The ecommerce marketing mix report

Is it time to recalibrate your marketing budget? Find out where brands are investing and pulling back in 2023.

Marketing leaders weigh in

In the midst of a historic economic downturn, making smarter decisions around marketing resources is a critical component of ecommerce success.

But it can be difficult to navigate a way forward amid a mass influx of conflicting information and perspectives across the industry.

Is retention really the new acquisition? Is it time to pull back on paid advertising? How much should you invest into which channels—and which channels can you rely on to turn a profit?

Klaviyo’s 2023 marketing mix survey set out to discover how ecommerce businesses of all sizes are putting together their marketing mix for 2023—so that you can make more efficient budgeting decisions based on what’s best for your brand.

Read the report to discover:

- How marketers are thinking about retention vs. acquisition

- What channels marketers are using the most and the least

- Where brands are spending their marketing dollars

- What channels are delivering the most ROI for brands

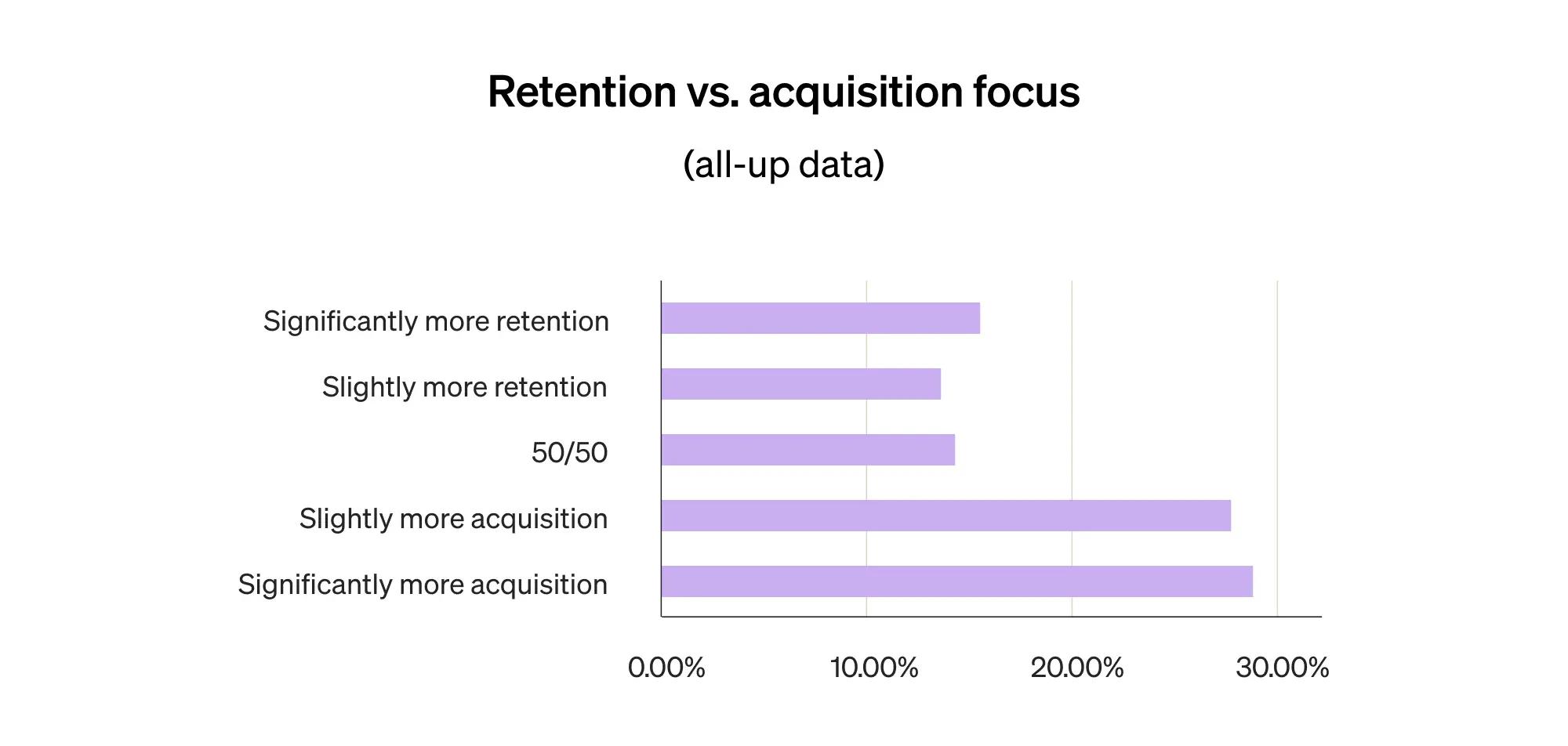

Is retention the new acquisition? Not necessarily.

