13 creative email segmentation strategies and ideas, with examples

When you look at your subscriber data, it’s natural to focus on the numbers.

But don’t forget, there’s a real person behind every screen, and each person has a unique relationship with your business.

One of the best things you can do to sustain your subscribers’ trust is to send them messages that are actually relevant. Imagine getting blasted with emails for flip-flops when you were just searching for formal dresses. Would you stick around?

With Gmail’s new unsubscribe feature, it’s easier than ever for your audience to end your relationship. Don’t give them a reason to hit that button.

Email segmentation enables you to send fewer, better-targeted messages to your subscribers by splitting them up into segments based on what you know about them—their browsing behavior, information you’ve captured through forms and surveys, what they like to buy, and more.

The more you know your subscribers, the more you’ll be able to segment your database and your sendings.

And when you do it right, it drives more revenue and a stronger brand reputation for your business.

“Segmentation is key,” says Victor Montaucet, CEO at ThirtyFive/Ben&Vic. “The more you know your subscribers/customers, the more you’ll be able to segment your database and your sendings.”

Fortunately, email segmentation doesn’t have to create a lot more work for you, and you don’t have to be a data scientist to pull it off—especially if your entire tech stack is feeding information into a single, robust customer database.

In this article, we’ll cover high-performing email segmentation strategies and tactical ideas you can use for your ecommerce business. You’ll learn how to send the right message to the right people at the right time so that more of your campaigns get delivered, opened, and clicked—and your customers place more orders.

Types of email segmentation strategies

Demographic segmentation groups subscribers by traits like age and gender. This enables you to tailor emails to resonate with specific demographics (such as diapers for new parents vs. other paper products for non-parents).

Behavioral segmentation groups subscribers based on their actions and interactions with your emails, texts, website, and more. This enables you to target your most active subscribers (e.g., those who have opened emails in the past 6 months) or those who are most likely to be interested in a given campaign (e.g., those who frequently click on a certain category of products).

Psychographic segmentation groups subscribers based on their interests, values, lifestyles, and personalities. This enables you to target emails based on what people care about, not just who they are (such as emails about eco-friendly products to environmentally conscious subscribers).

Geographic segmentation groups subscribers by location. This enables you to send targeted emails about local events, promotions, or information relevant to someone’s region (such as emails about upcoming sales at a local store).

Now that you’re more familiar with the types of email segmentation, let’s dive into 13 segmentation strategies for targeting these groups, which can ultimately boost customer loyalty and sales.

1. Customer engagement

When Huda Beauty saw a YoY decline in overall performance, they decided to overhaul their content strategy, clean up their email list, and focus on targeting their most engaged subscribers.

They now only send regular campaigns to subscribers who have engaged within the last 120 days, reserving full-list email blasts for major annual sales only. The results? Double the YoY growth in YTD Klaviyo-attributed revenue.

Improving email deliverability was key to this equation. “With simple Klaviyo segmentation, we were able to clean up a lot of the deliverability issues that we had previously. It was a small thing that created a really big lift,” explains Phuong Ngo, CRM and loyalty manager at Huda Beauty.

Moral of the story: your engaged profiles (everyone who has engaged with at least one email in recent months) are the most valuable segment of your main list. Focus on targeting them with the content they’re most likely to care about.

We recommend following a tiered engagement track strategy in which you send 70% of campaigns to engaged profiles, 20% to a broader audience, and 10% to the whole list.

