Editor’s Note: This article was originally published on April 8, 2020. It’s been updated to reflect the most current data and insights.

Perhaps one of the most pressing concerns marketers and brand owners are facing now is how they can maintain an exceptional customer experience when supply chains are impacted and timelines with third-party logistics companies are uncertain.

There are certain strategies that you can implement throughout the customer journey. These will ensure that you’re providing transparency and that your customers are well-informed of when they can expect their shipment to arrive.

Find out exactly how to communicate shipping delays and transactional updates with your customers ahead of the holiday season.

3 tips for sending shipping delay announcements to your customers

1. Update your website with known shipping delays

The first step when you have known shipping delays or inventory issues? Update your website.

Many brands are using a banner on their homepage to communicate any shipping delays, backups, or irregularities.

If there are certain products that are scarce, consider adding that information to their individual product pages.

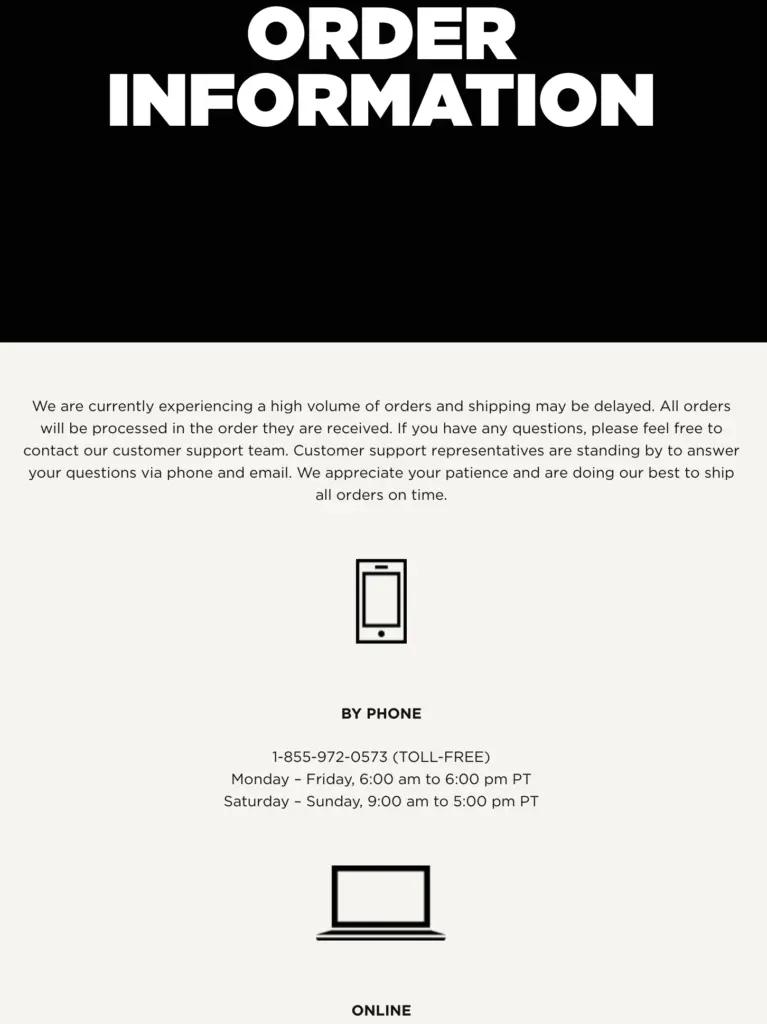

Brand example: Clif Bar has a banner that informs shoppers that they’re experiencing higher than average order volume and customers may experience delayed deliveries as a result.

Clif Bar includes a link that shoppers can go to and read more information about ordering, as well as customer support contacts in case they need to get in touch.

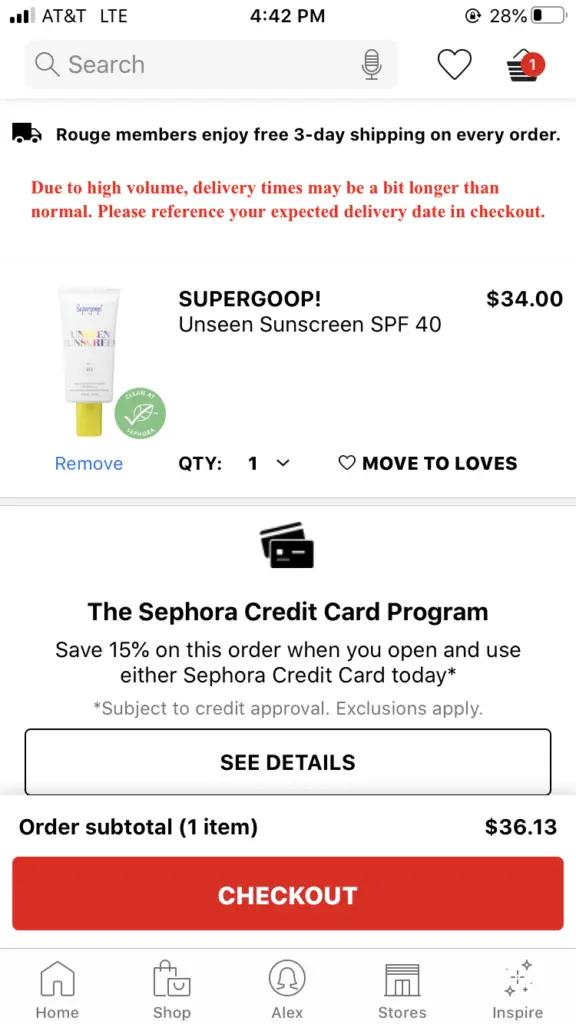

Meanwhile, some online stores are displaying notifications further along in the buyer’s journey. Sephora informs shoppers who are taking a last look at their cart that delivery times may be longer than normal.

