You’ve calculated your email bounce back rate, and—gasp—it’s higher than expected.

You’ve calculated your email bounce back rate, and—gasp—it’s higher than expected.

A high bounce back rate can put a damper on your entire email strategy because it can affect your sender reputation and therefore your email deliverability.

But we’re here to tell you it’s going to be okay—because there’s plenty you can do to reduce your email bounce-backs.

First, make sure you understand why your emails are bouncing back. Once you’ve diagnosed the problem, come back here to learn about some solutions you can implement.

1. Make sure the email addresses you’re sending to are real, consented profiles

It’s crucial that your subscribers are real, and that they’ve directly consented to your marketing.

To make sure this is the case:

- Never buy a list.

- Never message email addresses who have not opted in to receive communications from your brand.

- Limit the amount of on-site giveaways or contests that aim to collect email addresses. People may use fake or rarely checked email addresses just to get the incentive.

- Create a separate list for email addresses you acquire through those on-site giveaways or contests.

- Focus on other ways to acquire subscribers, like free shipping or discounts.

- Segment your lists to send to engaged subscribers that are actively interested in your brand (more on this later).

2. Enable double opt-in to ensure new subscribers really want your emails

A double opt-in method requires a subscriber to confirm their subscription via email before being added to your list.

If you use Klaviyo, lists are set to double opt-in by default.

A double opt-in process protects you from:

- Well-intentioned subscribers who accidentally typed their email incorrectly

- Spam bots that find your form and flood it with fake email addresses

- Folks who are curious enough to add their email address to your form, but not actually interested enough to confirm

Any of the above can increase your bounce rates and hurt your sender reputation.

3. Clean your email lists regularly

It’s important that you clean your email and SMS lists regularly. In addition to removing any fake or misspelled emails, you need to get rid of the unengaged ones as well. This will not only weed out any profiles who shouldn’t receive your messaging, but also decrease your spam complaints—improving your sender reputation over time.

Note: A hard bounce happens when an email can’t be delivered for a permanent reason, such as a misspelled email address. Klaviyo automatically suppresses emails that hard bounce, then excludes them from future emails.

You’ll be able to view these emails in your account so you can remove them as part of your list cleaning regimen. We recommend setting aside time to clean your lists at least once a month.

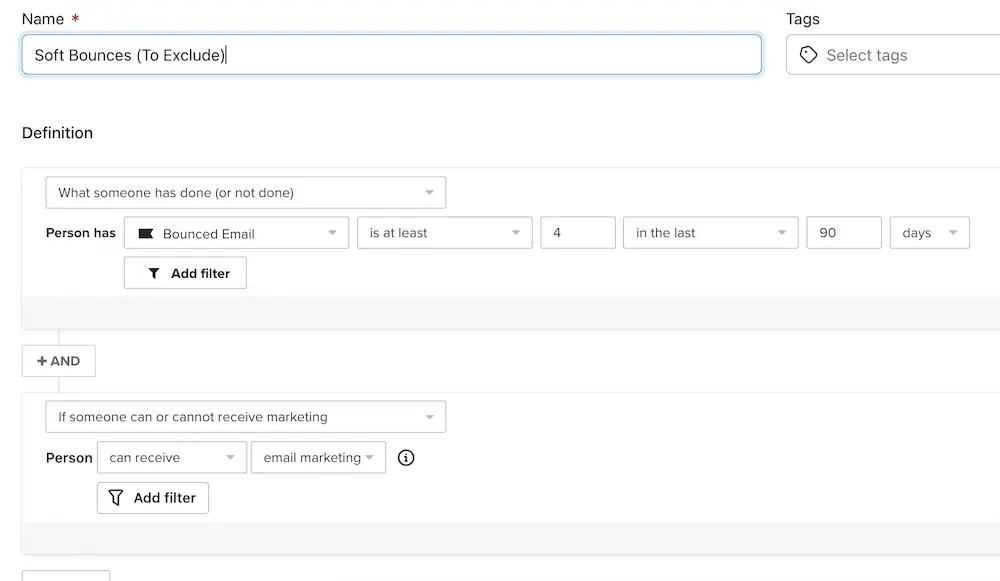

4. Remove soft bounces

In contrast to hard bounces, soft bounces are temporary and result from issues like a full inbox, an email server that’s temporarily down, or a change in email ID.

Natalie Sullivan, former retention marketing manager at Avex Designs, recommends addressing chronic bounces. “Keep an eye on email addresses that consistently bounce,” she says. “High bounce rates can harm your sender reputation, so it’s crucial to manage and update your list accordingly.”

Once you identify your soft bounces, limit how frequently you send to them by creating a segment of soft bounces and excluding them from campaigns for 90 days. After 90 days, these profiles will exit the soft bounce segment and thus rejoin the audience for your next campaign. If they get delivered, great! If not, they’ll fall back into the soft bounce segment to exclude for another 90 days until you try again.

This strategy helps reduce bounces where possible, while also giving soft bounce profiles a longer amount of time to remedy whatever is causing the soft bounce.