2. Newcomers to your business

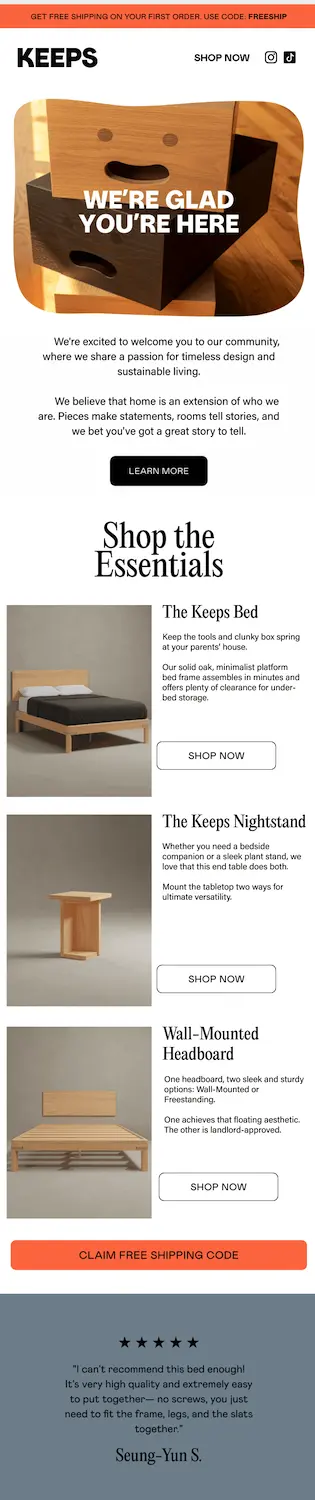

New subscribers may not be ready to buy, but they’ve indicated interest in your brand. Affirm their decision to subscribe by sharing top product features, brand storytelling, testimonials, and customer reviews—emails that help them get to know you better.

This email from furniture maker Keeps gives new subscribers a sampling of essential introduction content—they may want to click to get to know the mission, or they may be ready to skip forward to learn about the flagship products. Keeps also includes a customer review at the bottom of the email, which may be enough to prompt people to scroll back up and claim that free shipping code.

3. Past purchase history

Your customers’ past purchase history includes what they’ve bought, how much they’ve spent in total or on average, and how often they place an order. You can segment past purchasers and deliver tailored offers, promotions, or perks based on both their all-time and recent purchasing behaviors.

After a customer makes a purchase, you have a window of opportunity to deliver timely info or re-engage them to make their next purchase. Use what you know about the product itself to drive your segmentation strategy.

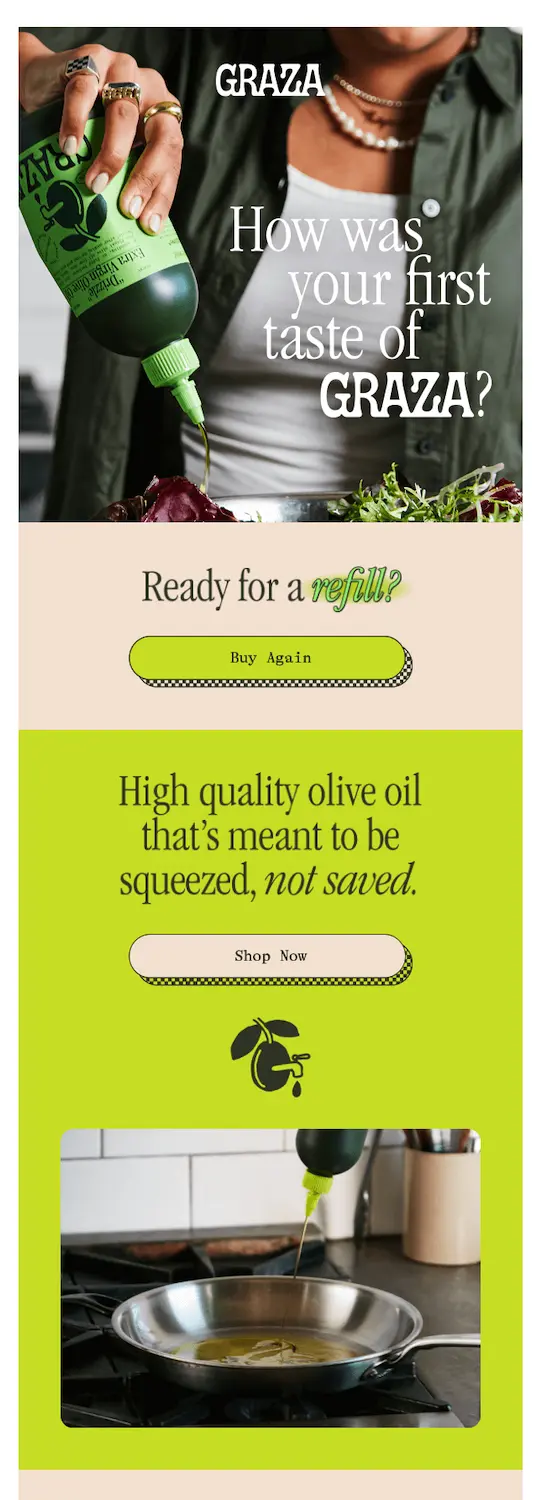

Do your customers need instructions to set up or use the product for the first time? Send them all the required info so they’re ready when the order arrives. Is the product consumable? Try sending a timely message when people are most likely to purchase again.

