What do online shoppers really want from brands? New data reveals 3 current consumer behavior trends

Ecommerce has been growing significantly in recent years.

Then, the pandemic hit and that growth skyrocketed. Online shopping became a necessity, even for people who hadn’t even considered it before.

Sure, COVID-19 changed the way people shop, but what does consumer behavior actually look like today? And what do people want from brands going forward?

To answer these questions, Klaviyo surveyed over 5,000 online shoppers about how they want to interact with brands—on social media, with email, and in everyday life.

And, because data’s most helpful alongside context and beautiful graphics, we put that information into a report that tells the story behind the numbers.

Read on to learn about trends that define consumer behavior right now, like:

- How people discover and interact with brands

- What’s important to consumers today

- What communication channels shoppers prefer

Key consumer trends affecting ecommerce

Curious about what your customers really want? Here are a few highlights from the consumer trends we discovered:

1. Word-of-mouth brand referrals still carry the most weight

When people look for a new brand, they prefer recommendations from friends and family. This isn’t new—but it’s important to note that it’s still true, despite the rise of social platforms like Clubhouse and Tik Tok.

In other words, building relationships with your customers and turning them into brand advocates might be a better investment than trying that flashy new channel you may be wondering about.

Recommendations from friends and family ruled supreme across all age groups.

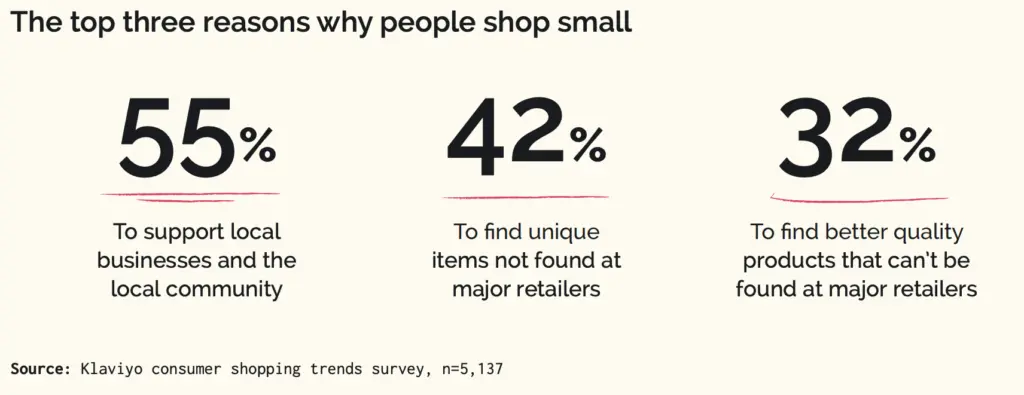

2. People shop locally for three main reasons

Even as parts of the world reopen, people are keeping their attention local. The survey showed people continue to be excited about shopping local—so we dug into what that special something is bringing consumers to smaller brands.

Possibly from a desire to protect their local community businesses or to discover more unique items

3. Email isn’t dead (still), and SMS messaging is gaining steam

The consumer’s choice award for marketing channel of the year goes to…email.

Consumers say email marketing is the way they want to engage with brands they already have a relationship with. Given how easy it can be to personalize emails to feel relevant, it makes sense that consumers enjoy email communications.

Plus, a new star has joined the show: Along with email, people shared they’re also interested in getting text messages from brands they love.

SMS marketing is on the rise

Now, are you wondering how consumers feel about hot topics like data privacy and social commerce? Rest assured, that’s in the full report. Explore it to learn:

- How many consumers are actually worried about data privacy

- What social media platforms your customers are most likely to use

- Actionable takeaways to help you meet your customers’ current needs

Today’s consumer data, tomorrow’s brand strategy

Consumers have shared what they want from brands like yours. It may not be what you thought or even what they once told you, so show people you’re actively listening by acting on what they expect from now on.

And what better time to prove your brand’s relevancy than the biggest retail moment of the year?

We’ve been through one Black Friday/Cyber Monday affected by COVID-19 and consumer behavior has already changed from BFCM 2020. Use this new data as you think about how you’ll adjust your marketing and CRM strategy heading into the holidays to meet your customers needs today and in the year ahead.

Related content

See how Customer Hub, Customer Agent, and Helpdesk powered faster support, reduced tickets, and boosted revenue during Klaviyo Service’s first BFCM.

Post-purchase experiences are where customer loyalty begins. Learn how to automate and personalize them to grow your B2C brand

Discover how lifecycle marketing transforms your CRM into a growth engine, driving retention, automation, and personalized B2C customer experiences.