How to communicate with empathy during uncertainty

If your brand encounters economic uncertainty, the best way you can communicate with your customers is with empathy. If the pandemic taught marketers anything, it’s that marketing strategies need to stay agile, and communications should always remain sensitive to global happenings.

So, how can brands make communications more empathetic and ensure they don’t create conflict within their own messaging? As one of the largest-scale health crises many of us will experience in our lifetime, the COVID-19 pandemic created a blueprint for how brands should—and shouldn’t—handle their communications during extraordinary circumstances.

Keep reading to learn how to approach empathetic communications for your brand in any event.

7 steps for communicating updates during uncertainty

There are many reasons you may have to send customers critical information in times of uncertainty.

It’s important to remain considerate about how often you relay announcements, what information you choose to share, and how you communicate certain messages.

The key is to keep your customers informed with need-to-know information, without spamming them with overbearing or unnecessary messages.

1. Consider which channel is right for your message

Not every update is right for every channel. Consider each marketing channel:

- SMS is the most intimate way to connect with your audience. It’s also the channel people use most to connect with friends and families during major events. Avoid this channel for communications immediately after an event to create space for more urgent conversations your customers might be having.

- Save email for messages you want to send directly to your community, including important customer updates. Be extra thoughtful about how often you’re inserting your brand into larger economic conversations.

- If you want greater visibility around announcements or statements you make as a brand, consider posting updates or empathy statements on social media. This allows you to get your message out on a more public platform.

Remember, the closer your message is to an event that causes uncertainty, the more sensitive your audience will be to its content.

2. Keep your customers informed

When local or global events affect your business operations, you may need to communicate important updates to active customers.

While it’s important to keep customers in the loop, think critically about how much information is necessary to share. The goal of your customer communications here should be to provide helpful information to customers. If your message doesn’t provide additional value and isn’t a follow-up to a recent customer experience, you might want to skip it.

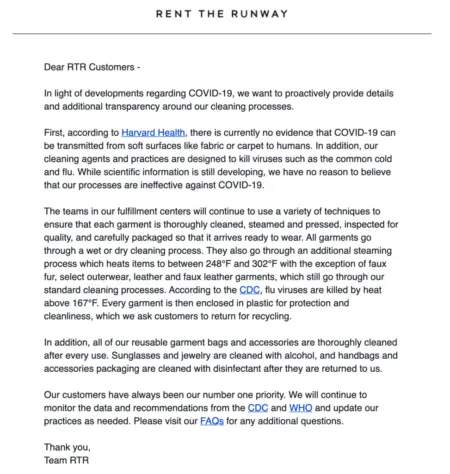

Here’s a great example from Rent the Runway, which sent out an email marketing campaign outlining their cleaning processes during the pandemic.

The team at Rent the Runway expertly handled the emerging situation by providing fact-backed updates based on customer inquiries and including customer support resources. They informed subscribers on a need-to-know basis, rather than sharing obvious or insignificant information.

You can also consider featuring these types of updates on your ecommerce website. Who Gives a Crap used this strategy to help keep their customers informed of the availability of their toilet paper during the pandemic.

“We tried to get as much information onto our website as possible—in our pop-up and our banners,” explains Mike Altman, senior retention manager. “We also have a blog that we updated regularly.”

That blog—appropriately named “Talking Crap”—kept their customers informed during the pandemic, while keeping things lighthearted.

3. Segment your audience to keep messaging relevant

People can get overwhelmed by information coming at them from every angle. They’re bombarded by the news, commentary from friends and family, and messages on social media.

This is where segmenting your audience allows you to more thoughtfully filter messages and communicate with your customers in the most effective way—ensuring you’re only reaching out to those who want to hear from you.

For example, you may want to consider setting up a list of customers who have purchased from you in the last 90 days. Especially if your brand is large and has a long list of subscribers, this will ensure your message only goes out to your most engaged subscribers.

