Meet K:AI, AI that does the work

K:AI creates winning strategies, builds launch-ready campaigns, answers customer questions 24/7, and helps you sell more by personalizing every interaction. All powered by your data—all where you already work. You take the lead, K:AI does the rest.

K:AI agents

What if AI could do your work for you? With an agent for marketers and an agent for customers powered by K:AI, your data can be used to automatically create on-brand, launch-ready campaigns, resolve customer issues, and sell 24/7. K:AI agents are everything you want in a teammate, built right into the Klaviyo platform.

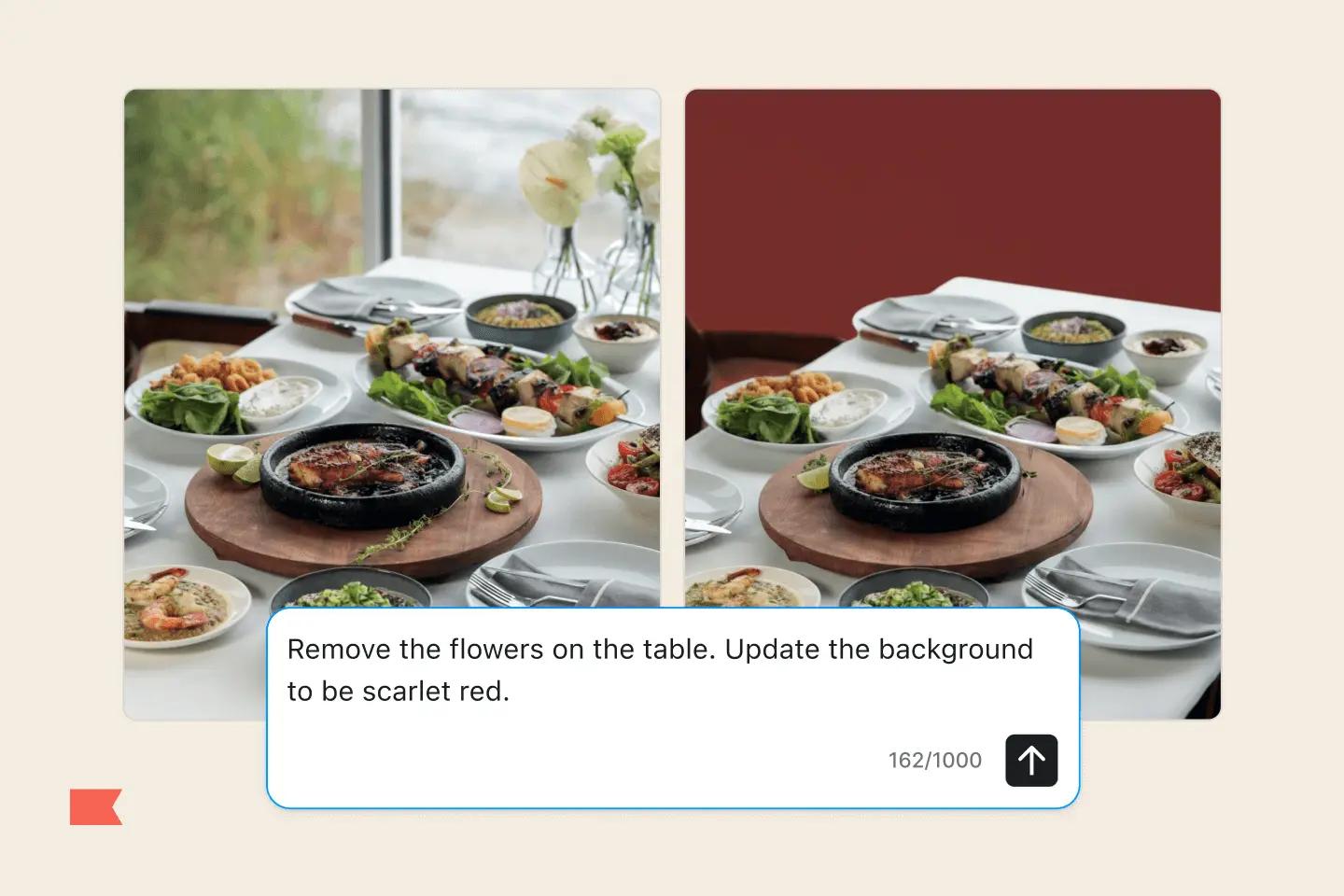

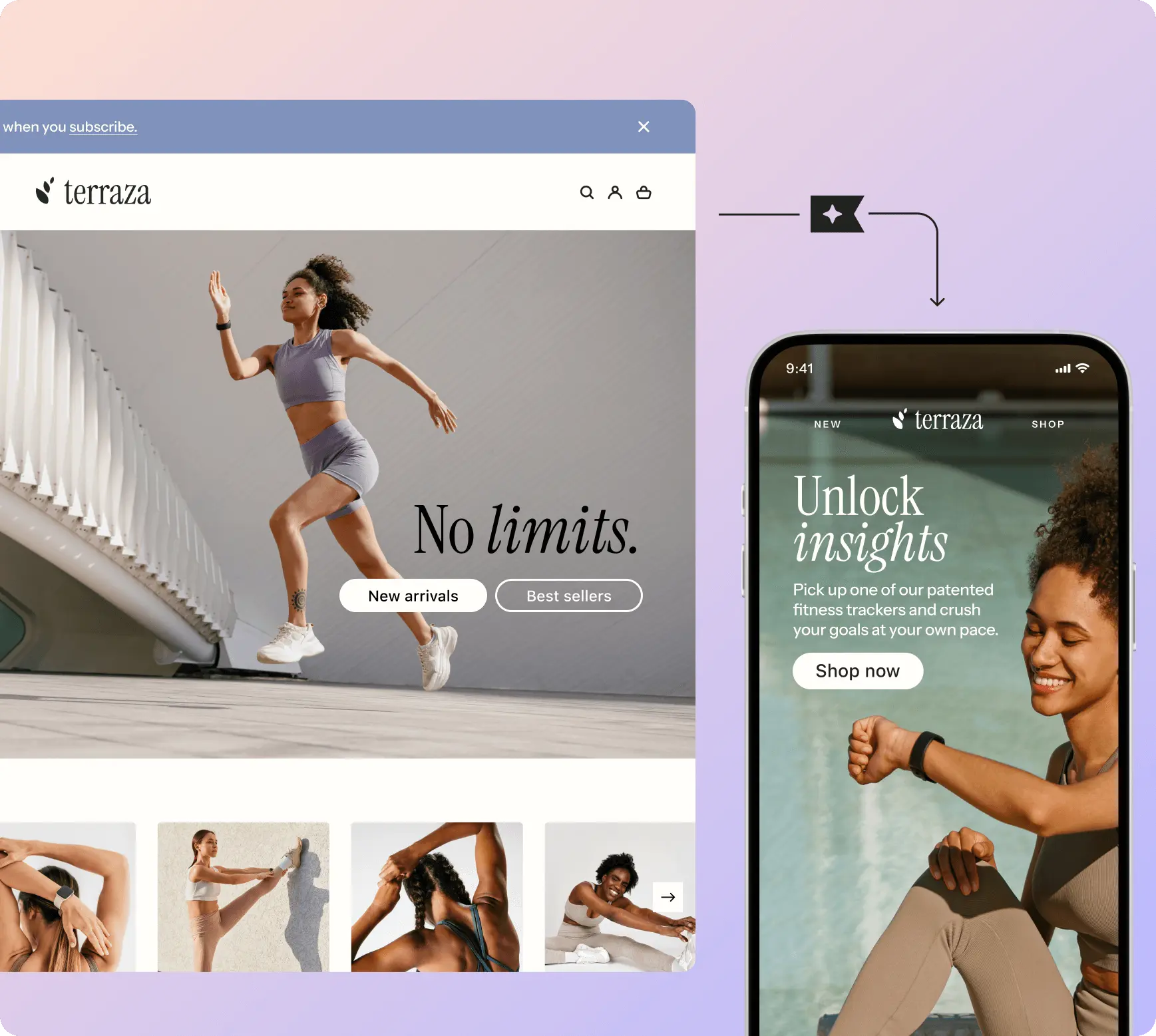

K:AI Marketing Agent

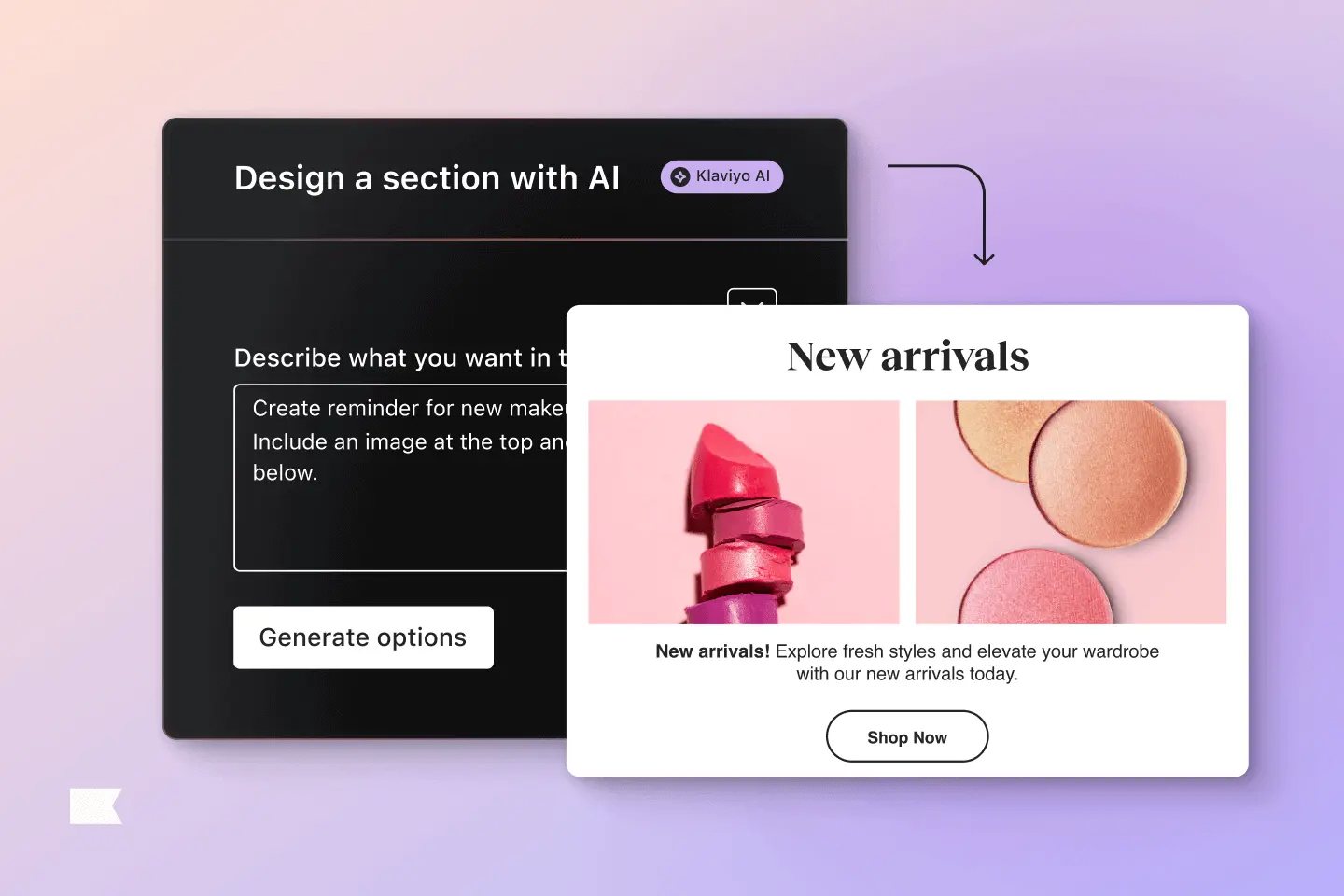

Marketing Agent learns from your website to create launch-ready campaigns.