In 2023, the majority of ecommerce brands will invest more heavily in acquisition (55.75%) than retention (29.87%). Only 14.38% will invest equally.

- Mid-market brands are more focused on retention (36.36%) than other business segments.

- SMBs are more focused on acquisition (58.80%) than other business segments.

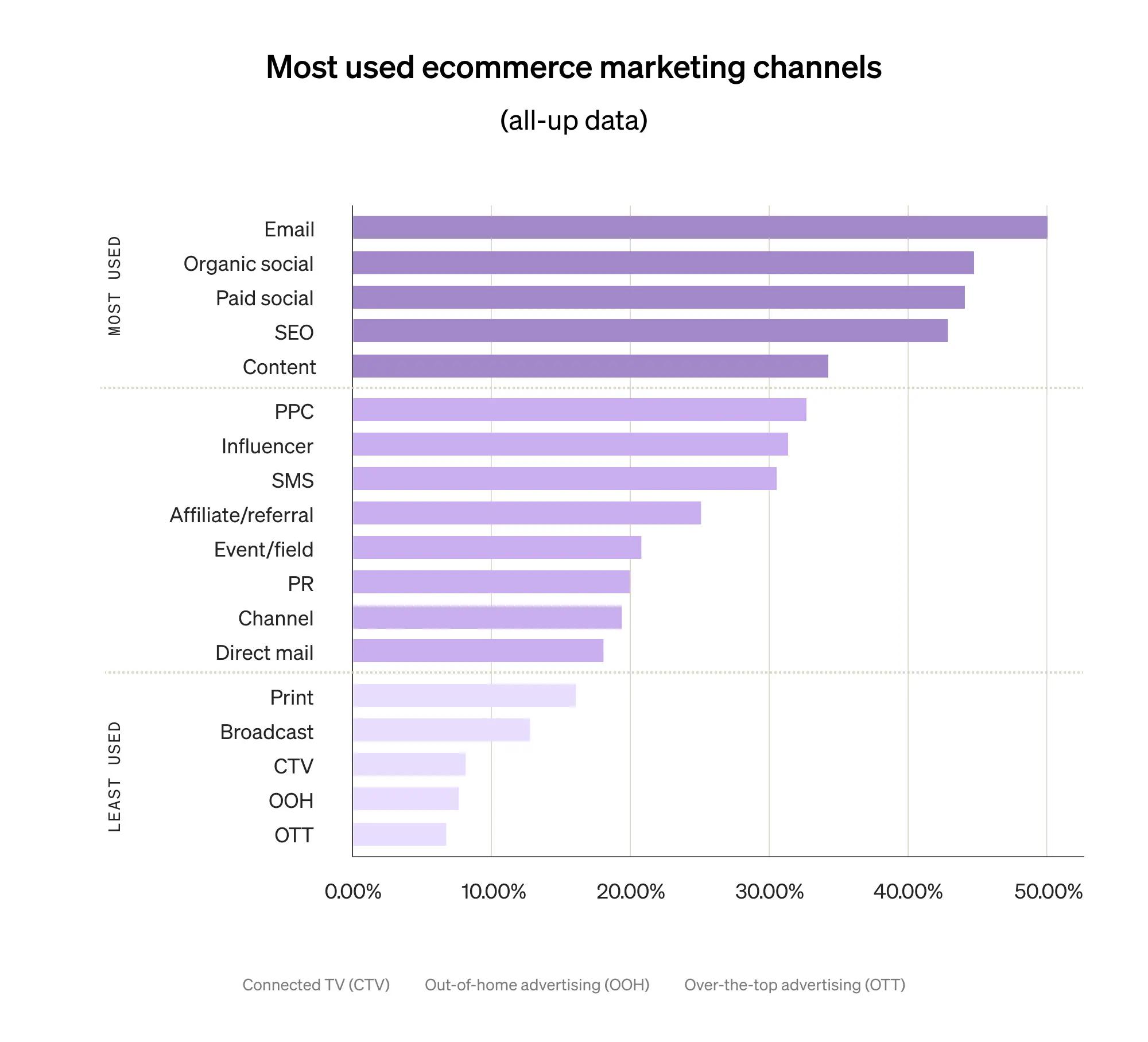

Email marketing reigns supreme.

