The 2023 consumer spending report

Discover how consumers are adjusting their habits amid economic uncertainty—for BFCM and beyond

Are shoppers spending more or less this holiday season?

Inflation is still hitting consumers hard, regardless of age. But according to new research of over 3K consumers, younger generations are more likely than their older counterparts to indulge in discretionary and luxury purchases—and to increase their holiday spending this season.

Understanding financial confidence in any demographic presents unique opportunities for marketers looking to understand shopping behavior during times of economic uncertainty—and act on it in time to drive real business results this Black Friday Cyber Monday.

Read the report to discover:

- How consumers feel about the economy

- Current vs. future spending plans and budget allocation

- How consumers plan to shop this holiday season

- Actionable insights from experts to apply these insights to your marketing

Using this research, you can develop a strategy that activates your first-party data in both owned and paid media channels to produce outcomes that drive profitable new customer acquisition and higher retention rates.

Economic perceptions

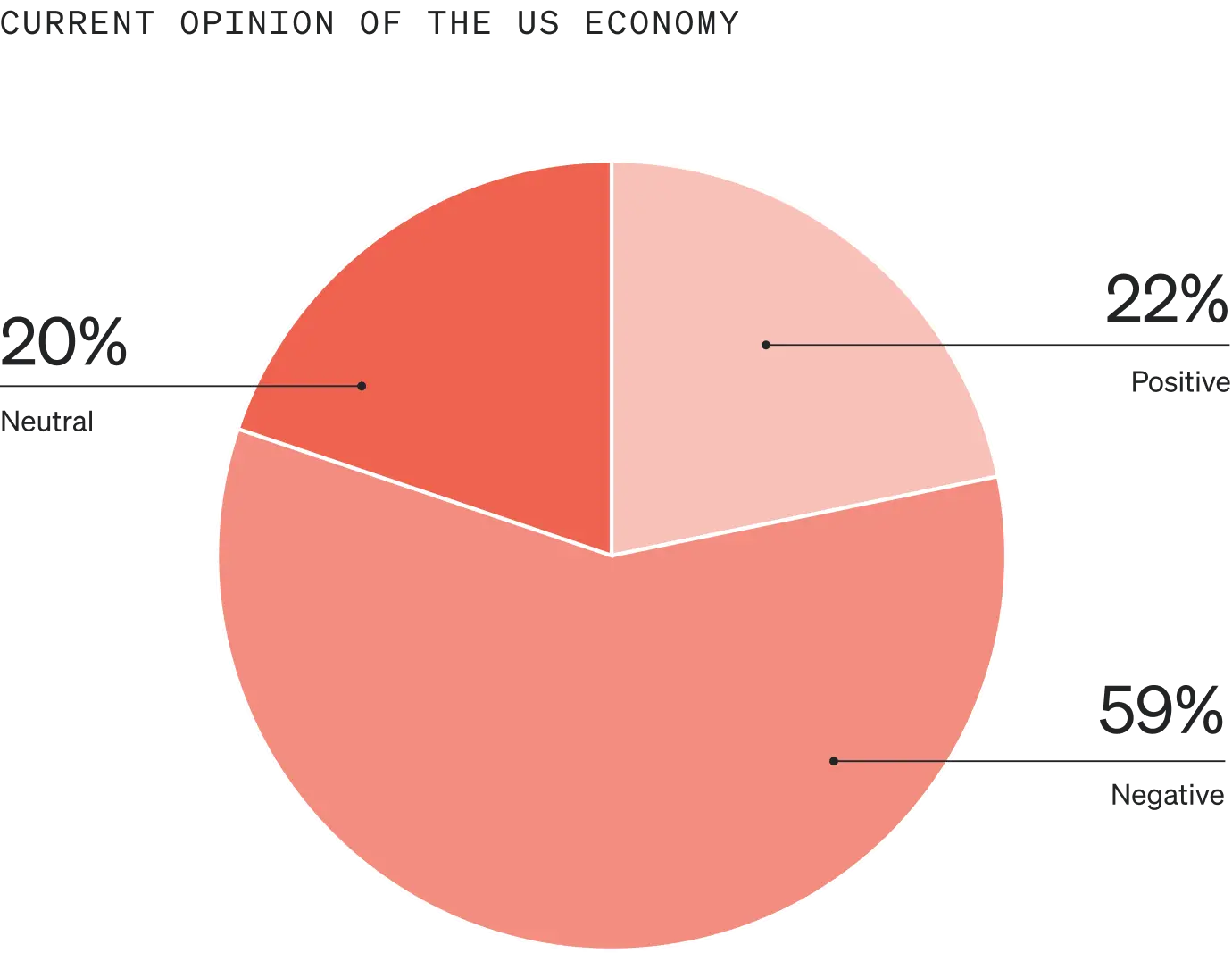

Overall, opinion of the current US economy is relatively split: While 59% of consumers feel negatively about the economy, 42% feel neutral or positive, and 46% believe it’s holding steady or on its way up.