Go from monotonous to autonomous

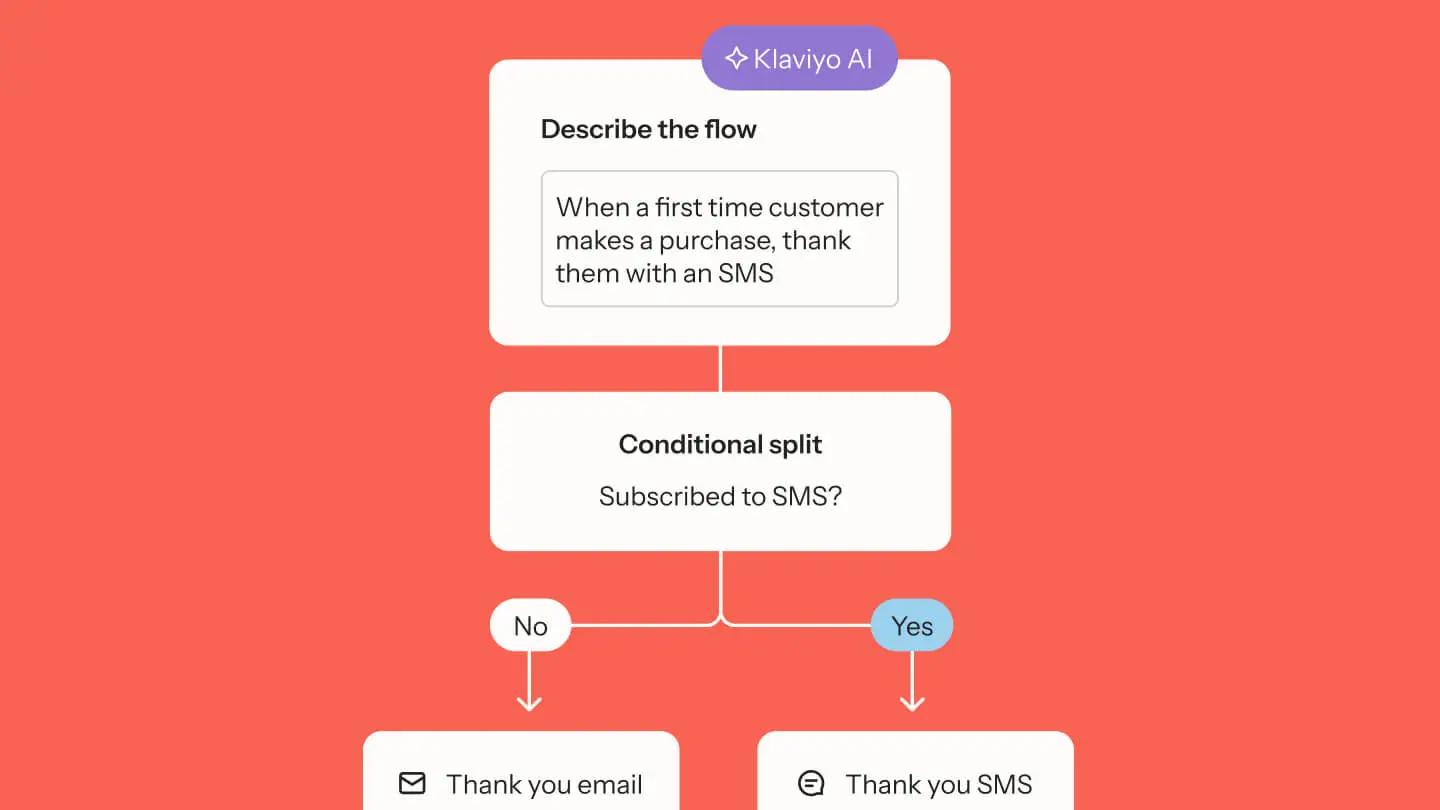

New No need to spend your time planning, creating content, and optimizing when Marketing Agent is here to do it for you—no prompts required.

Start fast

Get up and running in just 3 clicks—enter your website, and AI automatically creates your fully designed on-brand campaigns, sets your must-have flows live, and launches your first form.