Across all business segments, email marketing is consistently the No. 1 most-used marketing channel. It also appears in the top 5 channels in every other category in our survey, including the channels brands are investing the most money in and the channels that deliver the most ROI.

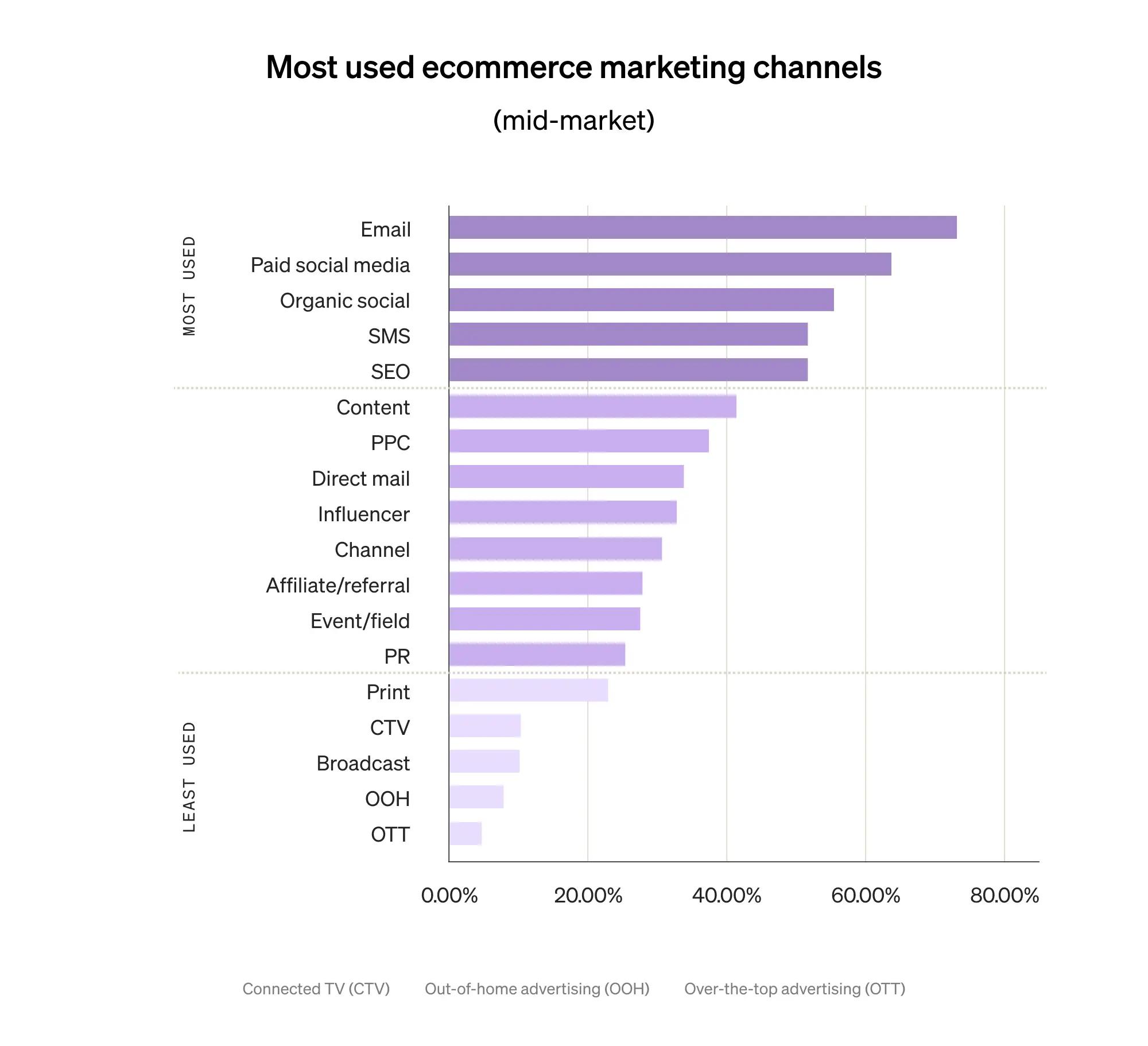

- An overwhelming majority (72.73%) of mid-market businesses use email as an ecommerce marketing channel—almost 1.5x the percentage across businesses of all sizes.