4. Provide retail updates to address confusion

You may need to provide additional transparency about the status of your physical locations and your ability to serve customers in-store. Consider updating your website to address the current situation, even if that just means a header bar that addresses store closings and your ability to fulfill online orders.

You can also segment your emails by geo-location, so that updates about store closings or other essential information only go out to people living in the affected area. For example, if you’re closing a store in New York City, you can email a segment of your subscribers within a certain radius with specific details about the store’s closing.

Additionally, take the time to update your search listings to reflect store closings, services available, and an up-to-date website address. You can also include contact information and any other relevant details that may be helpful to your customers during this time.

5. Avoid messaging that’s insensitive

Many brands continue to encourage their customers to support their business by shopping with them during uncertainty. Consumers generally understand brands have to keep the lights on, but some messages are in poor taste.

While you may want to give customers an incentive to shop, for example, referring to the cause of uncertainty in your discount code—“COVID19” or “coronavirus”—is probably not the best way to represent your brand.

There are better—and more sensitive ways—to offer discounts.

Supply, for example, offered customers this chance to win a “version of a stimulus package” with $1,200 in cash during the pandemic. Supply asked their customers to submit a video using their product for a chance to win the prize.

This contest not only encouraged customers to submit user-generated content (UGC), it also kept the brand relevant to shoppers without coming across as crass.

During times of uncertainty, it’s more important than ever to be sensitive with the language you use in marketing materials. The last thing you want to do is to appear to be taking advantage of a crisis to make more sales.

Make an effort to align the tone of your marketing with the gravity of the current situation, without sounding flippant or disrespectful.

6, Highlight relief efforts by your company and others

A better way to use your marketing materials during uncertainty is to show how you plan to give back to your community. Explain how you’ll donate some of your proceeds to relief efforts or provide examples of how you’re helping your community.

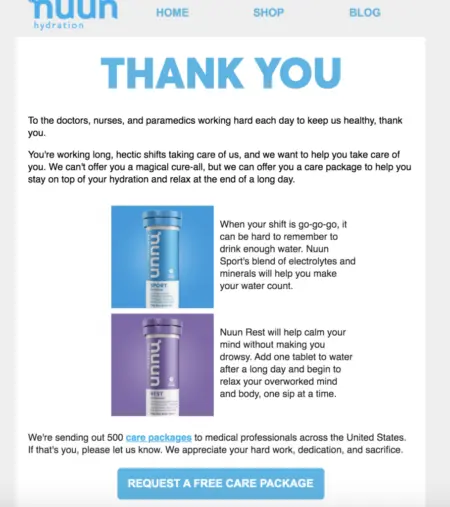

While Nuun explained the benefits of their products in this email, the main message was that they sent free care packages to medical professionals during the pandemic.

Consumers want to hear how brands are helping. If your company is giving back to your community, highlight those efforts and let your customers know how they can contribute to the cause.

Of course, always be cautious with these communications. You don’t want your marketing to come across as virtue signaling.

You may want to reconsider a purchase-to-donate campaign, for example, as they’re often met with swift backlash. Many customers may view this kind of campaign as your brand capitalizing uncertainty—and question why your company wouldn’t make a donation independently.

4 steps for sharing content during uncertainty

Just because you’re communicating critical company updates or announcements doesn’t mean you have to suspend all other activities completely. But it’s important to consider how and when to convey these messages.

1. Reposition planned initiatives

Depending on the magnitude of uncertainty, you don’t necessarily have to interrupt or delay a campaign. Consider how you can reposition your product launch in a way that feels more appropriate for the moment.

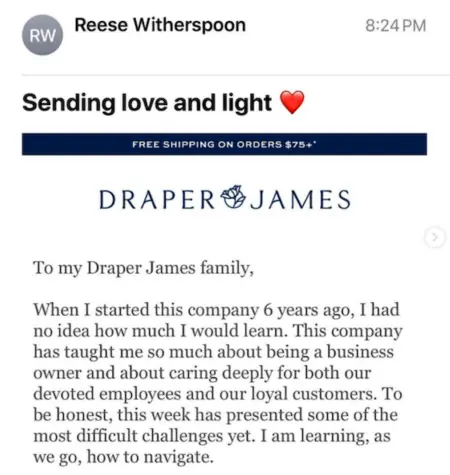

Take a look at this eloquent email from Draper James, written by founder and actress Reese Witherspoon. Her note obliquely addressed the pandemic, but in an effort to consistently be a “source of happiness and positivity” in customers’ lives, the message gently introduced Draper James’ spring collection, asking if the timing was right to share. The company also reposted the email on its social media channels.

