BFCM 2022 benchmarks by industry

BFCM (Black Friday / Cyber Monday) is the biggest sales season of the year in the U.S. It also drives the most revenue for the ecommerce industry––with many brands leveraging expected Q4 gains as part of their annual forecasting.

But not every ecommerce industry and vertical sees the same year-over-year growth, nor in the same channels.

Klaviyo’s BFCM benchmarks report by industry aims to break down how different brand verticals performed over email and SMS marketing so you can measure your success, and forecast the next year’s, more reliably.

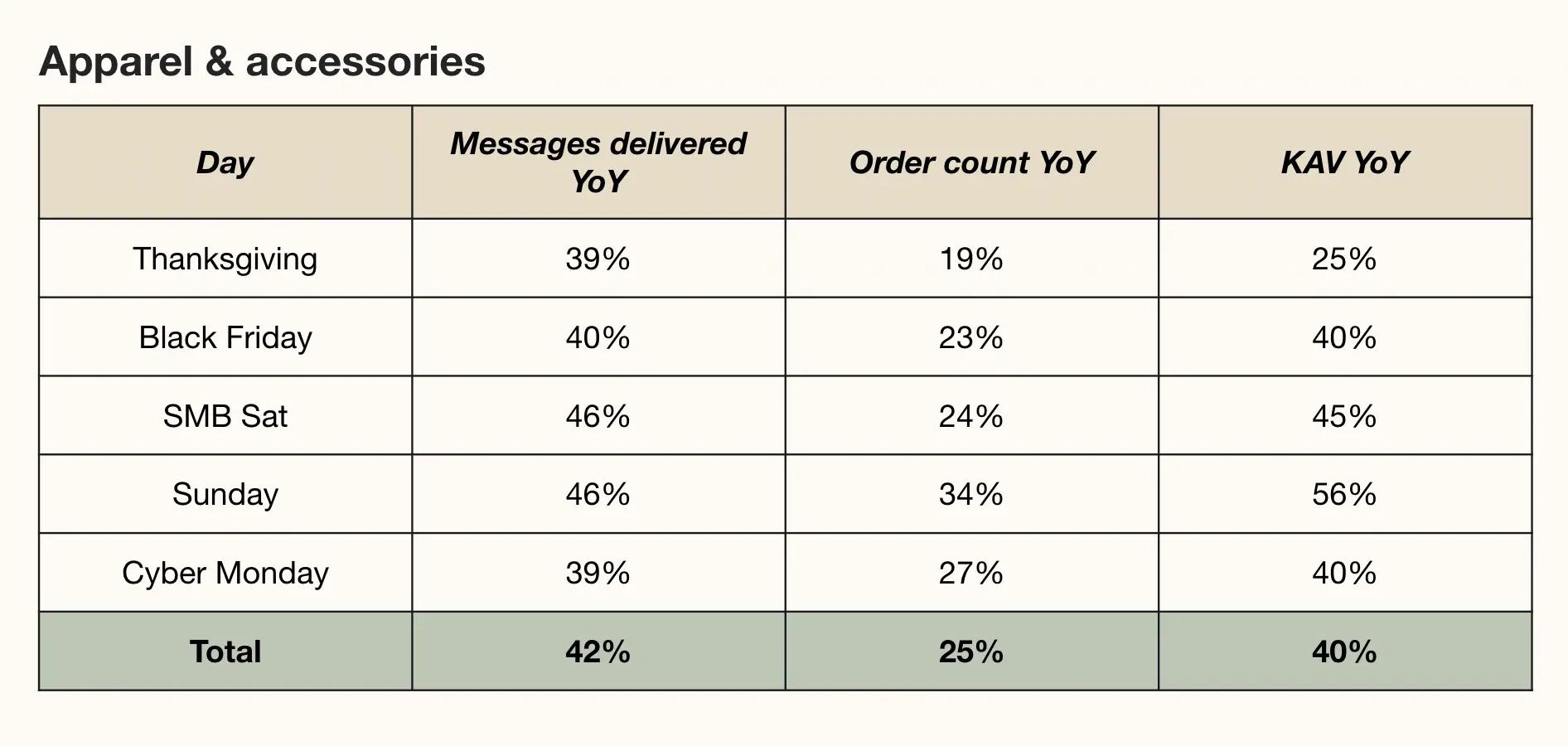

Apparel & accessories

In total, apparel & accessories brands sent 42% more messages in 2022 in comparison to 2021 throughout the BFCM event.