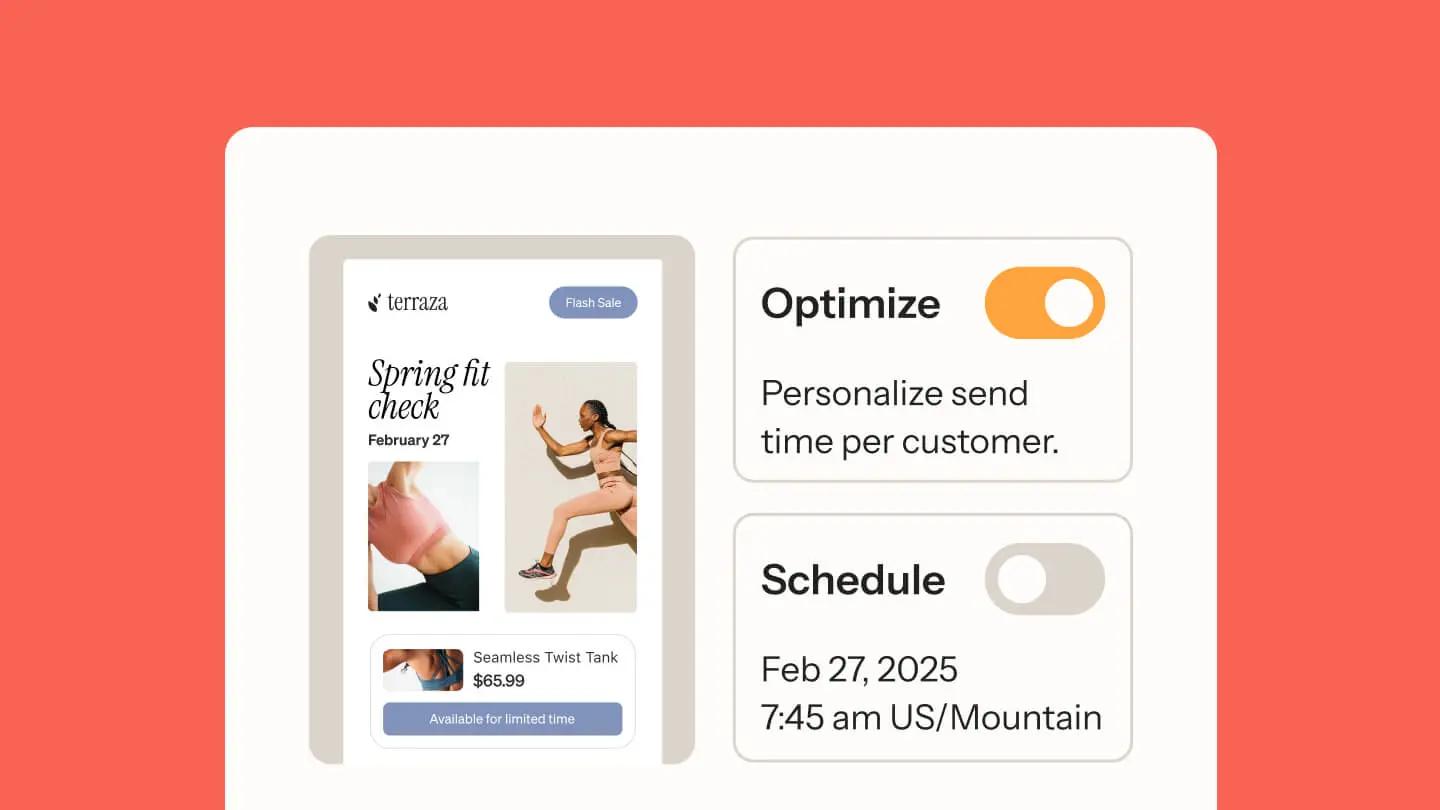

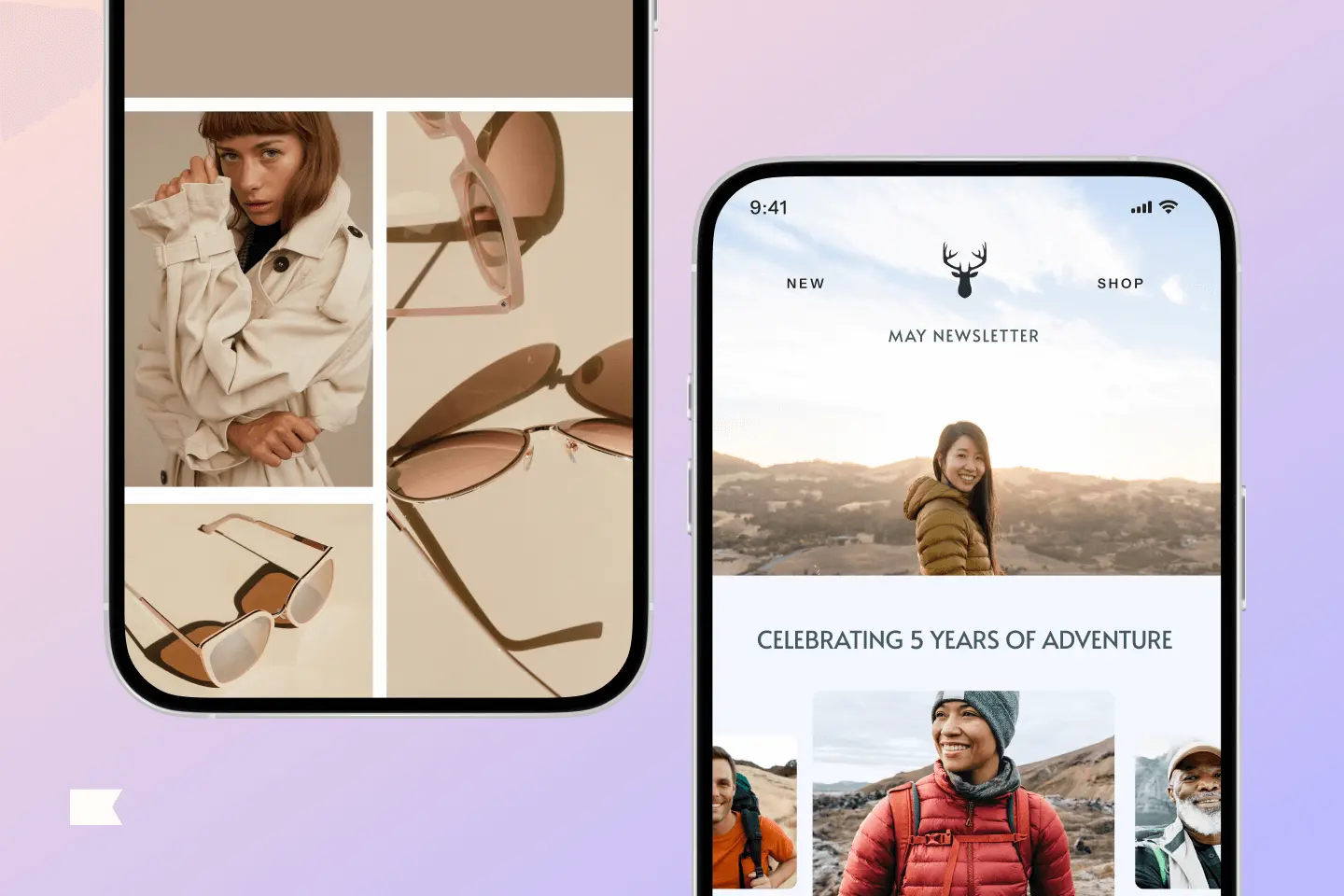

Scale content

Keep customers engaged—Marketing Agent generates fresh, strategic, on-brand content and weekly campaign ideas fast, based on historical performance and seasonal insights.