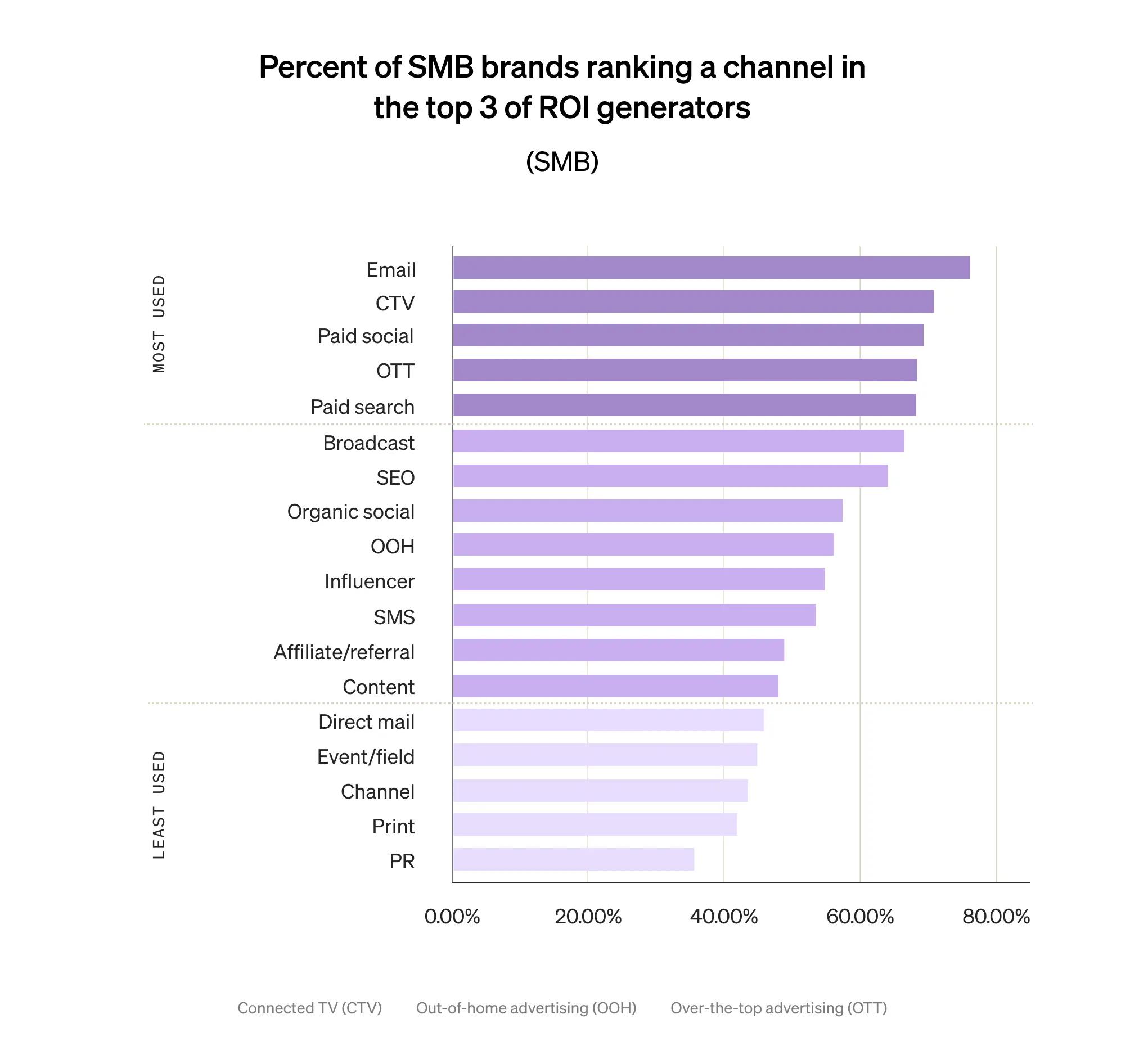

- Even more SMBs (76.52%) than mid-market businesses (73.77%) place email marketing in the top 3 of ROI-generating marketing channels.