Even if you don’t have any expected shipping delays, why not promote the fact that you can offer timely deliveries?

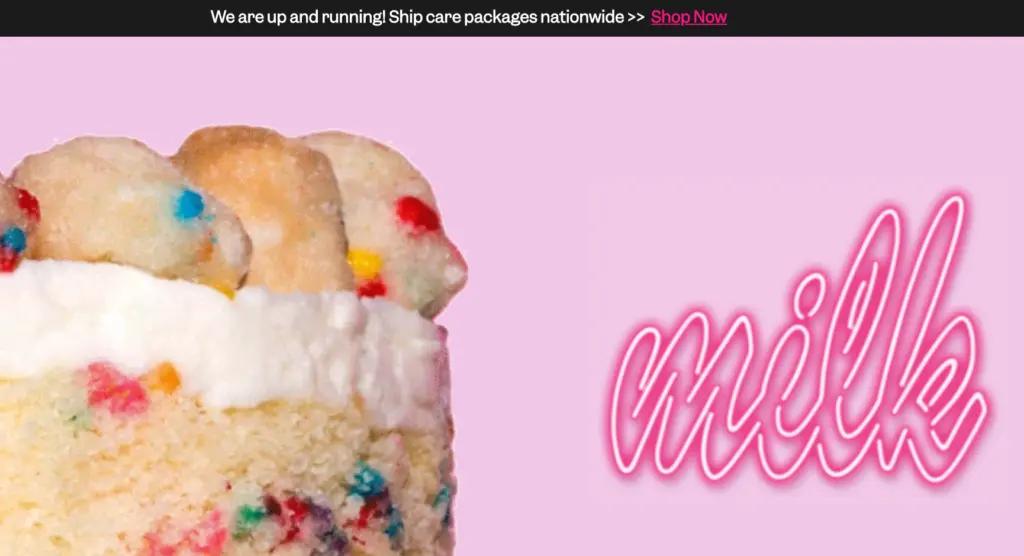

Milk Bar makes it evident to browsers that they can still expect shipments of their favorite treats on time, so shoppers with a sweet tooth can place their orders with confidence.

By addressing any shipping concerns upfront, you let your customers know what to expect when they order from you and ensure they aren’t in for any surprises.

2. Immediately communicate shipping delays customers may experience

If your customers are likely to experience delays, add more messages to your suite of transactional emails (such as your order and shipping confirmations) to acknowledge the backup and let customers know their order is still on the way.

Having this extra communication will be meaningful to customers who are dealing with long wait times by assuring them that their shipment is in progress, even if it’s delayed.

“People usually understand that carriers make mistakes, so when brands acknowledge that with transparency, consumers are less likely to get upset and reach out to their brand—or worse, tell their family and friends how terrible customer support was,” said Yaw Aning, co-founder and CEO of Malomo.

People usually understand that carriers make mistakes, so when brands acknowledge that with transparency, consumers are less likely to get upset and reach out to their brand.

Yaw Aning, co-founder and CEO, Malomo

“Brands can put a message in their shipping confirmation email acknowledging the delays and issues that could arise with the package, while using their unique tone and voice,” he said.

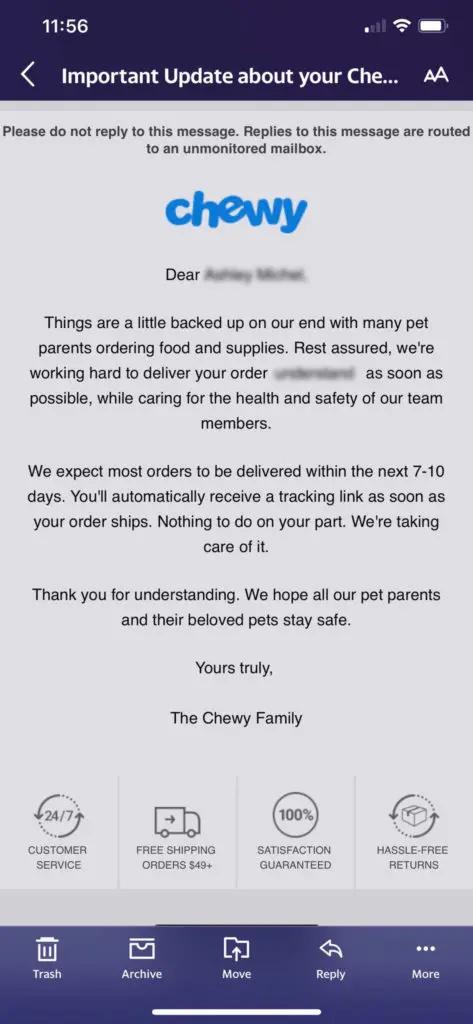

Brand example: Even though Chewy was experiencing high demand and corresponding shipping delays, they communicated with their customers about their order status with normal transactional emails.