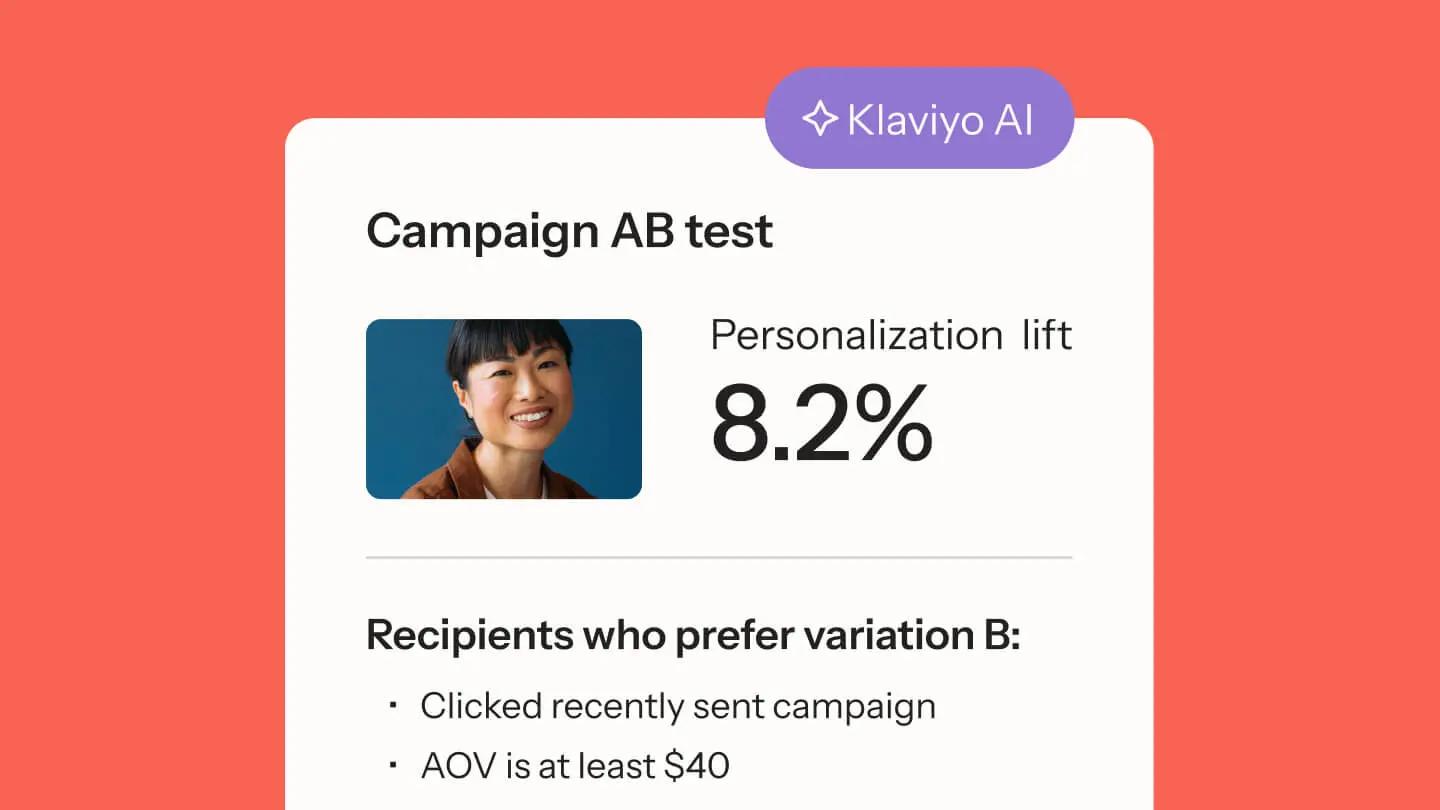

Optimize growth Coming Soon

Never miss a conversion—Marketing Agent continuously tests timing, creative, and offers across channels, then automatically applies what wins to improve performance and lifetime value.

