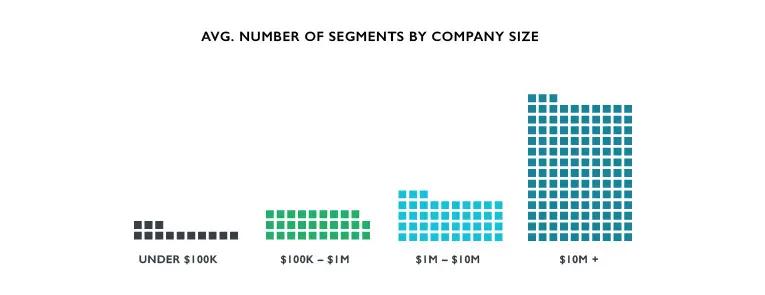

When we looked at the lists and email habits of the companies in our sample, we found, not surprisingly, that larger companies have bigger email lists. But we also saw that they have proactively divided their lists into a greater number of segments. This increases their capacity for sending highly targeted, relevant emails.

On average, we found that companies with an annual revenue of under $100K in 2016 had 13.36 segments. Those with annual revenue of $100K to $1M had 29.96; companies with $1M to $10M had 43.96. Meanwhile, companies with more than $10M in 2016 annual revenue had an average of 133.97 segments.

Building strategically tailored segments is a necessary part of targeting — but of course, it’s not sufficient unless you make use of the segments. Sending to more narrowly targeted groups is a winning strategy for a number of reasons. When you send more relevant messages, you’re typically supplying content that the recipients are more interested in. For example, if you put a product line on sale, you can send promotional emails to people who have indicated an interest in that product line in the past.

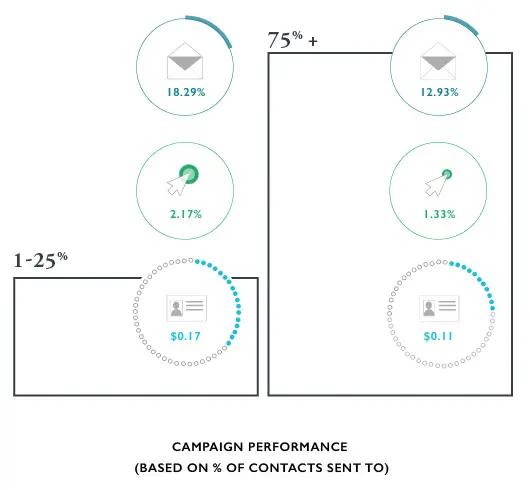

To better understand the effectiveness of this approach, we compared email campaigns sent in Q4 to less than a quarter of a company’s total email addresses (a narrow slice) to those sent to more than three-quarters of the total (a more traditional one-size-fits-all “blast”). And by email campaigns, we mean emails a company sends out proactively, including customized sale and promo emails, newsletters, holiday messages, and updates.

Campaigns sent to a narrow slice of a store’s contacts outperformed campaigns sent to most of the list, providing better open rates, click-through rates, and revenue per recipient:

It may be tempting to think that if you email enough people, you may bring in enough revenue to make up for the decrease in open rate, click-through rate, and revenue per recipient. But the fact is, the most successful companies are using more segmentation and driving more of their total revenue from email. So as a strategy, “batch and blast” is not your best bet.

━━━

Campaigns sent to a narrow slice of a store’s contacts outperformed campaigns sent to most of the list, providing better open rates, click-through rates, and revenue per recipient.

━━━

However, when you send highly relevant messages, you’re likely to get better results from your campaigns and to develop a better sender reputation over time. Ultimately, this results in improved deliverability for your emails across the board. In both the short-term and the long-term, segmentation is a tremendously effective tactic.

But that’s just half of email marketing success story. The other half is about emails that send themselves.

Setting Up for Success With Email Automation

The companies we looked at brought in over $50 million in Q4 using automation. They set up behavior-triggered email sequences, or automated email flows, in advance and let them run.

Once the flows were up and running, the marketing teams at these companies could focus on the busy holiday season while the emails essentially sent themselves.

The flows automatically sent on their own when a customer triggered them by:

Leaving items in a shopping cartPurchasing from a certain collectionGoing for a certain number of months without making a purchase

These are just a few examples. There are endless combinations of conditions that can trigger an email flow.

We analyzed the results from four common email flows: welcome series, abandoned cart emails, browse abandonment emails, and customer winback emails.