Pro tip: Klaviyo automatically suppresses profiles that soft bounce 7x in a row, but each time an email bounces, it still affects your deliverability. That’s why it’s important to exclude or suppress soft bounces.

5. Segment to show spam filters you have useful content

Segmentation can improve your deliverability because the more personalized an email is, the more likely a recipient is to open it and actually read it. Regularly opened emails show email spam filters that you’re safe, improving your sender reputation.

You can segment your lists according to:

- What subscribers want to hear about

- How often they want to hear from you

- How long they’ve been a subscriber

- How long it’s been since they’ve engaged with your emails (more on this next)

Some of this information you can observe directly on your owned channels, and some of it you can collect directly from your subscribers and customers.

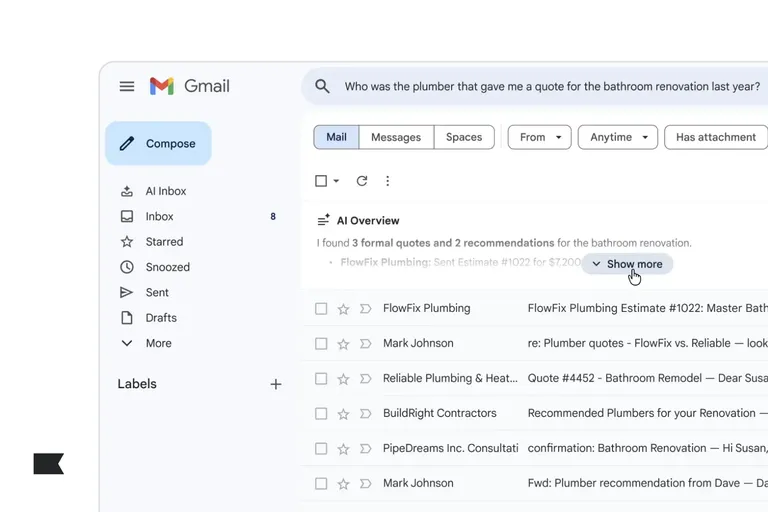

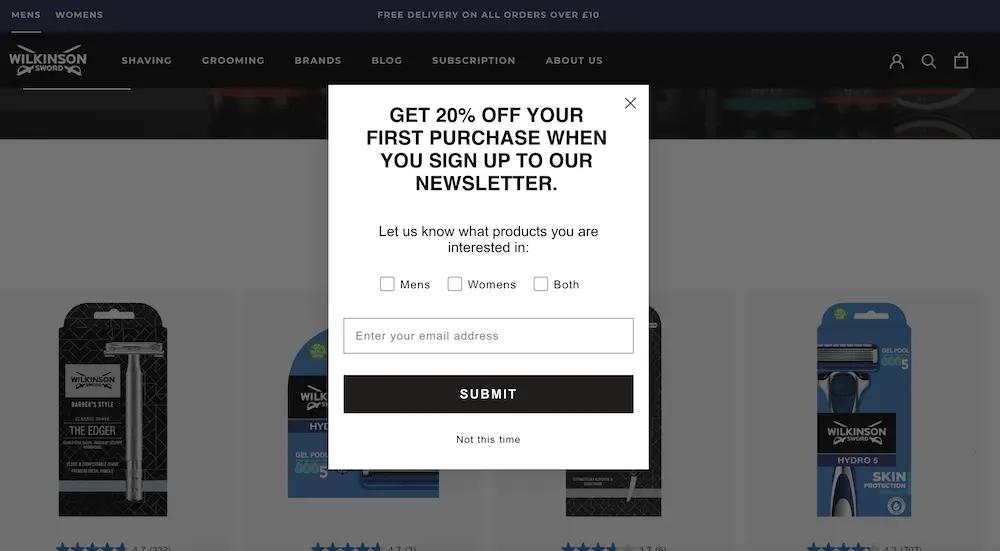

Check out this example from UK razor brand Wilkinson Sword—the brand experimented with adding a field to their sign-up form to allow new email subscribers to identify whether they’re interested in male products, female products, or both:

Image source: Wilkinson Sword

The form is quick and easy to fill out, and the responses provide the Wilkinson Sword team with powerful insights into what kind of emails will actually interest subscribers in the future.

“Data about what people are interested in helps us provide them with relevant content, so we’re willing to sacrifice a bit of conversion for that,” says John Pagni, ecommerce assistant. “But we actually haven’t seen a drop-off yet.”

6. Send emails at a regular cadence

To maintain strong open rates and a positive relationship with your subscribers, align your sending schedule with your segmentation strategy.

If you send too often to unengaged profiles, their lack of engagement will hurt your sender reputation. Meanwhile, if you don’t send enough to engaged customers, you may be missing out on revenue.

To determine the best sending schedule:

- Segment your subscribers into tracks based on how engaged they are.

- Take into account how long someone has been a subscriber, as well as how (and how often) they engage with your emails.

- Send more frequent emails to the most engaged subscribers.

- Send less frequent emails to less engaged subscribers.

- Consider sunset flows or re-engagement campaigns for unengaged profiles.