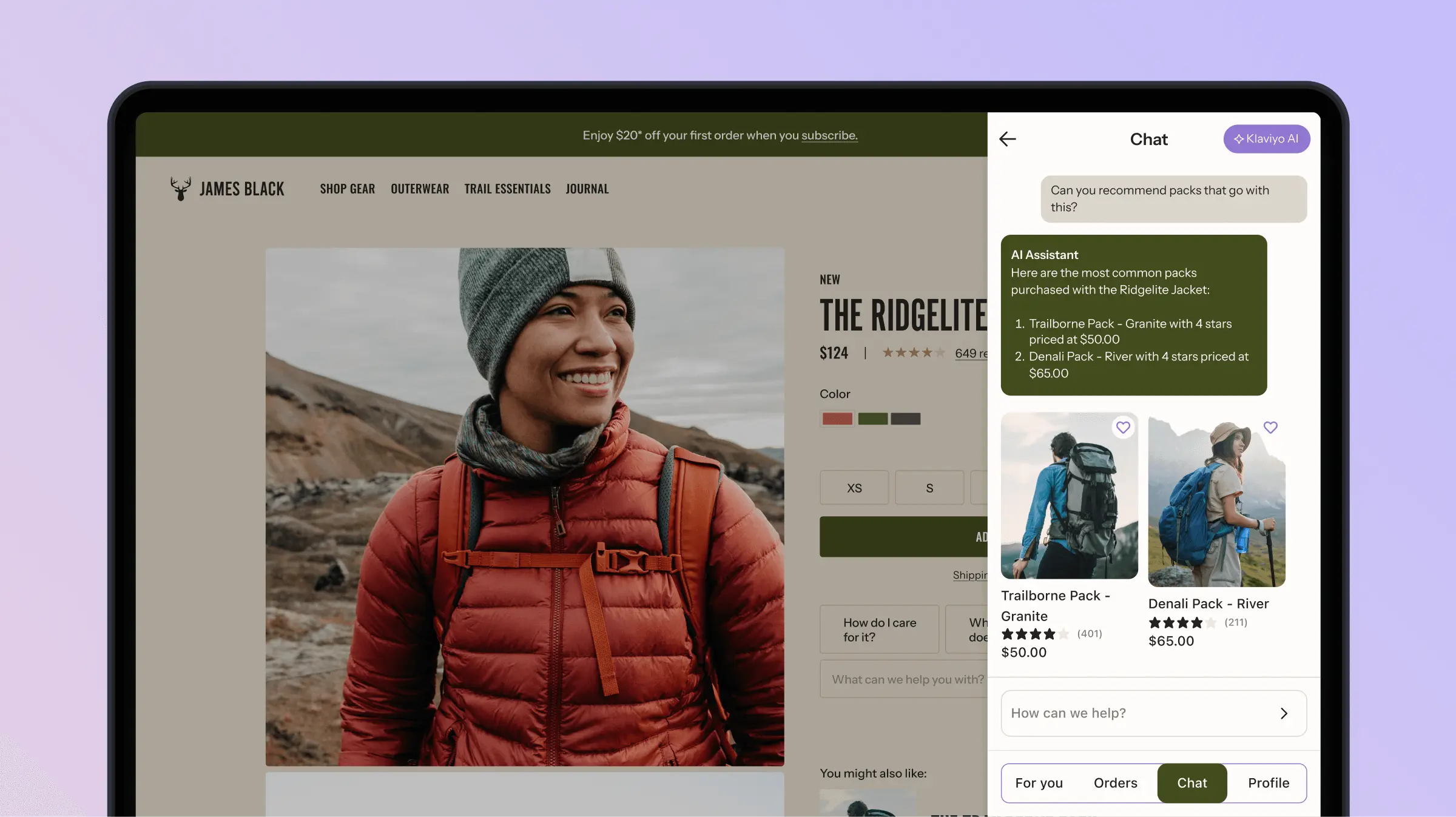

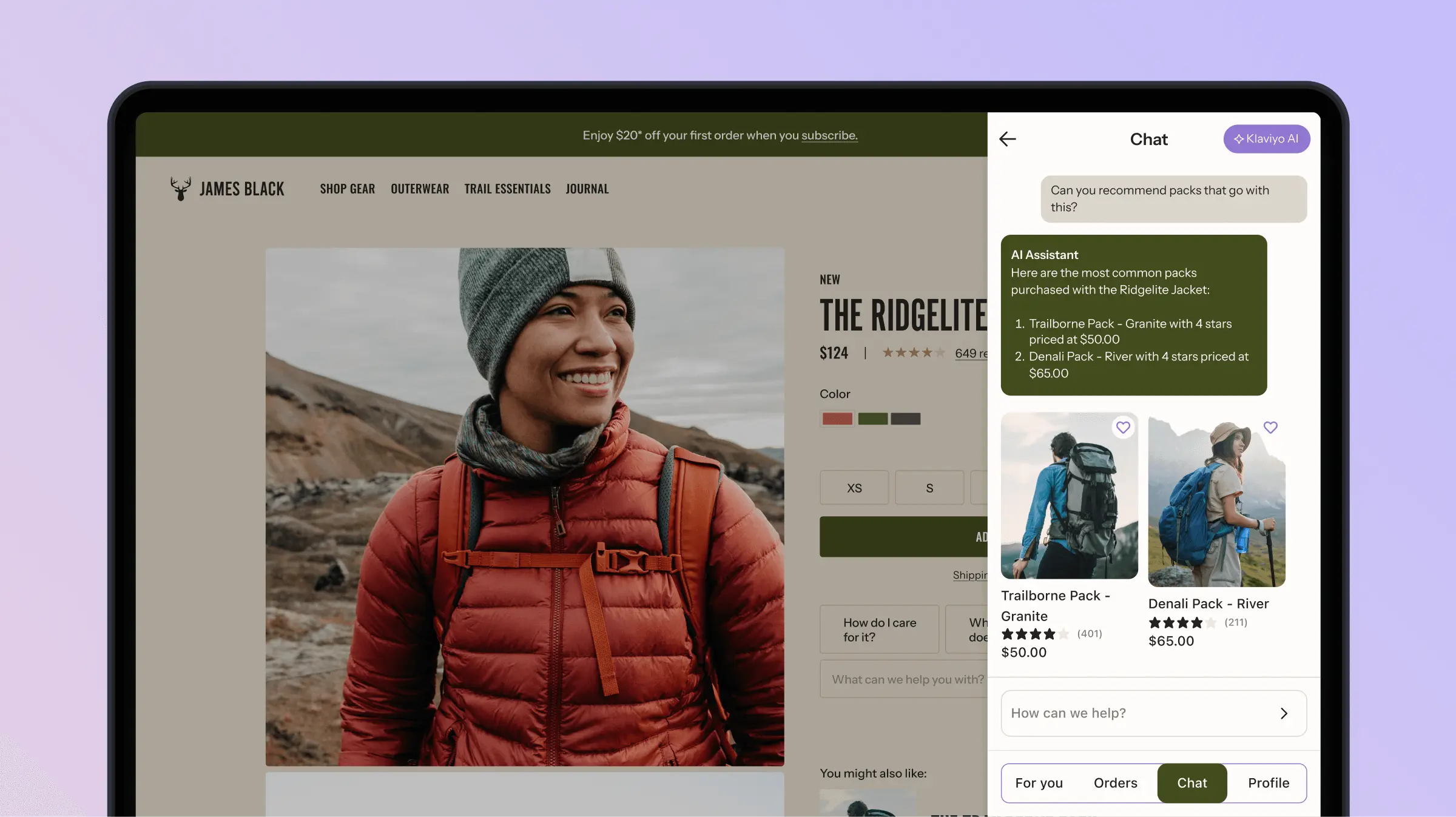

K:AI Customer Agent

Give your customers a personalized assistant that works 24/7 to resolve issues, answer questions, recommend products, and start returns (coming soon). And when a live agent is needed, it hands off the convo with full context. It’s a win-win.