Graza, for example, sends first-time olive oil purchasers a follow-up email with a reminder to purchase a refill, giving people a nudge to try out Graza’s innovative refill bottles.

4. Customer reviews

Make it easier to respond to positive and negative ecommerce reviews alike by segmenting customers who have left a review for your products.

Affirm a positive review by sending a note of appreciation, or share an offer to incentivize future reviews and purchases (just make sure you’re offering incentives for all reviews, not just positive ones). Always respond to negative reviewers to let your customers know you heard their feedback. You just might get a second chance to win them over.

Compass Coffee takes this process a step further by using Klaviyo Reviews to incentivize more people to submit a photo with their reviews. Using Klaviyo, Compass was able to set up a conditional split: if a review has a photo, the reviewer gets a 15% discount on their next order; if it doesn’t, they simply get a thank-you email and a reminder to leave a photo next time.

With this strategy, Compass saw a 3.7x QoQ jump in customer photos submitted—and a 70.5% jump in total reviews submitted.

5. Customer lifetime value

Customer lifetime value (CLV) is the total value of all purchases a customer has made with your brand.

When you segment your customers based on CLV, you can deliver personalized offers based on what they’re most likely to care about. The following segmented offers are a great way to raise your CLV and reduce churn:

- VIP (all-time high CLV): early access to new products

- Frequent purchasers: early access to sales

- Big spenders: exclusive product drops just for them

- Unengaged VIPs: deeper discounts on sales

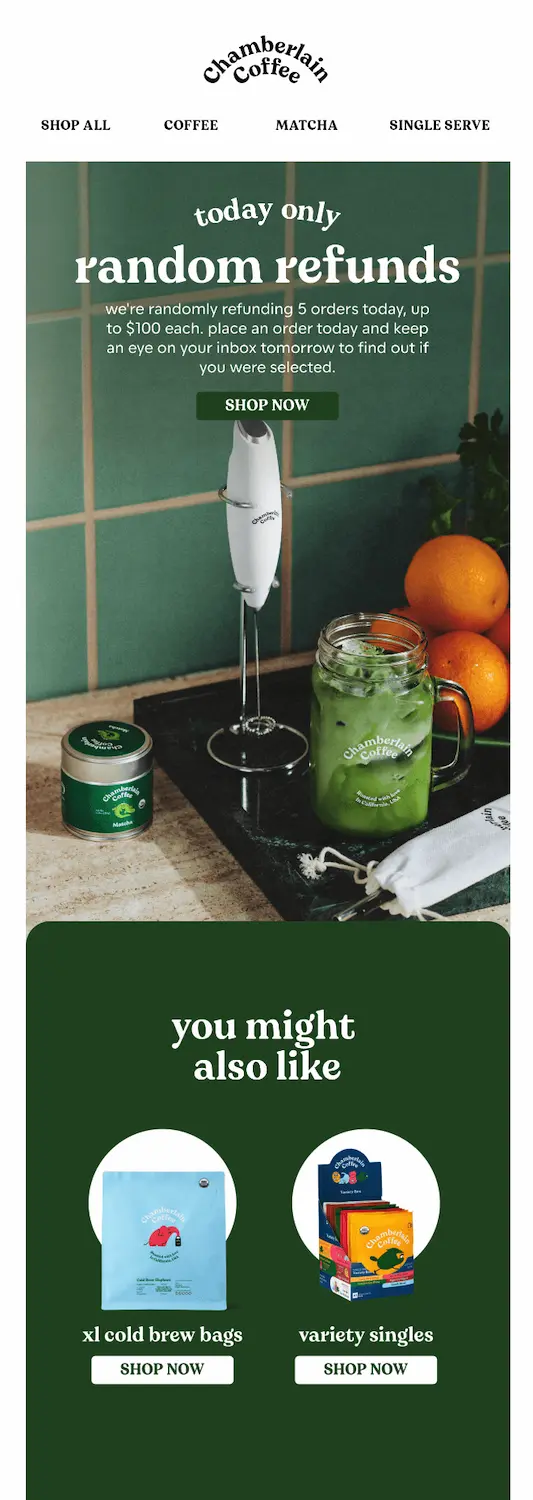

High-value customers are a great target for special offers and creative promotions. Chamberlain Coffee, for example, gives customers a chance to get their entire purchase refunded when they place an order that day. A limited offer like this could be a low-cost way to re-engage frequent purchasers, and may even encourage them to spend a bit more than they normally would.

With Klaviyo, you can also use AI to segment based on predicted CLV, which estimates how much money a customer will spend in the next year based on past behavior.

