Make every message count: 12 Black Friday Cyber Monday email examples for 2025

Black Friday Cyber Monday is one of the busiest times for people’s inboxes.

As a marketer at an ecommerce brand, you already know that.

But if you’re nervous about “adding to the noise,” the solution isn’t to limit your marketing channels. It’s to make sure that every message you send counts.

At Klaviyo, we’ve seen firsthand the power of an integrated, omnichannel approach with companies like Popflex, Shinola, and Marine Layer—all ecommerce brands that drove a significant boost in revenue by tapping into SMS, email, and mobile app marketing during BFCM.

The effectiveness of this approach is likely why companies with strong omnichannel engagement strategies retain an average of 89% of their customers, while those with weaker strategies only retain about 33% of their customers..

Get the most out of the messages you send, whether that’s by coming up with creative BFCM offers or crafting eye-catching subject lines.

To inspire ideas, we’ll use this post to focus on one critical piece of the omnichannel puzzle: email marketing. Check out these Black Friday Cyber Monday email examples from ecommerce brands to get your creative wheels turning.ot

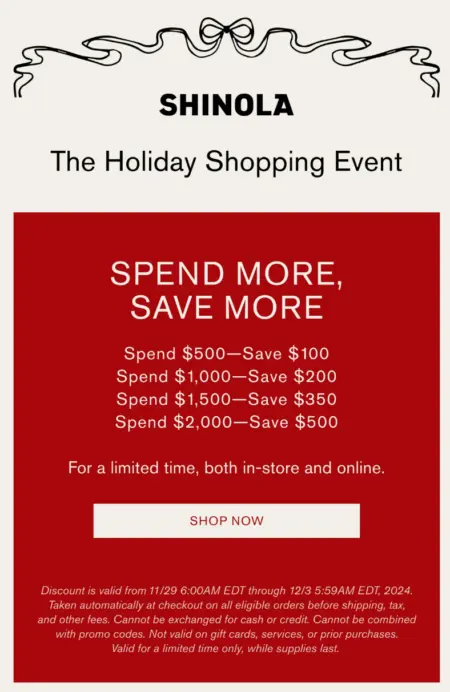

1. Shinola drives urgency with a tiered “spend more, save more” offer

This email from Shinola announces a holiday shopping event with a clear, compelling discount structure. The brand encourages higher cart values by offering bigger savings at higher spend thresholds. It pairs the offer with a clean design, limited-time urgency, and a shoppable gift guide to convert interest into action.

Source: Milled

Why we love it: The tiered offer creates a natural incentive to spend more without devaluing the product. A high-contrast hero section grabs attention instantly, while the curated gift categories below make it easy to browse. It’s a smart way to turn a single message into both a brand-builder and a revenue driver.

BFCM email marketing tip: Collect customer data in a B2C CRM so you know who’s purchasing at higher and lower value tiers. Use this information after the holiday to target people with follow-up campaigns that cater to price sensitivity.

2. Beekman 1802 gets exclusive with a cheerful, site-only BFCM offer

This Black Friday email from Beekman 1802 positions their sale as “The Kindest Black Friday Ever,” spotlighting exclusive products available only on their site, with up to 60% off and free shipping. Bright, inviting visuals and warm brand language reinforce the company’s values while showcasing their bestselling skincare.

Source: Milled

Why we love it: It’s friendly, on brand, and focused. The “exclusive to our site” message not only adds urgency but also directs traffic away from crowded marketplaces. Free shipping, loyalty rewards, and easy payments are smart trust-builders, especially during the competitive holiday season.

BFCM email marketing tip: Beekman 1802 didn’t just pull this email out of a hat—they leveraged historical insights and A/B testing to create segments of customers who received different emails based on likely purchasing behavior. In doing so, the brand grew their BFCM email revenue 74% YoY.

3. Nēmah’s grabs attention with a last-chance offer that’s hard to miss

This email from Nēmah leans into scarcity and time-sensitive messaging with a bold “Final Hours to Save” headline and a huge 40% off sitewide offer. Holiday-themed flat lay photography anchors the design, while the call to action—“Stock up before midnight”—builds urgency and reinforces the gifting spirit of the season.

Source: Zettler Digital

Why we love it: The combination of a strong visual hierarchy and a clear, urgent offer makes this email highly effective. The message is concise, benefits-forward (free shipping, up to 40% off), and appeals directly to gifters. Plus, the sophisticated design helps Nēmah stand out in a crowded inbox.

BFCM email marketing tip: Use automated SMS to mirror the urgency of this campaign. Send last-chance reminders to shoppers who browsed but didn’t purchase, and use dynamic product inserts to showcase what they viewed.