Go from conversation to conversion

New Customer Agent is your best sales rep, available to your customers anytime across every channel—web chat, SMS, email, and WhatsApp (coming soon).

Ready on day one

Learns your storefront, policies, and help content instantly—no developer required.

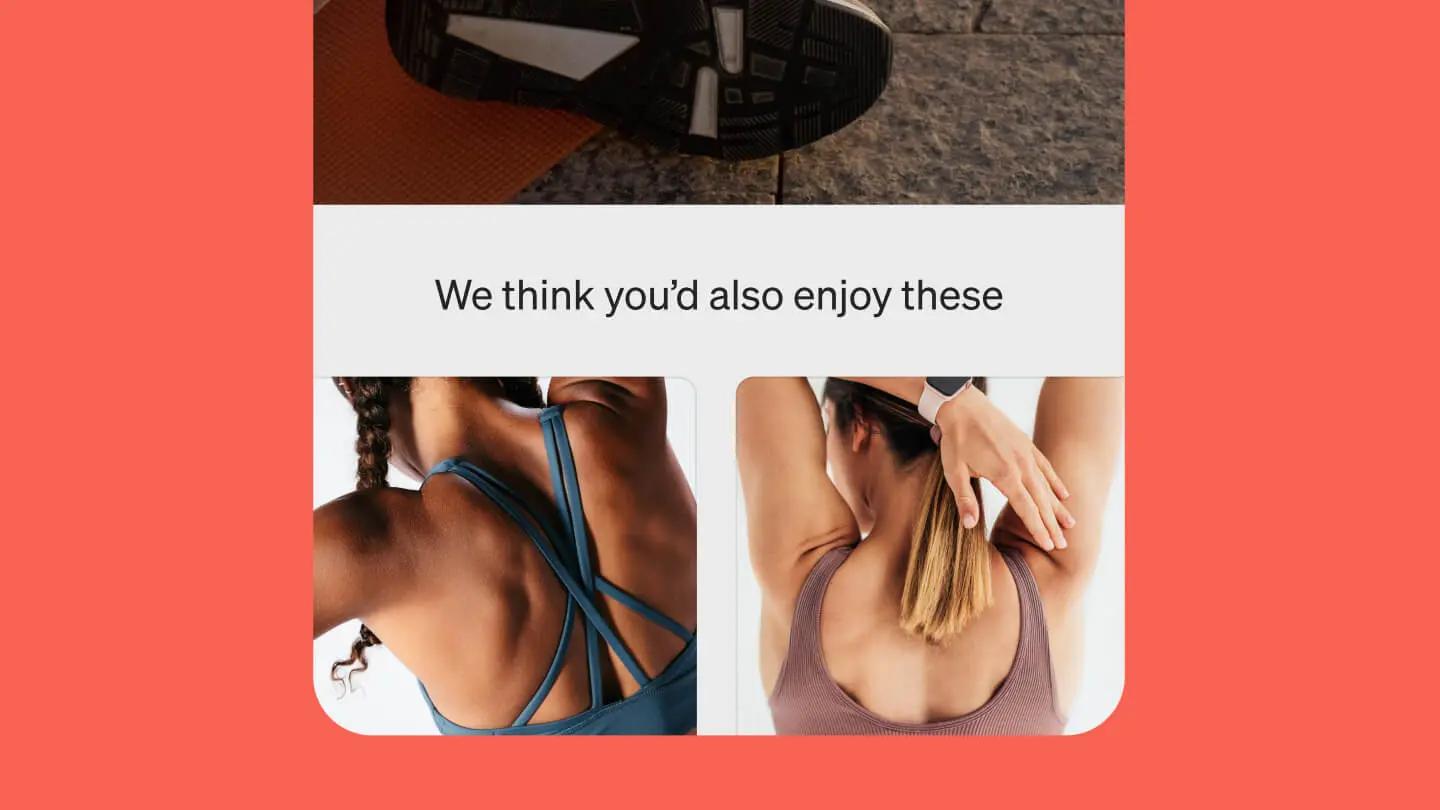

Drives more revenue

Suggests personalized products that shoppers can add to their cart directly in the chat.

Pre- and post-purchase resolutions

Helps with order status, returns, subscriptions, and more, from “just browsing” to “just bought.”

Seamless handoff to live agents

Escalates to your team when needed—with full context—so nothing gets lost.

Plays well with others

Becomes an even more powerful tool when paired with Customer Hub for self-service and Klaviyo Helpdesk for live agent support.