Although all generations are feeling the impact of the economy to a similar extent, Gen Zs and millennials are more likely to take an optimistic view of the economy and its potential impact on their future spending.

Current vs. future spend

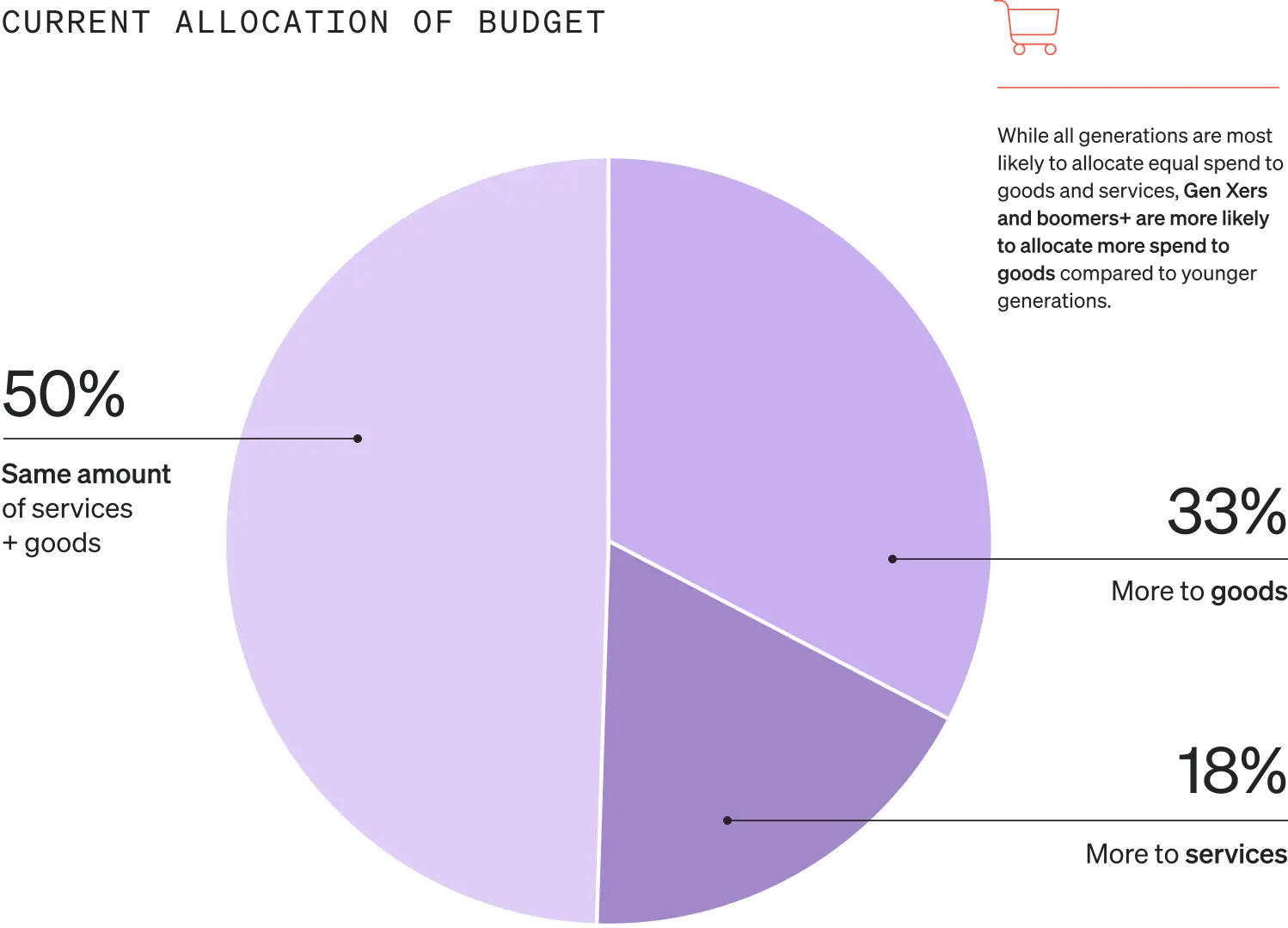

As in previous years, consumers continue to allocate most of their budgets to conventional goods. Most expect to continue to do so in the year ahead, and to be more diligent about discretionary spending. Many consumers feel hesitant to make large purchases.

Potentially due to their more positive economic outlook, younger consumers are more likely to engage in the “lipstick effect” and feel more comfortable spending on non-essentials.

