Customs + shipping after Brexit: what you need to know

Editor’s note: This article is a guest contribution from Andrew Norman, managing director for ShipStation International, an order and delivery management software designed to save you time and money on ecommerce order fulfillment.

If your business is based in the UK, and you’ve shipped anything to the EU since Brexit, then you’ve likely experienced one or more of the following:

- More paperwork

- Longer delivery times

- Customs charges and duties

- Value Added Tax (VAT) headaches

- Misinformation online or outdated guidance

Dealing with shipping post-Brexit varies from business to business. Some have abandoned returns policies while others have stopped shipping to European customers entirely. Just because something’s new or a little more time-consuming doesn’t mean you need to abandon it for your business.

This short guide pulls together official information and best practices to explain how to smoothly send orders across the UK border.

Once you understand the basics, you can focus on the trickier specifics that need a little more energy all the while knowing that you’ve delighted your European customers by staying open for business.

There’s no one-size-fits-all for customs and shipping after Brexit but there are fundamentals that every business has to follow, which I’ll outline below.

The basics of shipping after Brexit

All businesses need to provide the following information for items to pass smoothly through customs:

- UK Economic Operators Registration Identification (EORI) Number

- The importer’s EORI Number (if you’re shipping to another business)

- Sender and recipient’s name, address, and contact details

- Item details (quantity, weight, value, and description)

- Country of origin

- Harmonization code (typically an eight-digit number)

- Recipient VAT number (if applicable)

These specifics are non-negotiable and missing information will lead to delays, fines, and additional duties, or failing to clear customs entirely.

Collectively, this information tells the customs professional what an item is, its value, where it’s come from, and whom it’s going to.

For example, an EORI number helps identify the sender while harmonization codes are in place to standardize how customs operate across the world.

Gaining an EORI number is simple and applying for one takes minutes via the UK government’s dedicated portal. Everyone—from sole traders to global enterprises—require an EORI number when sending an item to the EU commercially.

Your EORI number should start with the letters GB. If you’re located in Northern Ireland, things are slightly different as I’ll explain later.

You can search for harmonization codes online. Simply describe what the item is and you’ll see its harmonization code, VAT rate, duties, and other key information you’ll need for your customs forms.

Customs forms

Before Brexit, UK businesses didn’t need to worry about customs paperwork when shipping items to the EU. Now, it’s an important part of ensuring your customers receive their orders without delay.

Forms vary slightly depending on your courier:

- Royal Mail and DPD use two types—a CN22 or CN23 form

- DHL, FedEx, and UPS use an Electronic Data Interchange (EDI) form

The CN22 form is used for items with a value of up to £270.

CN23 forms are for items valued above this £270 threshold and require additional accompanying paperwork such as a commercial invoice, appropriate license, or necessary certificates.

EDI forms operate in the same way.

You’ll need to know when a commercial invoice is required on your shipments. Some countries accept electronic commercial invoices, while others don’t and expect three paper copies to be included. If you’re not sure whether it’s required, it’s safer to include a hard copy than risk a poor customer experience due to delays.

If you’re using ShipStation to fulfill your international orders, our customs declarations are equivalent to commercial invoices and our solution automatically populates all the information required.

EU import VAT

VAT is where things become more complicated.

Before Brexit, UK businesses didn’t need to worry about EU import VAT on exports to the European Union. Since Brexit, VAT is applied.

This is different from UK VAT. Currently, UK businesses only need to collect VAT on sales after they surpass an £85,000 threshold. These domestic limits don’t change, though all businesses will need to understand what their UK VAT obligations are.

EU import VAT varies from country to country and its collection depends on how you operate as a business, the value of the item you’re sending, and the item’s country of origin.

Seek official tax advice when necessary to ensure your business is charging VAT appropriately and meeting its legal requirements in every country you sell into.

Some EU Member States have different thresholds to those outlined in the next section, so check where appropriate what the current rate is if you’re going to collect EU import VAT from your customers.

Do I need to pay EU import VAT?

1) Is your item valued at less than €22?

- Your item is not subject to EU import VAT.

- This threshold may change after July 1, 2021, as currently, there are low-value consignment relief thresholds in place.

2) Is your item valued between €22 and €150?

- EU import VAT is due.

- This is often charged at 20 percent but can vary from country to country.

3) Is your item valued at more than €150?

- EU import VAT is due and additional import duties may apply.

Important: If the item is alcohol, perfume, or a specialist product, then additional excise duties may apply no matter what the item’s value is. Always check first.