Tonya Gordon, manager of deliverability and compliance strategy at Klaviyo, shares this recommendation: “If you’re sending to less engaged subscribers, keep the volume below 15% of your most engaged subscribers. This will help your reputation remain positive.”

Pro tip: Dive deeper into how to create a sending schedule based on email engagement.

7. Use a branded corporate sender domain, not a free one

Corporate companies need branded sender domains—and not just because they’re professional.

Free sender domains like Gmail are more likely to be flagged by spam filters because scammers often use them to send nefarious emails. Besides, recipients are much less likely to trust a branded email that comes from a free sender domain—and they may take steps to block your address as a result.

Source: writer’s inbox

You also need a corporate domain to comply with CAN-SPAM Act provisions, which states that your emails can’t contain “false or misleading routing information.” This means your domain name and email address must accurately identify your business.

8. A/B test your emails as a standard practice

A/B testing is the process of refining your email content and design so that it’s optimally relevant for specific audience segments.

Except it’s so much more than that.

A/B testing forces you to form a hypothesis about your content and audiences, measure performance, and revise your approach if it’s necessary. While this ritual almost always leads to better, more personalized content for your audience, it also indirectly improves email deliverability and reduces email bounces.

Here’s what you can test for better personalization, specifically:

- Subject line components (e.g., recipient’s first name and relevant products)

- Different offers for different segments of your audience

- Visual elements

- Copy length and tone

9. Check in with subscribers who may want to change their preferences

Good email list hygiene involves identifying people who haven’t interacted with your emails in a while, usually 3-6 months. But you don’t want to get rid of these unengaged profiles without taking some steps to re-engage them, including asking them to update their preferences.

This is important because it may not be that they want to unsubscribe—they may just want to hear from you less. Providing them with that choice lessens the likelihood that they’ll unsubscribe altogether, or just get so sick of hearing from you that they flag your address (hurting your sender reputation).

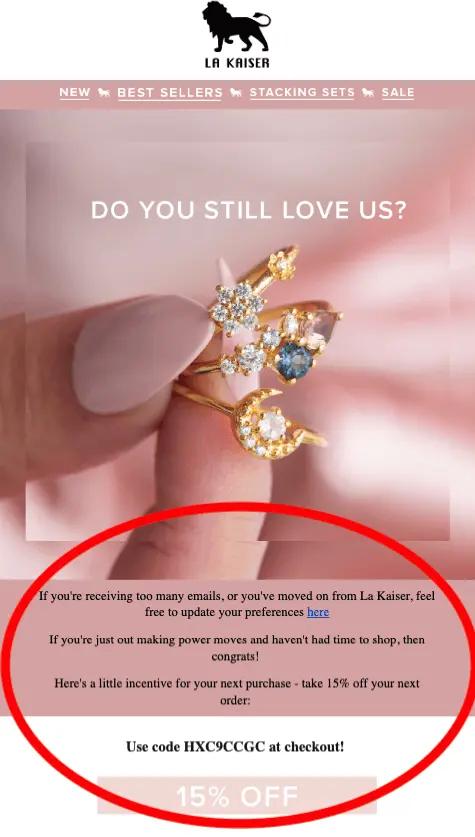

Here’s a great example from jewelry brand La Kaiser. The email goes out to a subscriber who hasn’t interacted with marketing messages in a while, inviting them to update their preferences and offering a discount.

Image source: La Kaiser

10. Be mindful of subject line keywords

While you often want to convey a sense of urgency with your subject lines, be mindful that you’re not stepping into spam territory.

It used to be standard practice to avoid certain words in subject lines. The thinking was that if you just avoided specific words, you could avoid the dreaded spam filter.

Now, it’s a lot more complicated than that. While it’s safe to say that you’ll end up in a junk folder if you use words like “Viagra” and “Earn $1 million this year,” you won’t necessarily end up there if you talk about discounts or limited-time offers.

This is why it’s important to follow subject line best practices, like:

- Using the recipient’s first name

- Limiting subject lines to 7 words

- Writing thoughtful preview text that expands on your subject line

- Using emojis sparingly, if at all

- A/B testing your subject lines

A good subject line piques curiosity without wildly overpromising. Think of it as a little bit of earned trust that can reduce bounce-back emails over time.

How Klaviyo can help you reduce your email bounce-backs

The key takeaway here is that solid email marketing best practices are what can help reduce your email bounce-backs. These best practices are exactly what thousands of brands uphold with Klaviyo, without the time-intensive labor that can come with maintaining a healthy email marketing program.

Klaviyo helps brands maintain their sender reputation with:

- Dynamic audience segments that populate based on set criteria

- Double opt-in email consent

- Automatic hard and soft bounce email suppression

- Bounce-back reports that are easy to understand

- Advanced A/B testing

- Automated win-back flows

- AI subject line assistant

Related content

- How to create email blasts that aren’t spam: the secret’s in the audience segmentation

- How to meet Google and Yahoo’s email sender requirements in 2024

- Understanding bounced emails in Klaviyo

Power smarter digital relationships with Klaviyo SMS.