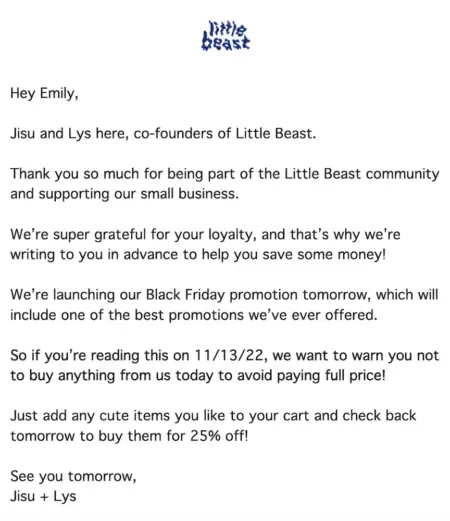

4. Little Beast gets a jump on sales with a pre-BFCM “get ready” email

This email from pet-focused lifestyle brand Little Beast gives subscribers a heads up about when their BFCM sale goes live. This not only potentially saves customers money, but also gets people excited to load up their carts in preparation for the 25% off discount.

Source: personal inbox

Why we love it: This email is working double time, pulling the levers for both customer acquisition and customer retention. A 25% discount is a fantastic way to bring in first-time purchasers, and the message inspires brand loyalty in customers who will appreciate the transparency.

BFCM email marketing tip: Always make sure to guarantee the best prices with this type of email tactic. There’s nothing more frustrating than making a ton of purchases on Black Friday at a 25% discount, only to discover that Cyber Monday offers a 30% discount.

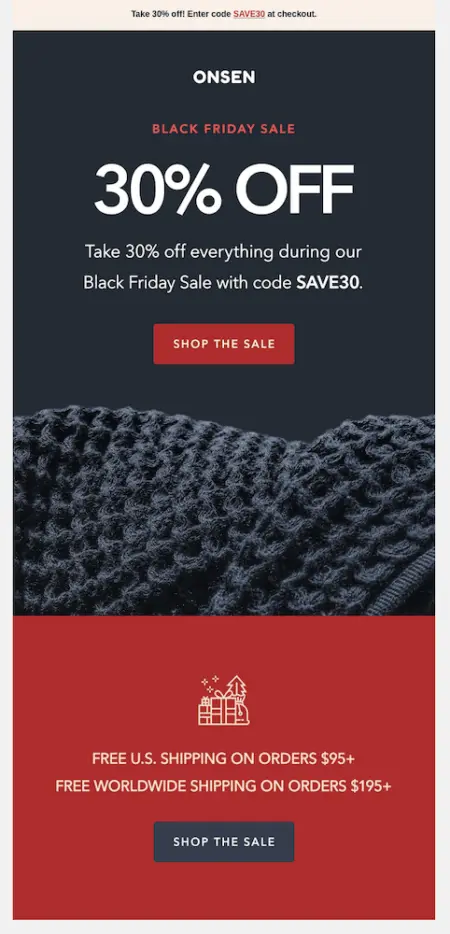

5. Onsen offers free worldwide shipping

Onsen offers free US and international shipping for their Black Friday sale, creating a double incentive for customers worldwide to shop for bath towels and bathroom essentials.

Source: Really Good Emails

Why we love it: If you’re a global brand, this type of offer is a fantastic way to appeal to customers from around the world and tap into additional revenue.

BFCM email marketing tip: Be crystal clear about shipping timelines, and stay on top of communicating any potential BFCM shipping delays.

6. Art of Play rolls out a limited-time mystery collection

In this BFCM promotion email, home goods company Art of Play offers a limited-time edition deck of mystery collection cards—an offer that will only be around for 24 hours for customers to take advantage of.

Source: Really Good Emails

Why we love it: By offering an exclusive, time-bound deal, this email tactic is sure to drive even more sales while also delighting customers who are avid card collectors.

BFCM email marketing tip: Using language like “while supplies last” and “today only” intensifies the urgency for subscribers. It’s especially smart when you don’t have a ton of product in stock. Just don’t overdo it—consumers are smart, and they’ll be able to tell when the sense of urgency is manufactured purely for sales.

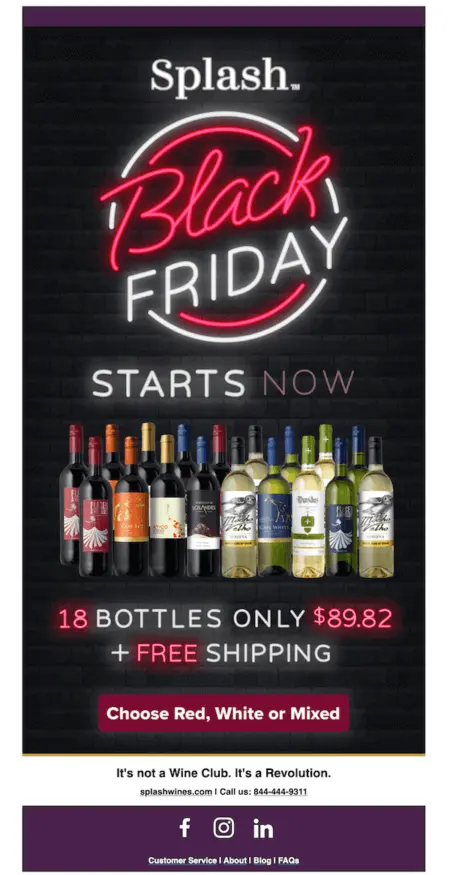

7. Splash Wines reveals their wallet-friendly BFCM deal

Even though Splash Wines offers competitively priced wine all year, the brand recognizes that BFCM is special to their customers. That’s why they coordinate with partners and wineries to offer the absolute best price of the year during this season: a $4.99/bottle promotion.