Total KAV over that time was also up 40% YoY.

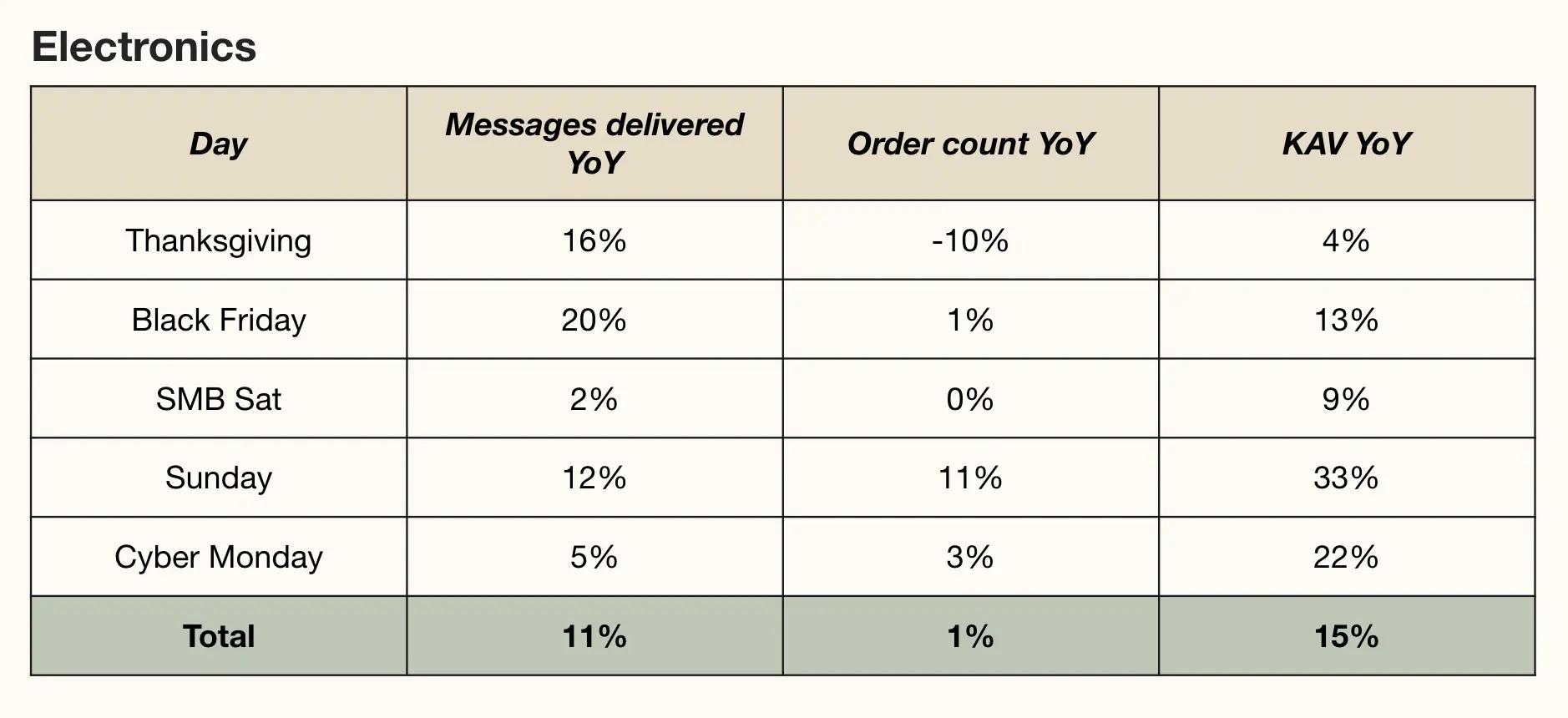

Electronics

Though order count from email & SMS messages only grew 1% YoY for the electronics industry, KAV (Klaviyo attributed revenue) grew 15%.

Messages were up, too, and only Thanksgiving saw a decrease in order count YoY.