The brand handled their new collection launch with respect and understanding for the situation, instead of ignoring the challenges that their customers were going through. They also welcomed feedback while approaching self-promotion delicately.

Similarly, when Dagne Dover announced its spring collection in an email, they addressed the pandemic directly.

Here, Dagne Dover shows that there’s no need to make a grand statement or offer suggestions on how to get through. Sometimes it’s enough to simply acknowledge the challenges consumers are facing.

2. Update marketing automations

If it’s not business as usual, your communications in marketing automations shouldn’t be, either.

Perform an audit of your regularly scheduled messages. Take a look at your content calendar for the coming weeks and decide whether the content and automations you have scheduled are still appropriate. Ask yourself:

- Is this content still relevant?

- Could this content come across as insensitive to customer pain points?

- Could we use more empathetic language?

- Is there anything we could do to make it more helpful?

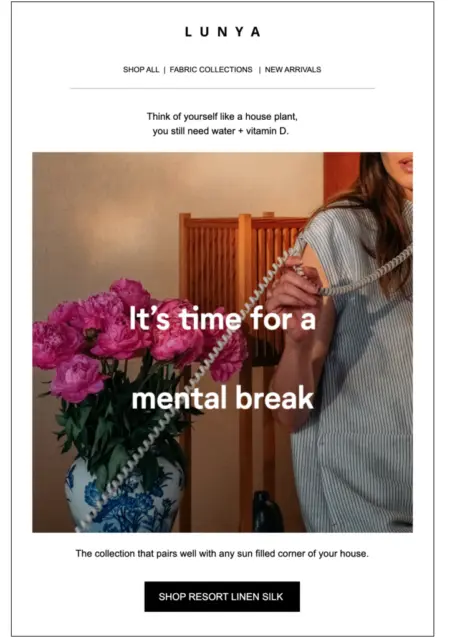

One brand that did an excellent job of adjusting their content is Lunya, brand that put extra effort into optimizing every touchpoint during the pandemic.

Subject lines like, “Soft things for hard times,” “Business not as usual,” and “We’re all in this together” struck the right tone and gave a subtle nod to the current climate, without being flippant. The brand demonstrated that they know their place in their customers’ lives as a source of comfort.

3. Spread some joy when the time is right

When it comes to building deep, long-lasting relationships and instilling customer loyalty, it’s important to show empathy for your customers’ situation personally and professionally. People often welcome distractions to get their minds off thinking about what’s in the headlines.