6. Purchase amounts

Similar to CLV, you can also segment your customers based on their past purchase amounts and send targeted incentives. Experiment with the following segments and offers:

- Low spenders: Highlight value-driven offers, free shipping thresholds, or product bundles to incentivize larger purchases.

- Medium spenders: Offer exclusive discounts, early access to new products, or personalized recommendations based on their purchase history.

- High spenders: Express appreciation for their loyalty, and offer VIP rewards, or exclusive experiences while showcasing high-end products.

7. Acquisition source

How your customers signed up for your email list—on your website, through a referral, via social media, in-store, etc.—tells you something about what they might want next from your brand. And that makes acquisition source a particularly helpful characteristic for segmenting your welcome series.

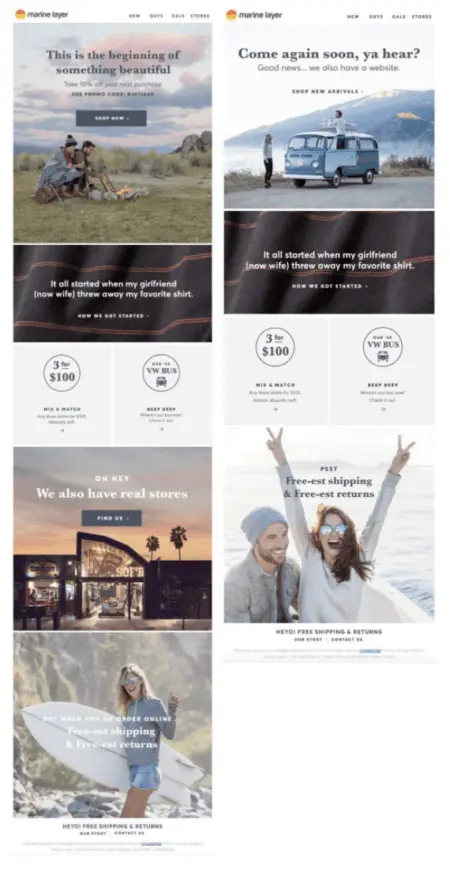

For example, Marine Layer has one welcome series for in-store subscribers and another for online subscribers. Those who visit the summer apparel brand in-store are introduced to the brand’s website. For those who subscribe directly on their website, Marine Layer offers a coupon code for 10% off, and encourages them to locate their closest store.

Try tailoring your first messages to new subscribers based on their probable motivations:

- If they signed up from a promotional offer page, they may be interested in discounts.

- If they signed up for a newsletter before buying, they may be more interested in educational or brand content.

- If they signed up through a referral, they may already trust your brand because someone they know does. So try to entice them to make their first purchase.

- If they signed up when making a purchase, they may be enticed to come back for more. Try offering an incentive to leave a review or make a future purchase.

8. Last viewed products

Similar to their more popular cousin, the abandoned cart email, browse abandonment emails go out automatically to customers who view a product page without adding an item to their cart or making a purchase.

If you have a large catalog, creating segmented emails for all your products may be an overwhelming task, but you can start by choosing 3–4 top bestsellers or grouping by category.

Taylor Stitch, for example, segments their browse abandonment series by their top 4 product categories. People who view a category that isn’t one of those 4 receive more general content about the company’s most in-demand, lower-cost items. The example below is specifically tailored to people who browsed any item in the men’s shirts category.

9. Abandoned cart value

Abandoned cart emails are one of the most commonly used trigger flows for a reason: they work! To increase your profitability, segment your abandoned cart flows by cart value. For customers with low-value carts, send compelling messaging without a coupon. For customers with higher-value carts, you can offer a discount knowing the ROI is worth it.

Juice brand Pulp & Press, for example, guarantees 30% off on orders above $100 if recipients “hit that order button now” during their Cyber Monday sale, banking on scale and a higher price to offset any money lost through discounts.

10. Birthdays

Who doesn’t love being treated to something on their birthday? Birthday offers aren’t just a nice way to build loyalty—they also tend to drive purchases.

Try sending your customers a discount code or offering a gift with purchase, online or in-store. Be sure to give your customers a heads-up about their birthday offer ahead of the day so they can plan to make the purchase.

11. Loyalty program status

Your customers’ past purchase history includes what they’ve bought, how much they’ve spent in total or on average, and how often they place an order. You can segment past purchasers and deliver tailored offers, promotions, or perks based on their past purchasing behaviors.