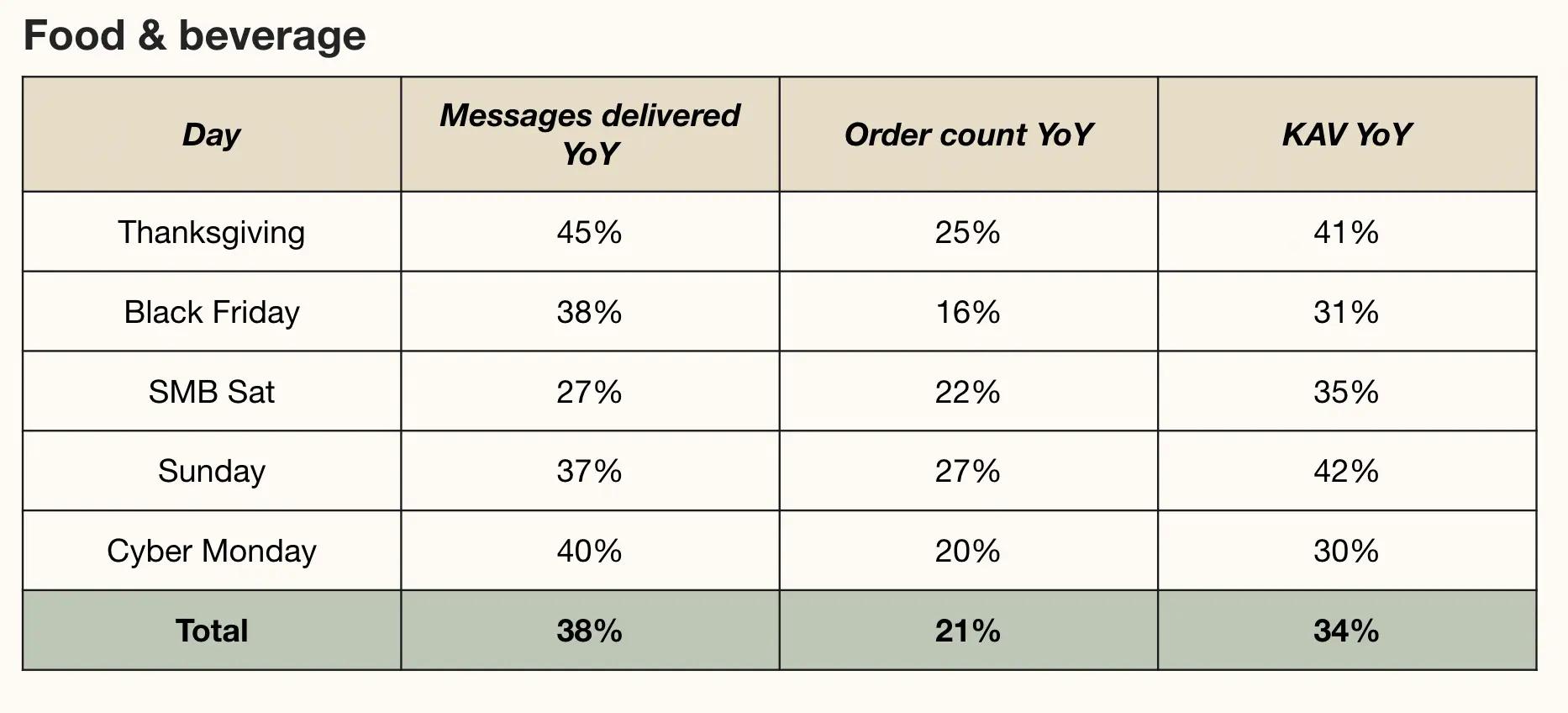

Food & beverage

The food & beverage industry, also often referred to as CPG, saw nearly 40% growth in overall message volume YoY, and a 34% increase in total KAV.

Order count grew, too, as a whole––the most on Thanksgiving and Sunday.