Source: Splash Wines

Why we love it: A promotion like this demonstrates that the brand is willing to go above and beyond for their customers.

BFCM email marketing tip: This type of deal is not only a great way to bring in new purchasers, but also instills loyalty in existing customers, who will appreciate feeling extra special during BFCM season. This holiday season, think about creative ways to make your BFCM email marketing pull double-duty for both your acquisition and retention efforts.

8. Fussy launches a sustainability-focused BFCM email campaign

Deodorant brand Fussy created their own event around BFCM: Green Week, which comes with discounts for customers and an opportunity to learn more about the brand’s sustainability efforts.

Source: Really Good Emails

Why we love it: Fussy gives customers the discount they expect, while staying true to their values around sustainability.

BFCM email marketing tip: BFCM is often all about sales—but it doesn’t have to be. Fussy’s email creates an educational touchpoint for people who are curious to learn more about the brand’s other environmentally focused efforts, helping them feel good about their purchase as well.

9. Beyond Yoga drops exclusive daily deals for loyal customers

Beyond Yoga is known for their monthly product launches. For BFCM, the team amped up their cadence by promoting daily drops—all featuring new products—throughout the entire week.

Source: Beyond Yoga

Why we love it: By combining a generous discount with a daily product launch, Beyond Yoga engages subscribers and customers for the duration of BFCM, not just the first and last days. This approach was so successful that it helped contribute to a 274% increase in Beyond Yoga’s campaign revenue from October to November.

BFCM email marketing tip: Try spacing out your promos and product drops to give customers something to look forward to for longer than the weekend.

10. Baboon To The Moon goes minimal with their BFCM email

Adventure brand Baboon To The Moon takes a slightly different approach to Black Friday by using a minimalist, short email template to remind people of the discount while also linking out to other unrelated content.

Source: personal inbox

Why we love it: Simple is sometimes best, and Baboon To The Moon leans into this approach in a way that feels authentic.

BFCM email marketing tip: Notice how this email wastes no time acknowledging that customers’ inboxes are likely flooded with BFCM emails. A little self-awareness can go a long way in gaining the trust of your subscribers.

11. Baboon To The Moon shares a convenient holiday gift guide

Yes, we’re including another BFCM email example from Baboon To The Moon—their emails are just that good. This one offers a holiday gift guide for items under $50, as well as a link to purchase digital gift cards, creating a more convenient purchasing experience for customers.

Source: Klaviyo

Why we love it: Again, Baboon To The Moon keeps things simple. Offering a price-specific (and price-sensitive) gift guide is a great way to address the potential overwhelm customers might be feeling with all the different options to choose from.

BFCM email marketing tip: Make life easy for your customers by linking directly to your digital gift cards—another great gift option for a loved one.

12. Peak Design goes wacky with their Black Friday promo email

This might win the award for the silliest Black Friday email. Peak Design goes all out in their campaign, teasing a trailer for a 17-minute action film they created specifically for this season. Don’t worry, they also include a 30% discount.

Source: Really Good Emails

Why we love it: Weirdness, when done well, creates intrigue that drives engagement—and what could be more intriguing than an action film about a superhero named Bird Legs?

BFCM email marketing tip: Lean in to your brand identity, here. What makes this work is that, while totally bizarre, the campaign is still on brand for Peak Design, which sells travel bags and camera gear.

Put your learnings from these BFCM examples into practice in 2025

By drawing inspiration from other creative ecommerce brands and crafting an integrated, omnichannel marketing strategy, you can find ways to stand out during even the busiest BFCM. Use the email examples and tips from this post to spark ideas and make 2025 your best BFCM season yet.

Whether you’re a beauty brand looking to send more personalized communications to your customers or a skincare brand trying to optimize your BFCM messaging, Klaviyo, the CRM built for B2C, can help you take your digital relationships to the next level.

Related content

- 10 key steps in building a solid Black Friday Cyber Monday strategy

- 10 digital BFCM tactics we already know customers love

- 8 BFCM email tips from Western outfitter Tecovas’s superstar marketing team

Related content

Learn how to use Klaviyo SMS, segmentation, and hybrid flows to re-engage lapsed email subscribers, boost deliverability, and drive higher retention.

Boost D2C email revenue from 12% to 30% with the Klaviyo playbook: high-converting pop-ups, a 5-email welcome series, smart filters, and optimized abandonment flows.

Even though the BFCM season ended, there are still important precautions to take. Learn how to clean up your sender reputation at the beginning of December.