How do I pay EU import VAT?

There are two ways to pay for EU import VAT. One option is often simpler for you, the seller, but can lead to extra charges for your customers. The other benefits the buyer and ensures there are no nasty surprises for your customers.

1) You leave EU import VAT unpaid.

Your customer sees your item’s price without VAT. You complete the necessary paperwork and ship the items. The courier charges the recipient the EU import VAT and releases the item to them.

While seemingly easier for you, this can lead to delays at customs, customers refusing to pay and therefore items being stored at a cost or shipped back to you, and additional accounting.

Check whether you need to register for tax in the countries you’re operating in.

2) You collect EU import VAT and pay the courier.

As before, your customer sees the item price, but this time, VAT at the appropriate rate for that country is added and collected by you.

You choose to pay the VAT and other duties to the courier. The buyer pays nothing more.

This is often called Delivered Duty Paid (DDP).

Delivered at Place (DAP) or Delivered Duty Unpaid (DDU) is what occurs in scenario one—where your customers are asked to pay EU import VAT to release their items.

Again, check whether you need to register for tax in the countries you’re operating in.

Some marketplaces provide shipping programs that simplify this process further by paying EU import VAT on your behalf. But using services like these come with their own pros and cons—shipping can be more expensive and delivery times are sometimes slower, for example.

Shipping to Northern Ireland post-Brexit

Northern Ireland has different shipping and customs regulations than the rest of the UK.

If you’re located in Northern Ireland and shipping to the EU, then you require an additional EORI number starting with XI.

Duties don’t apply if you’re shipping from Northern Ireland to the Republic of Ireland. The shipment is treated as “intra-community” and isn’t subject to extra charges.

Note that Northern Ireland to Great Britain exports are considered domestic shipments, even though they require customs information.

Extra tips for shipping internationally after Brexit

While the post-Brexit shipping requirements can appear daunting, once you understand what’s expected of your business, adjust to new systems, and check with a tax professional, things become easier as time goes on.

Remember:

- Be detailed: It’s better to add too much information than not enough.

- Be aware: Additional measures may prompt carriers to increase pricing, so monitor the situation.

- Be truthful: Specifying “gift” on a customs form is illegal.

- Be considerate: The less complicated you make purchasing for customers, the more likely they will buy from you.

- Be patient: Shipping internationally will take longer than before Brexit, so communicate any delays carefully and proactively.

ShipStation makes EU shipping easier by managing much of the new administrative procedures for you, but even if you decide to go it alone, remember that Brexit has happened—and now is the time to act.

Brexit-related EU import VAT, customs charges, and changes to how you ship items are here to stay.

Related content

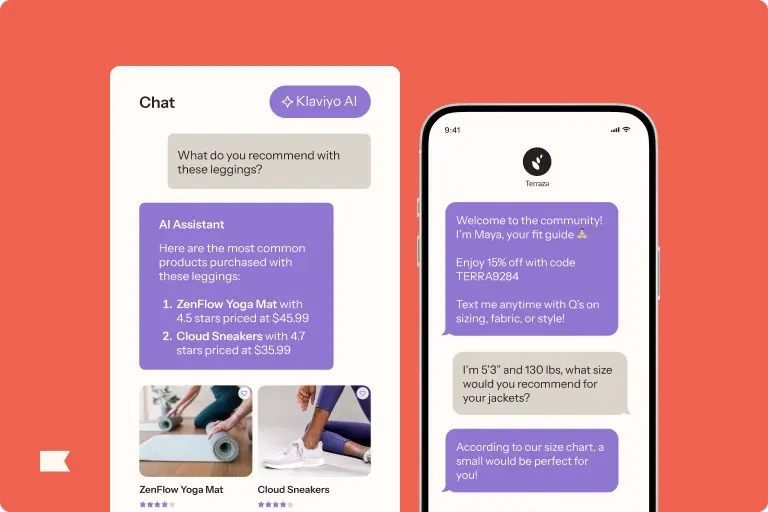

Customer service technology in 2026 is integrated, powered by AI, and backed by customer data. Learn what your service stack should look like to exceed rising customer expectations.

AI customer service is expanding fast in 2026. Learn how brands use AI to improve efficiency, customer satisfaction, and loyalty, and unlock new revenue opportunities.

See how Customer Hub, Customer Agent, and Helpdesk powered faster support, reduced tickets, and boosted revenue during Klaviyo Service’s first BFCM.