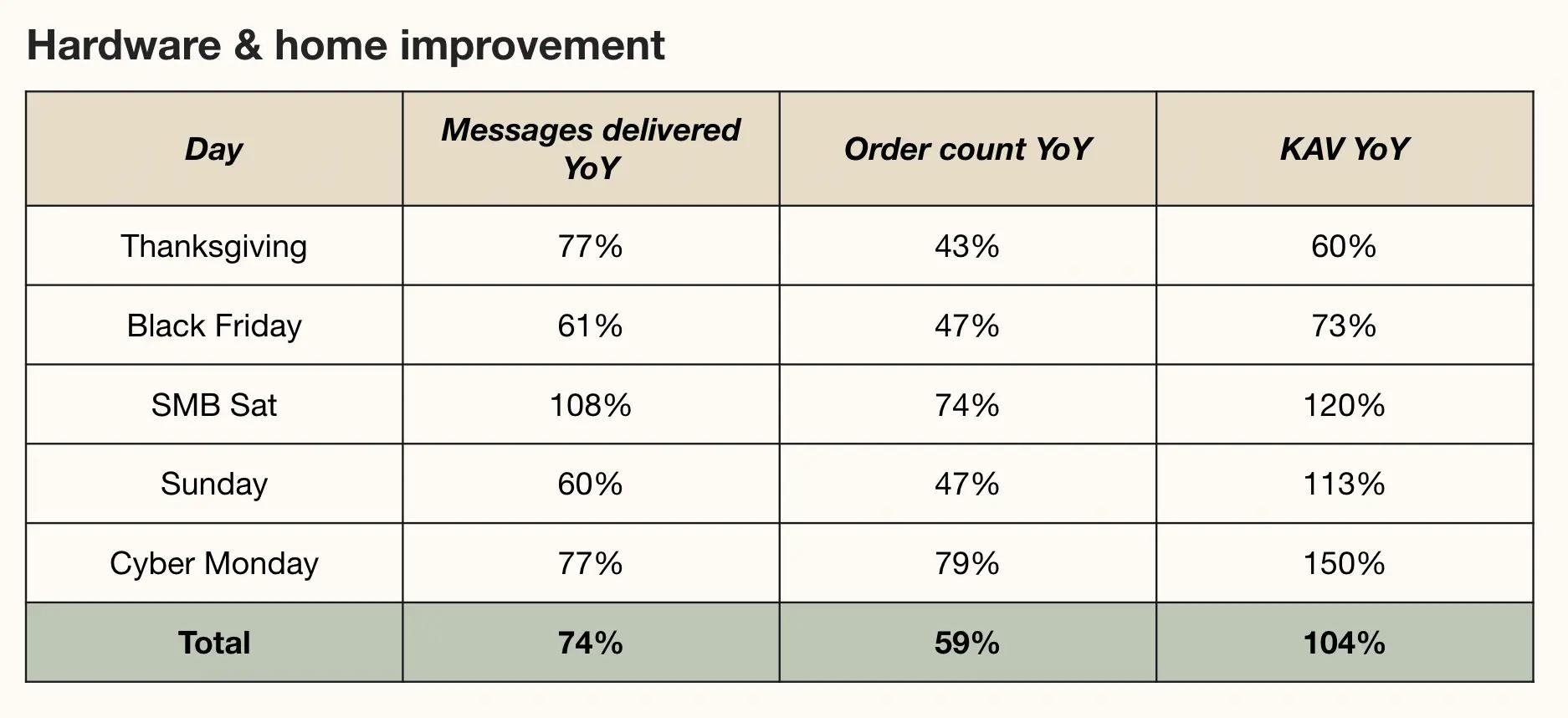

Hardware & home improvement

Hardware and home improvement had a great BFCM in 2022––with a 104% YoY increase in Klaviyo attributed revenue.

Message volume from email and SMS was up 74% and order count, too, was up nearly 60%.

It was the latter part of BFCM that saw the biggest revenue gains for this vertical.