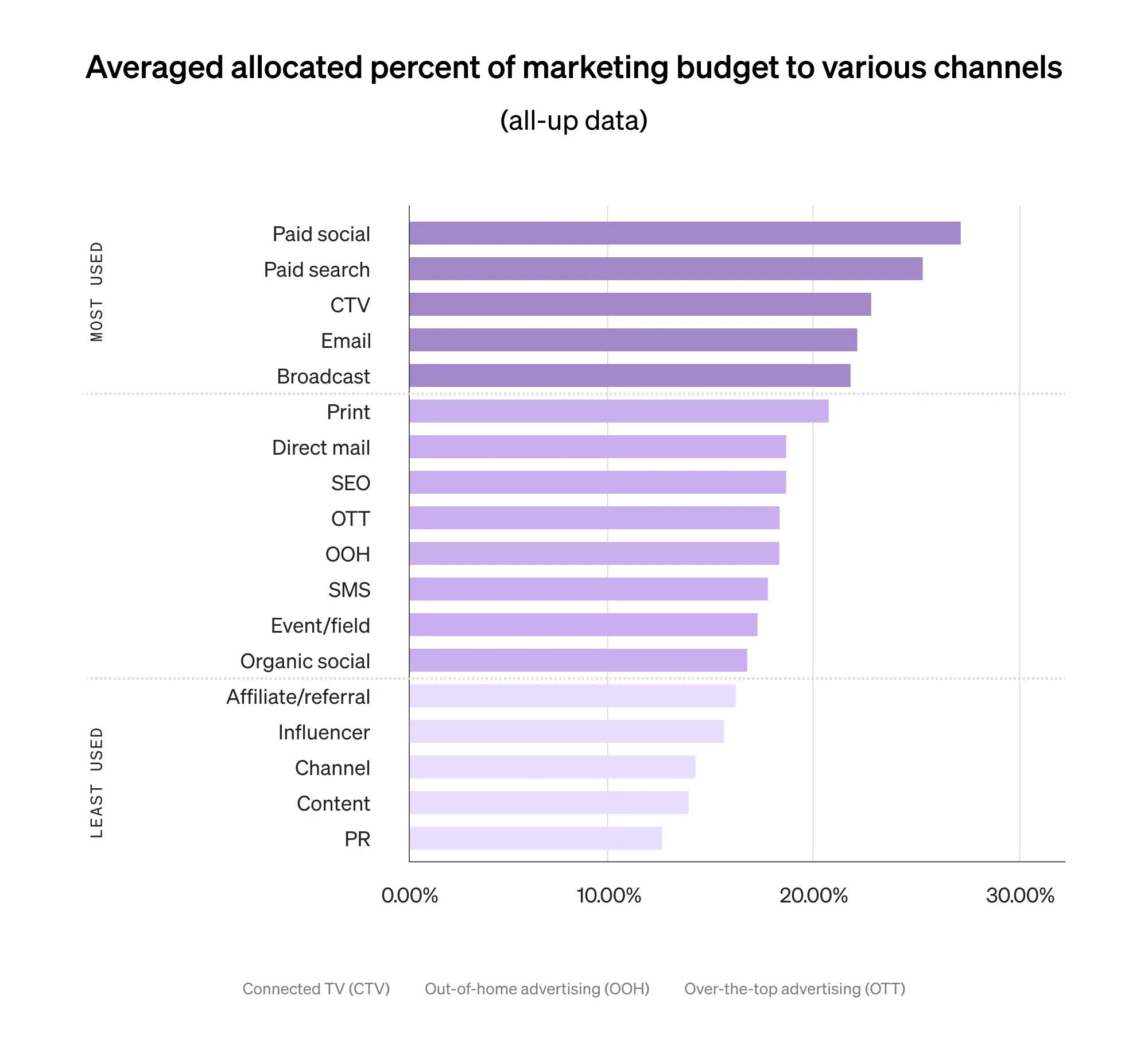

Paid continues to eat up marketing dollars.

Across all business segments, paid social and paid search repeatedly appear in the top 3 channels earning the highest slice of marketing budgets.

- Mid-market businesses spend the highest percentage of their budgets on paid search (24.79%) and paid social (23.31%).

- SMBs spend the highest percentage of their budgets on paid social (28.03%), CTV (27.75%), and paid search (25.25%).

Larger brands are going all in on SMS.

Whereas less than a third of all businesses use SMS for marketing, over half of mid-market businesses do—suggesting SMS is gaining serious traction as a must-have marketing channel among leading brands.

- Unlike businesses of all sizes, mid-market businesses that use the channel are allocating a top-5 average of 19.44% of their marketing budget to SMS, compared to a 17.39% average across businesses of all sizes.

- By contrast, SMBs that use SMS place it in the bottom 5 channels for budget allocation—signaling that the SMS marketing space may be less crowded, and therefore less competitive, for SMB businesses interested in exploring the channel.

SMBs are focused on personalized marketing.

Like other business segments, the top marketing channels for SMB ROI include paid social and paid search. But instead of broadcast and SEO, CTV and OTT round out the top 5 ROI generators for SMBs—all ideal channels for not only tracking performance, but also delivering personalized experiences to customers.