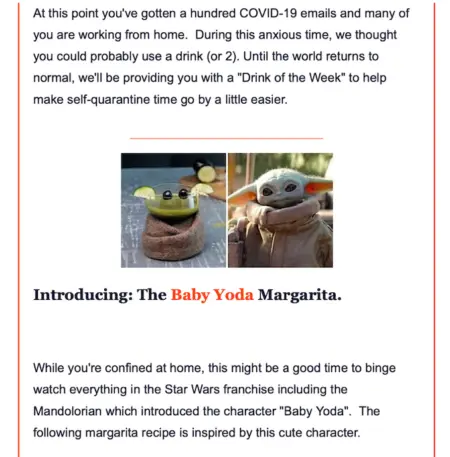

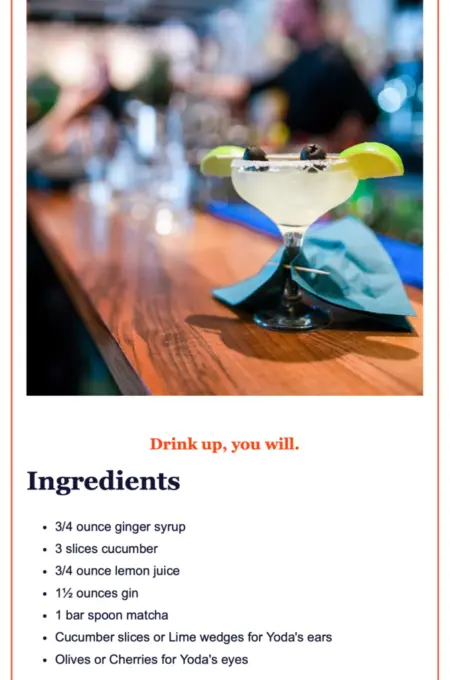

Find small ways to delight your customers. This email from Host Events strikes the right balance between lighthearted and compassionate.

Host Events couldn’t provide its usual service, but it could still offer value to its customers with a recipe to make their own specialty cocktail at home.

4. Ask your community what resonates with them

Nobody has all the answers as to how you should be talking to your customers during uncertainty. Some customers will want to receive frequent updates from your company, while others prefer a more hands-off approach.

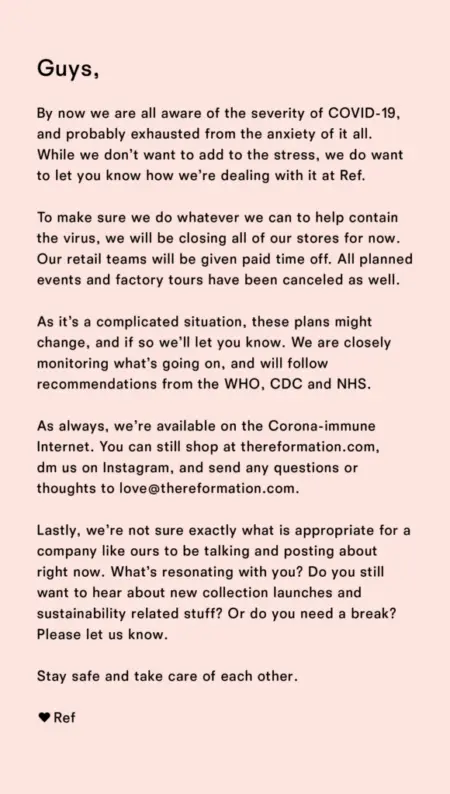

Reformation asked their customers directly for validation around what they wanted from the brand during the pandemic. In an email, the team explained how they were responding and asked for customer feedback on what sort of communications would be most appropriate.

The email asked, “What’s resonating with you? Do you still want to hear about new collection launches and sustainability related stuff? Or do you need a break? Please let us know.”

This small effort inviting people to share their point of view on the situation opened up a dialogue between Reformation and their customers. It ensured that whatever Reformation was sending out—whether it was new arrivals or business updates—they were being cognizant of what their unique customer base wanted to hear about during a sensitive time.

The key to navigating a fluid situation: stay true to your brand values

Staying true to who you are as a brand is the best strategy.

When you’re as authentic, empathetic, and transparent as possible with your customers, you continue fostering the relationships you’ve already built—and nurturing the new ones that will grow as a result of how you respond during this time.

Naadam took this approach with an email they sent to their customers at the beginning of the pandemic.

Smart business owners are constantly adjusting and adapting their marketing strategies. Listen to your audience and use empathy to guide your customer relationships. You’ll be better equipped to move your business forward during uncertainty.

Related content

Discover the best marketing automation platform for 2026 and learn how to choose based on data, integrations, scalability, and the features that drive real customer value.

Discover 4 proven ways to reduce cart abandonment and recover lost sales. Learn how to build trust, streamline check-out, and personalize abandoned cart flows to convert more shoppers.

Looking for the best Shopify apps for marketing and customer service? Klaviyo, Rebuy, and Recharge together create a high-performing tech stack that revenue and customer retention.