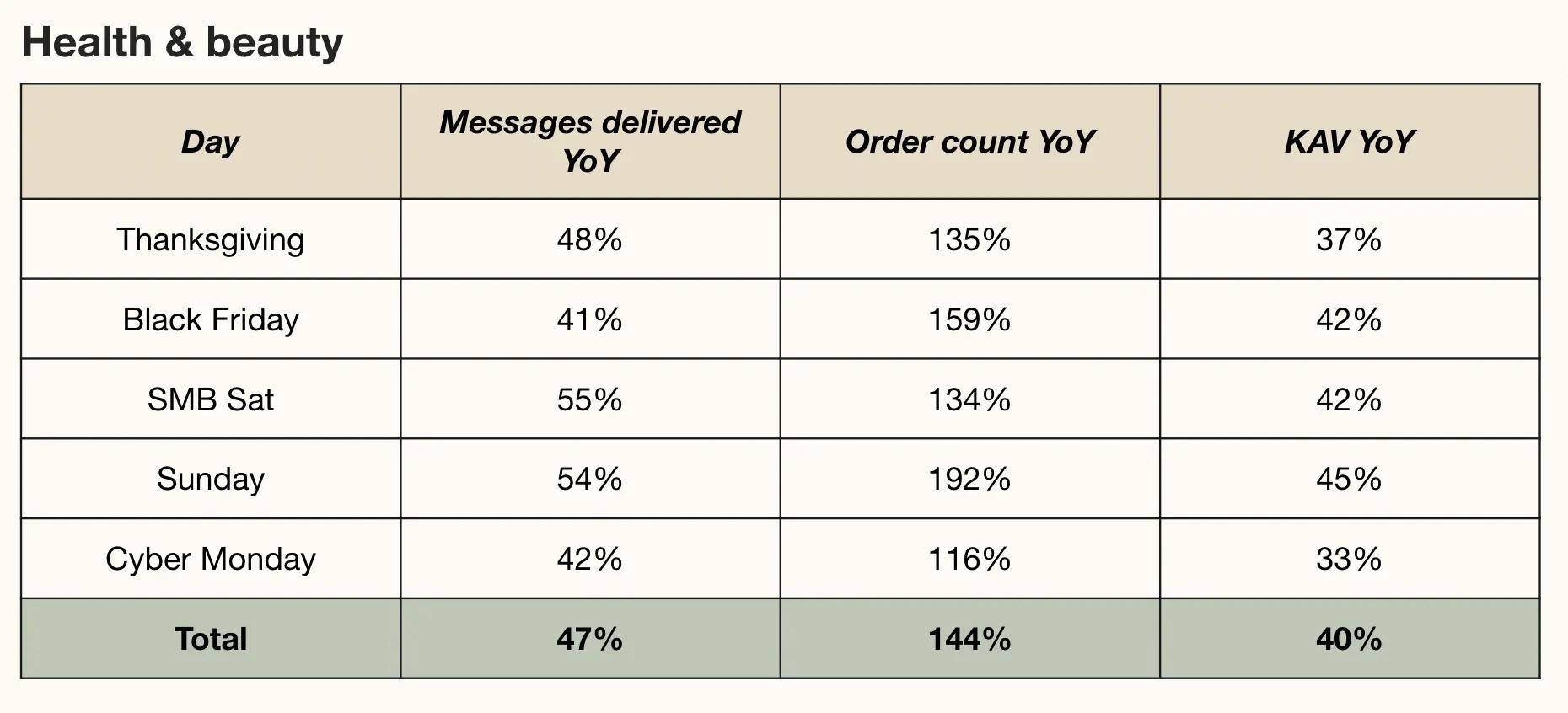

Health & beauty

The health & beauty industry saw a near 40% YoY KAV gain, but it was in the order count numbers that the biggest gains were seen.

Health & beauty brands have some of their biggest sales of the year during BFCM, perhaps leading to this high rise in total order count.