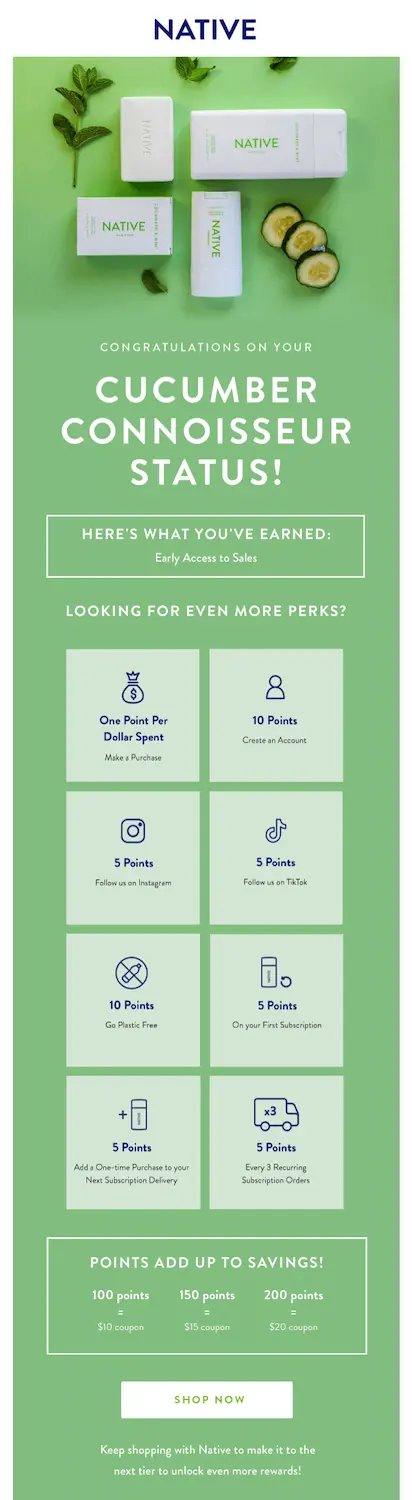

Here, deodorant brand Native offers perks to loyal customers who reach a certain status based on their past purchases. The cleverly branded “Cucumber Connoisseur” status offers early access to sales, and customers can access even more perks by taking another action.

12. Location

Shoppers who live anywhere outside of Florida aren’t likely to open a series of emails about an in-store event in Miami. Similarly, if your winter clothing line just dropped but it’s summer for half your customers, you might want to hold off on sending that promo email.

For international brands in particular, weather or season-specific collections, shipping offers, pricing, and product availability can all range by location.

Location-based segmentation allows you to send more relevant messages based on where people live. With Klaviyo, you can segment your customers based on their country, state/region, zip code, or by radius around a specific location (within the US, EU, UK, Canada, Australia, and New Zealand).

13. Customer preferences

When you understand your audience, you can send them more of what they want—and less of what they don’t.