Plus, they used additional emails to apologize for any delays and to let the customer know that their order is still on its way.

As hard as you try to plan ahead, sometimes it’s just not possible to avoid complications. But your customers will likely be understanding so long as you’re transparent with them about the issues you’re seeing and communicate changes as they occur.

3. Avoid irrelevant emails

While the post-purchase email is a great way to build your brand voice, you also want to avoid sending marketing emails that pertain to your customer’s order if the item hasn’t arrived yet.

Imagine receiving an email asking you to rate your purchase or provide feedback when you haven’t even received the product you purchased.

These kinds of emails will be extremely frustrating to anyone who is still waiting for their purchase to arrive.

To avoid creating a disjointed shipping experience, trigger the post-purchase email to send a few days after the customer’s order has arrived or after an order-delivered email is sent out.

Additionally, if you send out an order confirmation or shipping confirmation email and then your customer receives nothing and hears nothing from your brand after weeks, it can cause them to lose trust in your brand.

If your shipping times are unpredictable, consider setting up marketing automation to go out if the customer doesn’t receive a shipping confirmation after they receive an order confirmation.

One last piece of advice: If you’re aware of shipping delays, be as transparent as possible throughout the customer journey and make sure it’s evident to shoppers before they order.

Receiving an email that says “Orders are taking longer than usual” a week after the order is placed with no other warning doesn’t bode well for customers who are patiently awaiting their items.

How to announce shipping delays around Cyber Weekend and the holidays

This year, marketers are going to have to plan ahead of time to communicate shipping delays and ensure their customers receive the gifts they order in time for the holidays. And it mainly comes down to setting customer expectations.

Bess Welch, senior ecommerce manager at Southern Tide, shared a few ways their team addressed shipping issues during the 2020 holiday season by making the process as transparent as possible to customers.

“We typically add a holiday shipping calendar to our shipping information page. This shows customers how long they can wait to receive their package. We’ll definitely be padding in time due to the delays customers are already experiencing,” said Bess.

They also held their sales earlier, promoted gift cards earlier, and decided against running expedited shipping promotions close to Christmas.

“The risk is too high and we don’t want to cause any frustrations. Making a promise we can’t keep is not an experience we want for our customers,” she said.

From a logistical standpoint, Bess worked with their warehouse and fulfillment teams to prepare them for an increase in orders. They also talked to their shipping partners to try to make sure they have adequate support and time allotted to their account.

“You really have to think through every department that touches the customer’s order and try to prepare everyone as much as possible for what could happen this season. Don’t assume anything,” said Bess.

People usually understand that carriers make mistakes, so when brands acknowledge that with transparency, consumers are less likely to get upset and reach out to their brand.

Yaw Aning, co-founder and CEO, Malomo

Additionally, Bess emphasized that brands will have to be more forgiving when it comes to accommodating returns and exchanges, especially if customers’ orders are delayed. They extended Southern Tide’s return policy to alleviate any frustrations for packages that arrived too late and couldn’t be gifted.

When it comes offering to advice for other brands for the holiday season, Bess’s is pretty simple: Over-communicate with your customers at every touchpoint.

“Communicate everywhere possible because you never know where someone is actually going to read your message. Don’t assume they’ll go to your shipping page. If possible, include a note at the top of the site and in order confirmation and shipping emails. Arm your customer service team with all the details and possible solutions for the customer,” she said.

Communicate promptly amid shipping delays

Shipping delays can be frustrating for business owners, marketers, and shoppers alike, but there are certain communications you can use to ease your customers’ anxieties and display empathy—even in moments as small as your checkout process or transactional email automations.

Optimizing your buyer’s journey and communications to reflect the current climate is not only essential for your customers’ peace of mind, but also for you to create a trusted brand.

Shipping delay announcement FAQs

How do you announce shipping delays to customers?

It’s always better to announce any potential shipping and delivery delays to your customers as early as possible. The best channels to use are:

- Website: Include the announcement on banners and at checkout.

- Emails: Shipping status emails are a great opportunity to announce any expected shipping delays.

- SMS: If you notify your customers of their shipping status via SMS, be sure to include an announcement if you expect any shipping delays.

What is the best way to write a shipping delay notice to customers?

Whether you communicate the shipping delay via email, website, or SMS, it’s always good to write in a sincere tone, and be transparent about the situation.

Should I use an email template for shipping delay announcements?

It could be handy to have an email template or sequence set up and ready to go specifically for shipping delay announcements, should you experience any unforeseen shipping delays. Be sure not to spam your customers with too many follow-up emails in this sequence, keep it to 2-3 emails.

Want to learn more about Klaviyo’s email marketing?