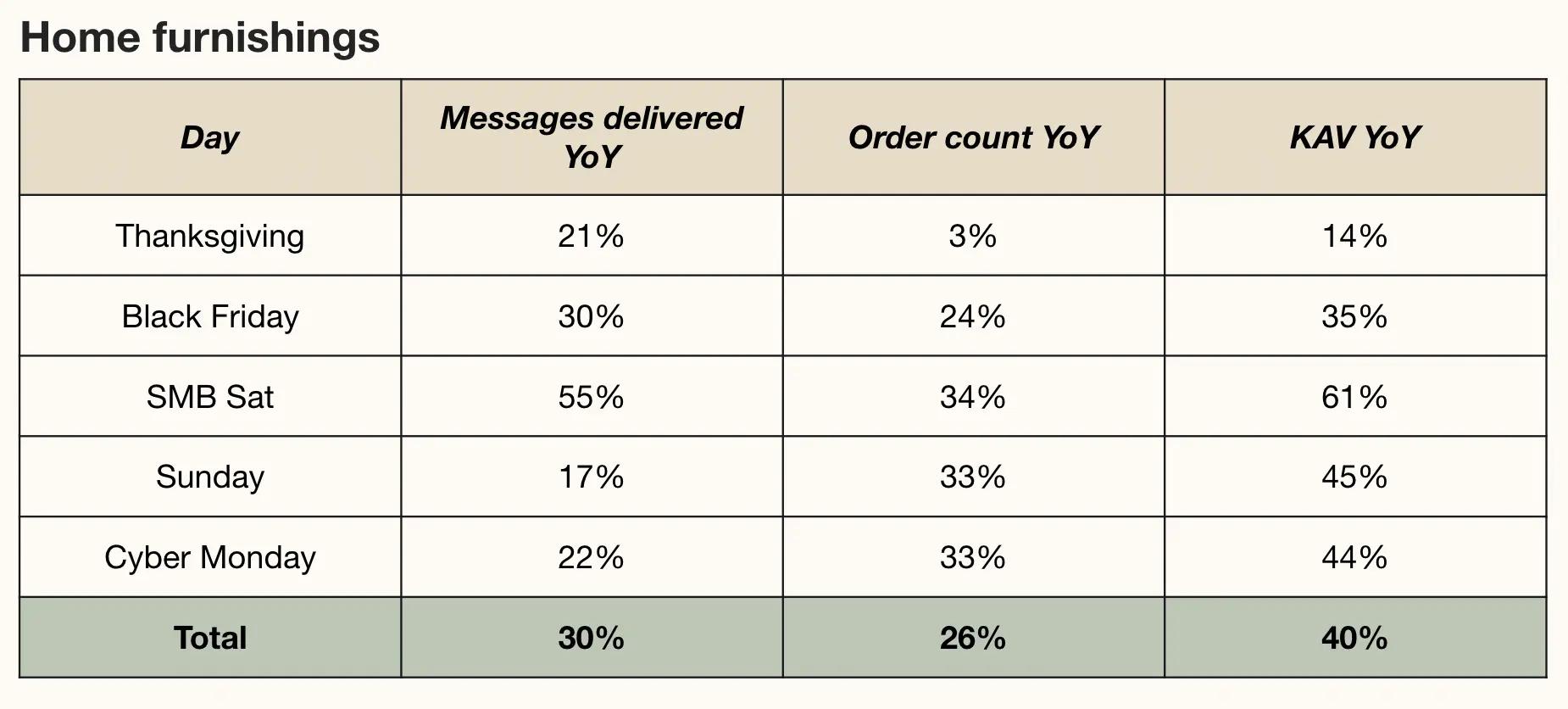

Home furnishings

Despite fears of a recession and on-going inflation, the home furnishing industry performed well over BFCM 2022–-seeing a total email and SMS message lift of 30%, order count of 26% and total KAV growth of 40%.