In-store vs. online shopping

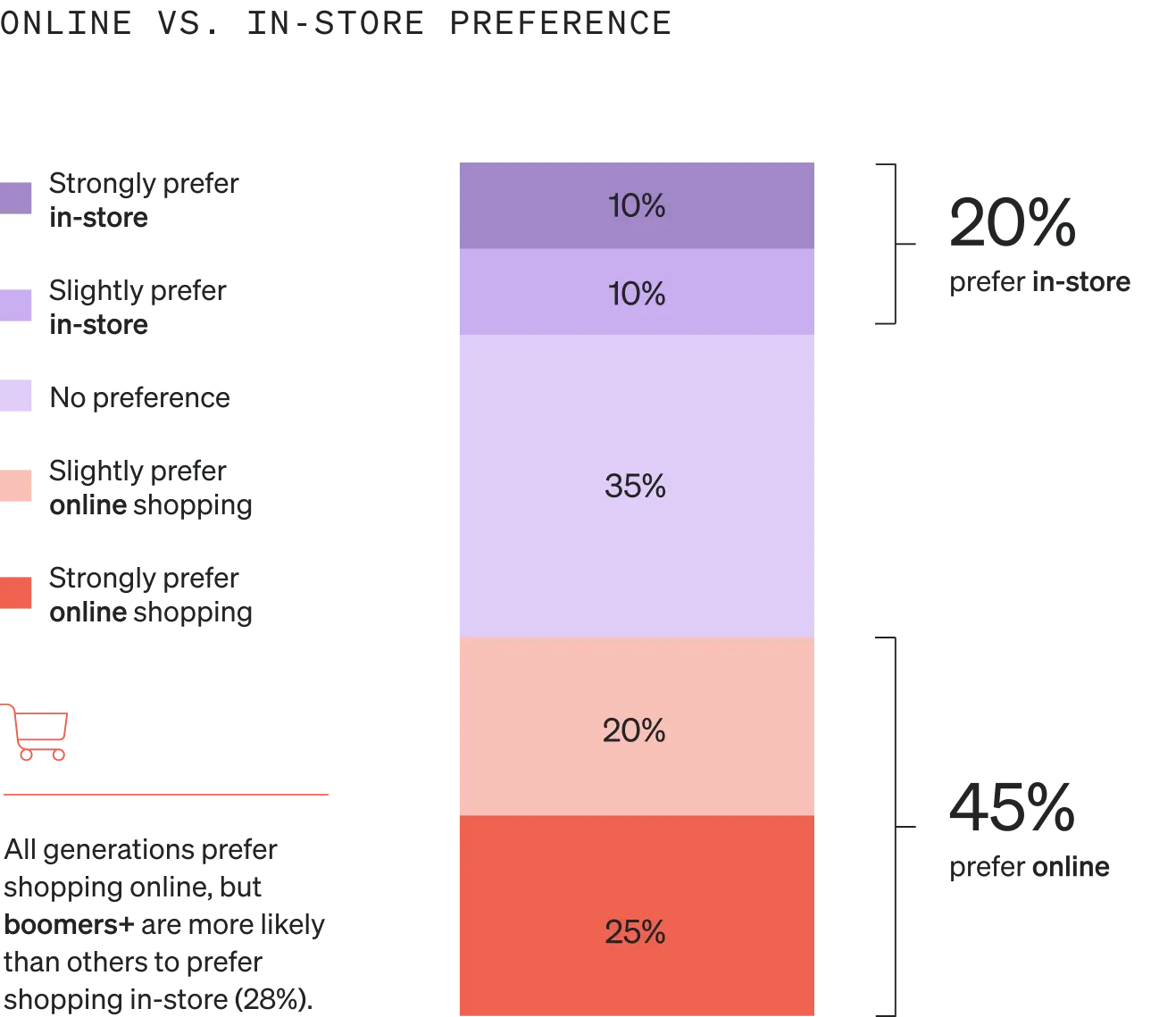

Consumers are 2.25x more likely to prefer shopping online, but they’re currently shopping about equally online and in-store. Those who shop in-store do so to touch the product and for immediate product availability, while those who shop online do so mostly out of convenience. Nearly half of consumers prefer email over all other methods of brand marketing.

Older consumers are more likely to prefer shopping in-store and are currently doing so more frequently. Their shopping behaviors are more influenced by promotions and competitive prices.

Holiday shopping plans

Consumers plan to shop primarily online this holiday season, most likely during the months leading up to the holidays. Holiday spend is likely to remain similar compared to previous years: On average, consumers spend $745 on holiday gifts.

Older consumers are more likely to shop in-store for the holidays and generally plan their shopping throughout the year. Gen Zs are more spontaneous and are most likely to do their shopping the month in which the holiday falls. They’re also likely to spend significantly less on gifts.