Welcome series are a way to bring in new customers, often with a discount on a first purchase or access to a downloadable ebook or other asset. They’re also an opportunity to share your company’s story.

More about welcome series ›

Abandoned cart emails are sent to shoppers who add items to their cart and go through part of the checkout process but fail to complete a purchase within a designated amount of time. Given that 7 out of 10 shopping carts get abandoned, there’s a lot of opportunity here to recover revenue.

More about abandoned cart emails ›

Browse abandonment emails are sent to shoppers who view products but didn’t add them to their cart. The initial setup for these emails may require a bit more work, but the payoff is well worth it.

More about browse abandonment emails ›

Winback emails, also known as re-engagement emails, are sent to customers who made a purchase (typically 3, 6, or 12 months ago) but not since. They’re a powerful way to reach and re-activate dormant customers.

More about winback emails ›

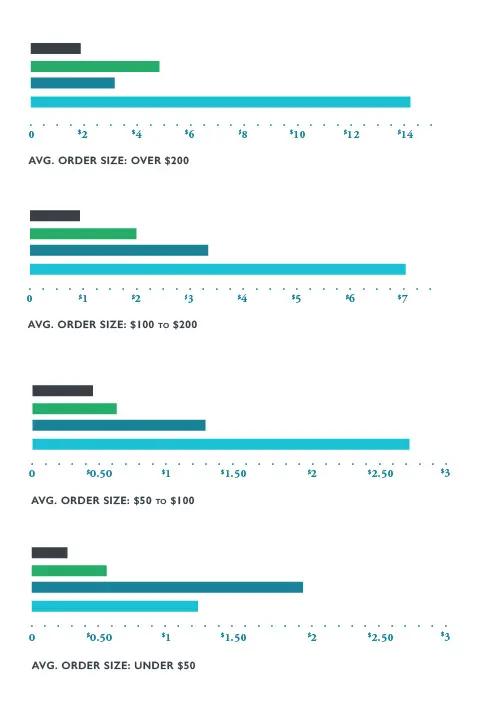

We analyzed how all four automated email flows performed in Q4, categorized by the companies’ average order size. For instance, companies with an average order size of $100 to $200 had an average revenue per recipient of $7.01 for abandoned cart flows, $3.34 for welcome series, $1.95 for browse abandonment emails, and .84 for winback emails.

The highest revenue per recipient was found in abandoned cart emails sent by stores with an average order size of over $200: $14.14. Not bad for a set of emails that went out by themselves!

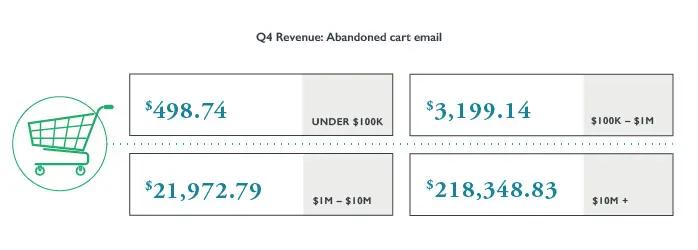

Speaking of abandoned cart emails, let’s look at the overall impact for stores that had them up and running in Q4. Here’s how much revenue the companies we looked at brought in, on average, in Q4 simply from abandoned cart flows.

Setting up even sophisticated abandoned cart email flows is relatively simple. It’s remarkable to see how much revenue comes in as a result of investing some time and effort up front.

Actionable Takeaways

So what can you take away from these findings? First, begin by assessing the percentage of your ecommerce revenue that you can attribute to email. If it’s less than the average in your annual revenue tier, you’ve got significant room for revenue growth.

Next, stop thinking in terms of total email list size — and start thinking in terms of smart ways to divide that list into targeted segments. The more you know about your shoppers’ behavior on your site and with your previous emails, the more precisely you can segment your list and follow up with highly relevant content.

━━━

Stop thinking in terms of total email list size and start thinking in terms of ways to divide that list into targeted segments.

━━━

Set aside time to build out automated email flows, especially the four we’ve looked at here (abandoned carts, welcome series, browse abandonment, and winbacks). Without at least basic versions of each of these flows up and running, you’re missing out on a relatively easily realized source of store revenue.

If you already have these four email series up and running, look for ways to apply our findings around segmentation to those automated flows. For example, you can send different versions of your abandoned cart email series to new and returning customers.

Most of all, ensure that you have a way of measuring the effectiveness of your emails to customers in dollars and cents. Not only can you keep track of how your results stack up to those of comparable companies, but you can track your growth as you put these strategies to work.