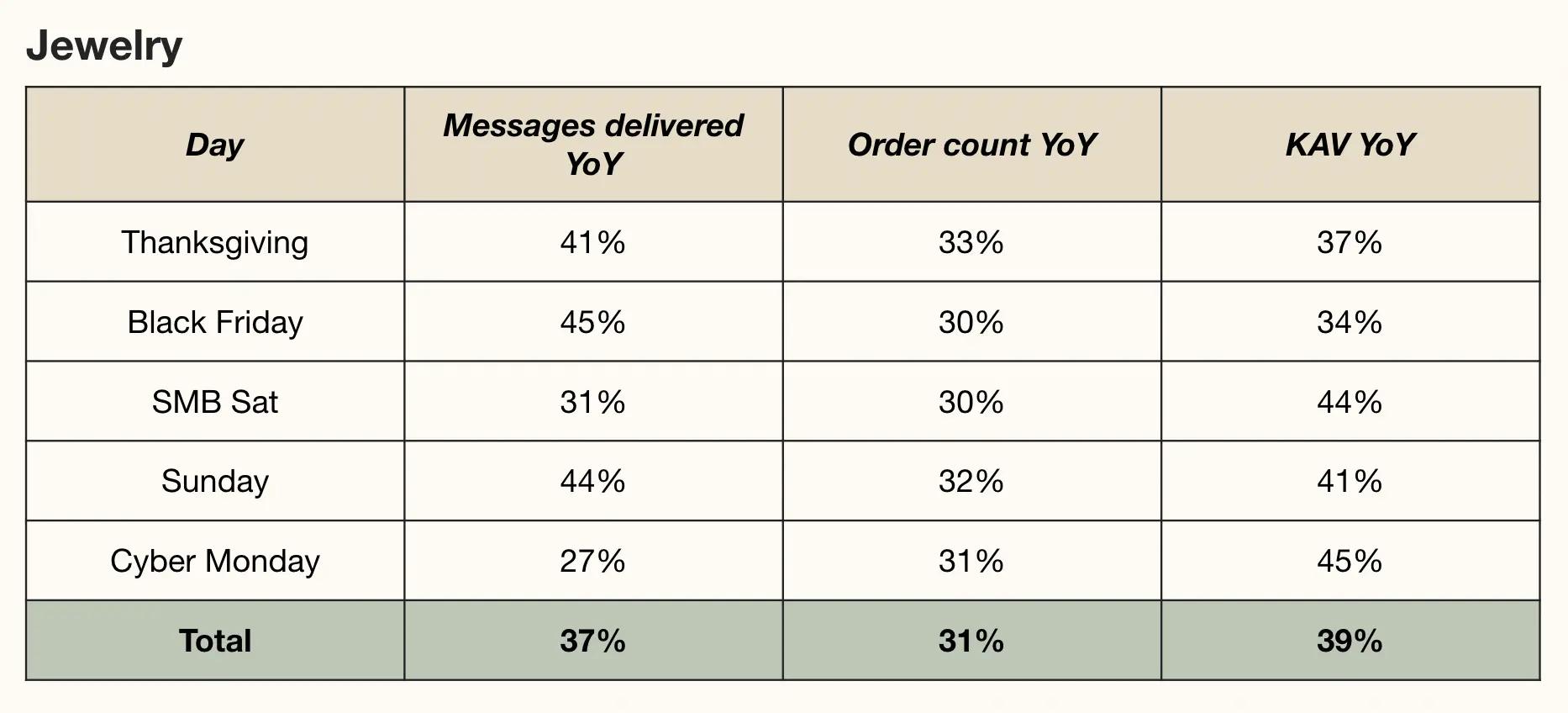

Jewelry

The jewelry industry performed steadily across all days of BFCM 2022––seeing more than 30% KAV growth every single day beginning on Thanksgiving.

Email and SMS message volume was up significantly, with the lowest gain on Cyber Monday itself.

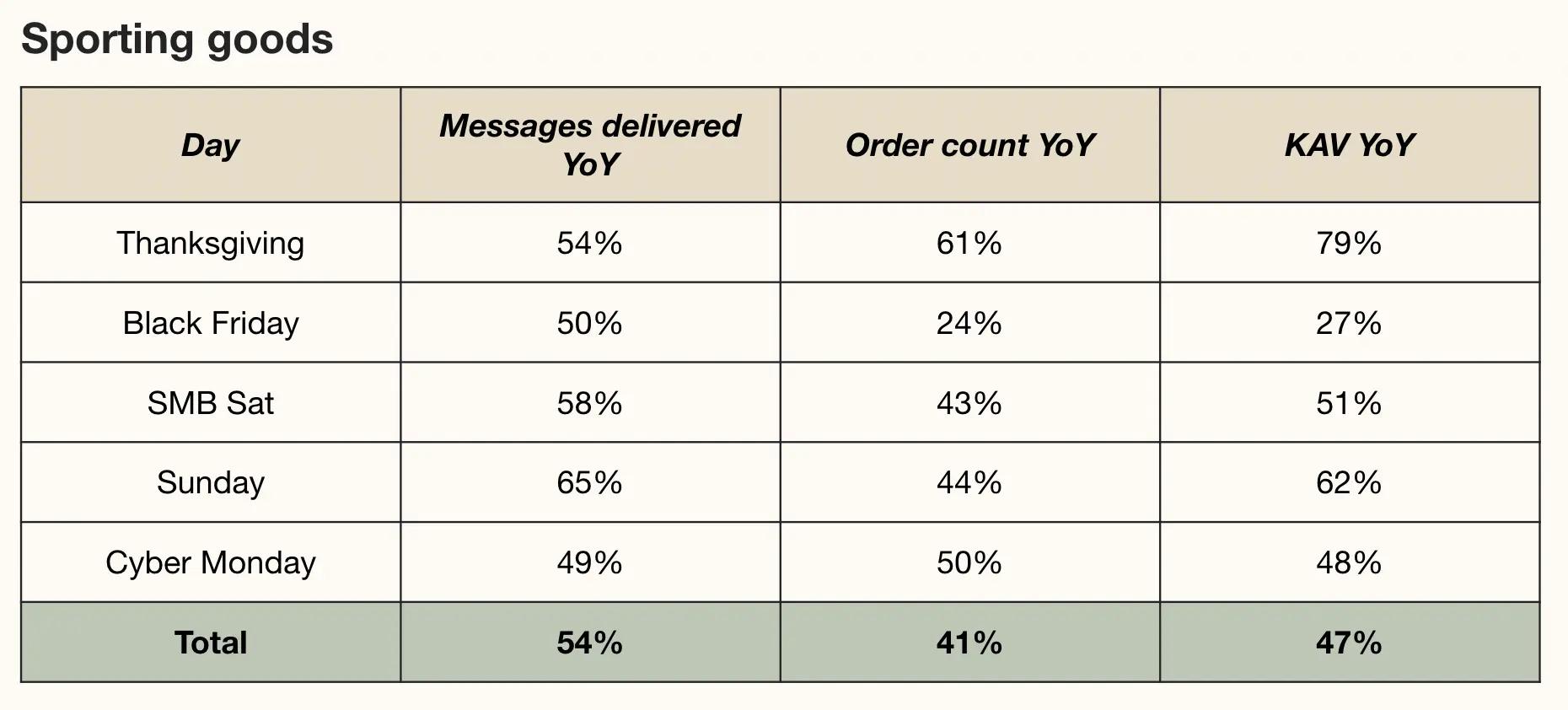

Sporting goods

The sporting goods industry grew the number of email and SMS messages sent over BFCM by 54%, and saw a 47% gain in KAV, too.