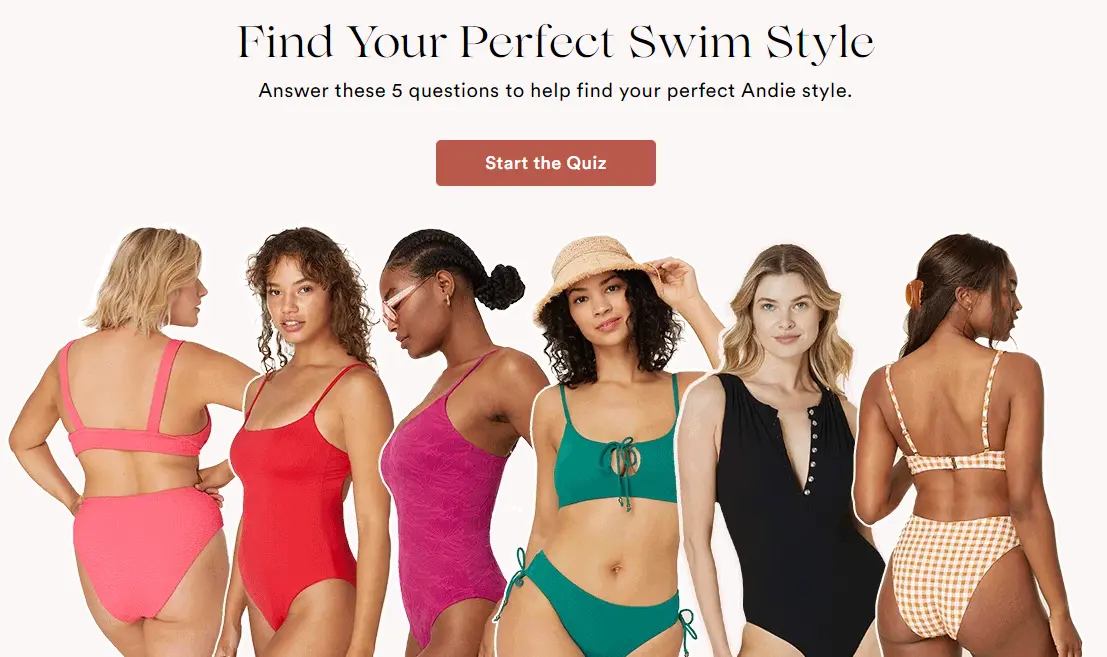

Andie Swim has seen incredible results from their personalized segmentation strategy. In just 8 months, it drove $70K+ in additional revenue.

The swimwear brand uses a fit-finder quiz to segment its email list based on style and fit preferences. Klaviyo’s audience breakdown feature automatically reviews engagement by segment, so they can continually optimize targeting based on their audience’s interests.

How Klaviyo AI can make segmentation work even harder for your brand

By gathering zero- and first-party data in Klaviyo, you’ve already taken the first step toward building an effective email segmentation strategy. You know some things about who your customers are and what they’ve done in the past.

The magic (a.k.a. increased CLV) happens when you use that data to predict what people will do next.

That would be impossible to do quickly and at scale if you were doing it manually. But Klaviyo’s predictive analytics AI analyzes your historical customer data and generates future predictions for you, in real time.

In Klaviyo, you can send campaigns or trigger flows based on the following predictive metrics:

- Predicted next order date

- Predicted CLV

- Predicted spending potential

- Predicted churn risk

- Predictive demographics

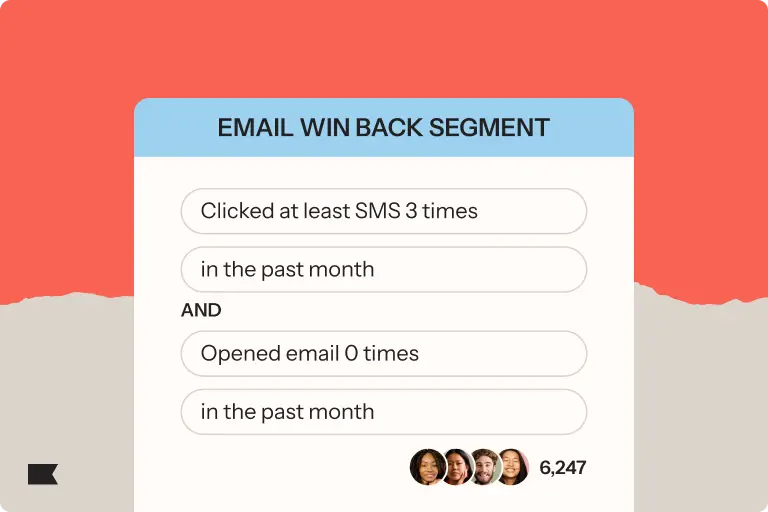

Segments AI, meanwhile, helps you build segments faster so you can send more targeted campaigns. Simply type something like “I want to create a list of customers who have made more than one purchase this year,” and your segment will be ready for you to review in seconds.

Whether you’re an experienced data-driven marketer or just getting your feet wet with segmentation, Klaviyo AI makes it easier to make sure your emails reach the right audience. Because if your emails don’t reach the right audience, even the most cleverly crafted headlines, spot-on copy, and captivating designs will get ignored, unsubscribed or worse, sent to spam.

If old you was sending your campaigns to everyone on your list, new you is about to see why segmentation is essential to every email marketing strategy today.

Related content

- Email segmentation tools have evolved—and you should use them to do the same

- Engagement-based email segmentation: 3 key benefits

- Top-performing brands segment their lists. Their tactics are becoming more sophisticated

Related content

Discover the best email marketing platform for ecommerce in 2026. Compare top tools for data, automation, personalization, and deliverability.

Learn how to use Klaviyo SMS, segmentation, and hybrid flows to re-engage lapsed email subscribers, boost deliverability, and drive higher retention.

Boost D2C email revenue from 12% to 30% with the Klaviyo playbook: high-converting pop-ups, a 5-email welcome series, smart filters, and optimized abandonment flows.