Order count was also up more than 40%., with the highest gains on Thanksgiving and Cyber Monday.

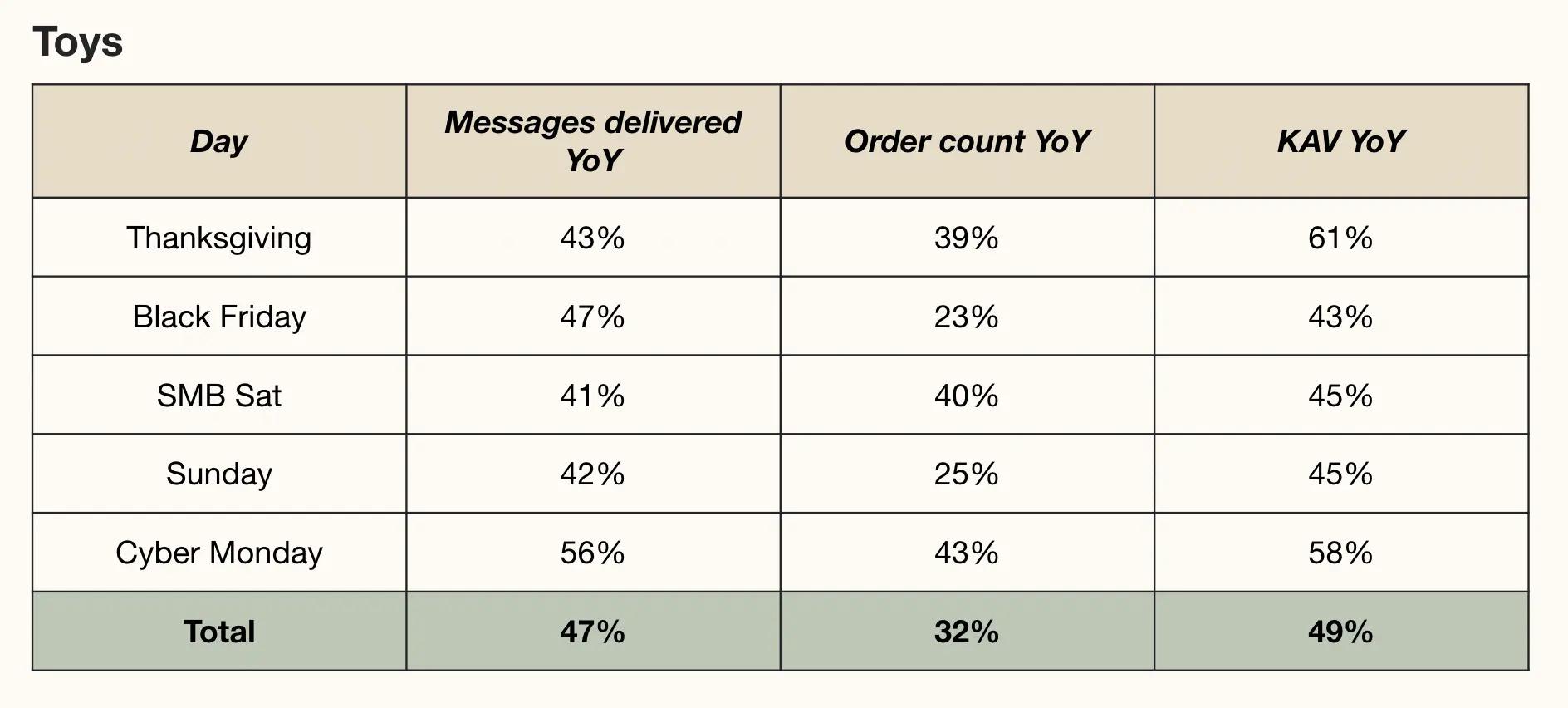

Toys

And finally, the toys industry also saw great YoY BFCM growth in 2022. Nearly 50% growth in the number of messages sent and in KAV.

Order count was up too, by 32%, with the highest gains on Cyber Monday.