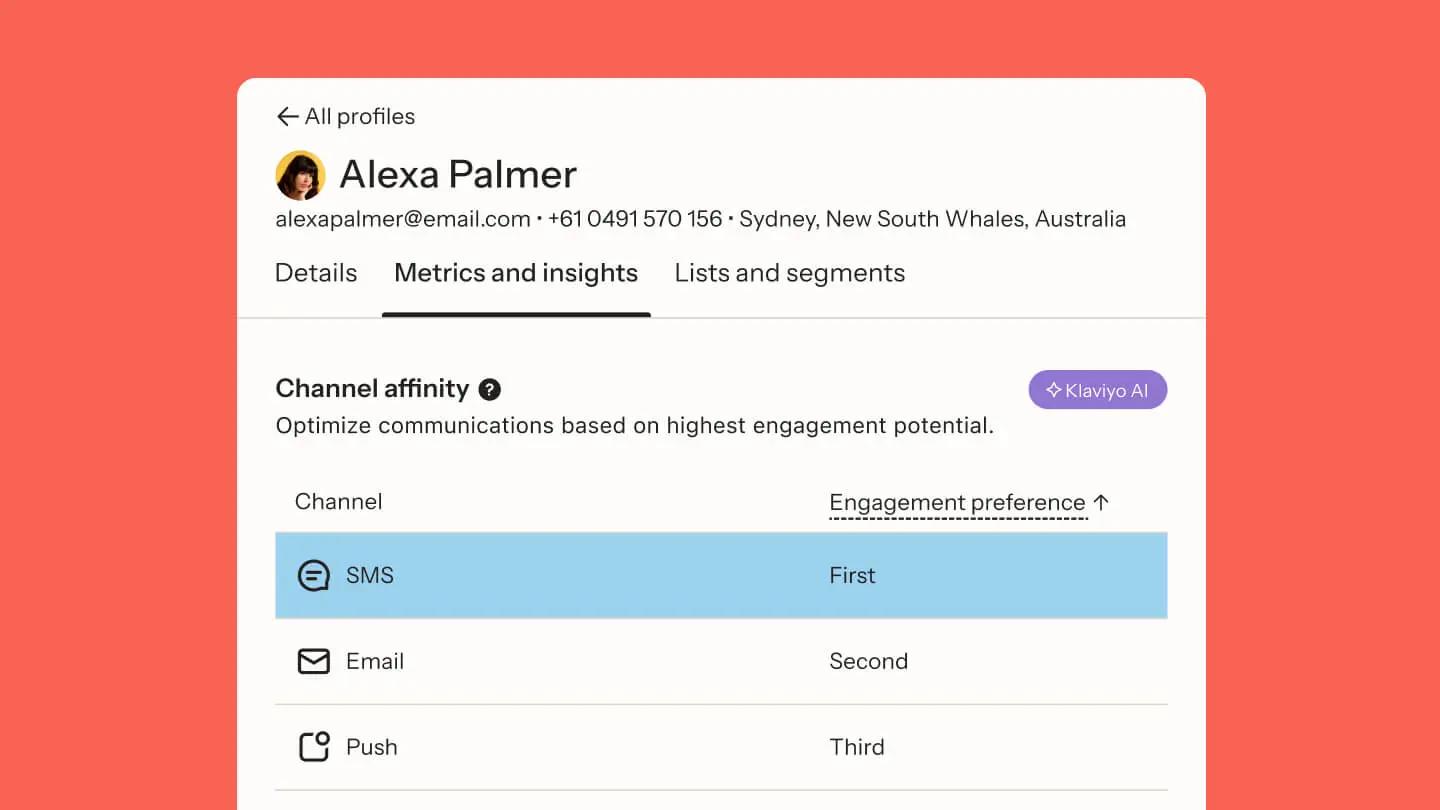

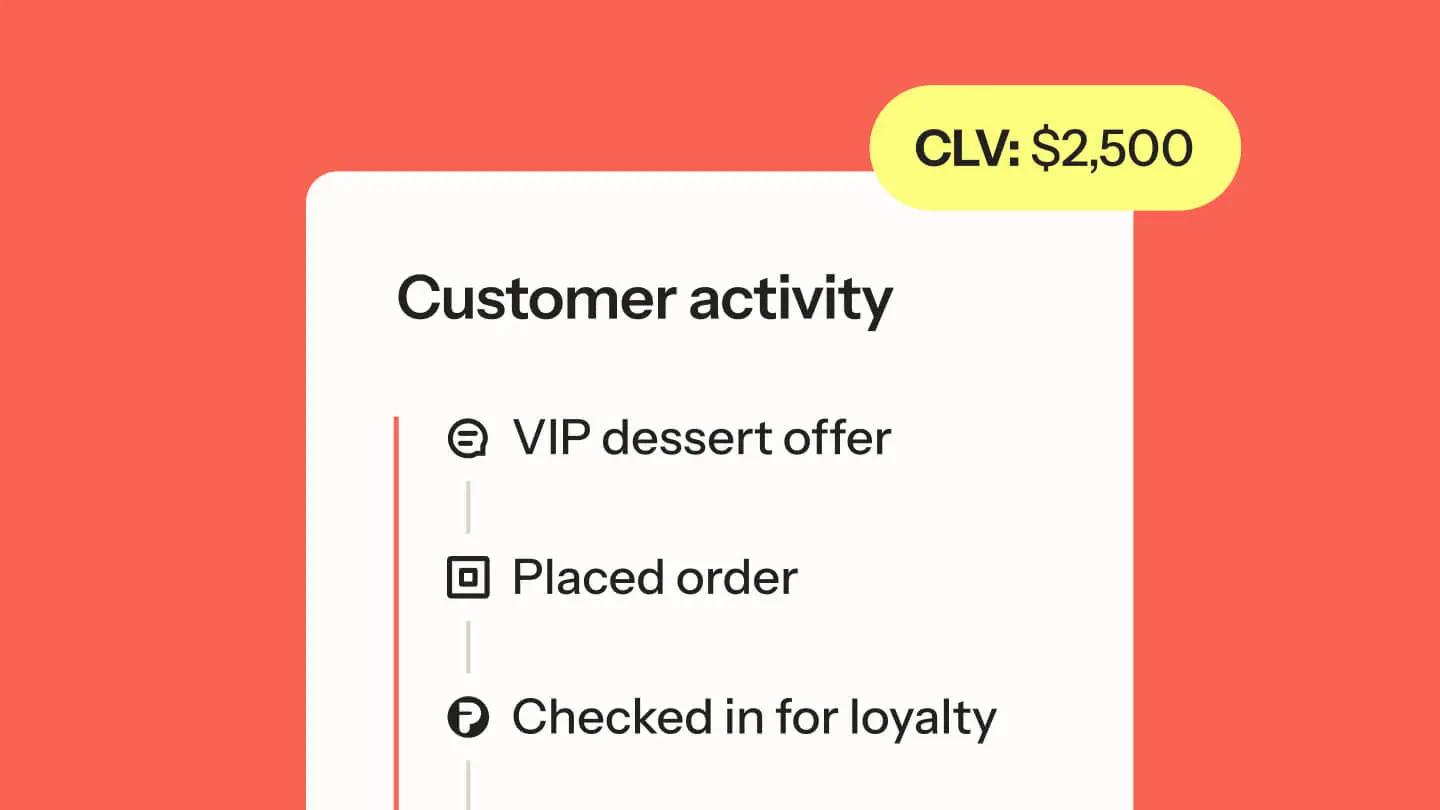

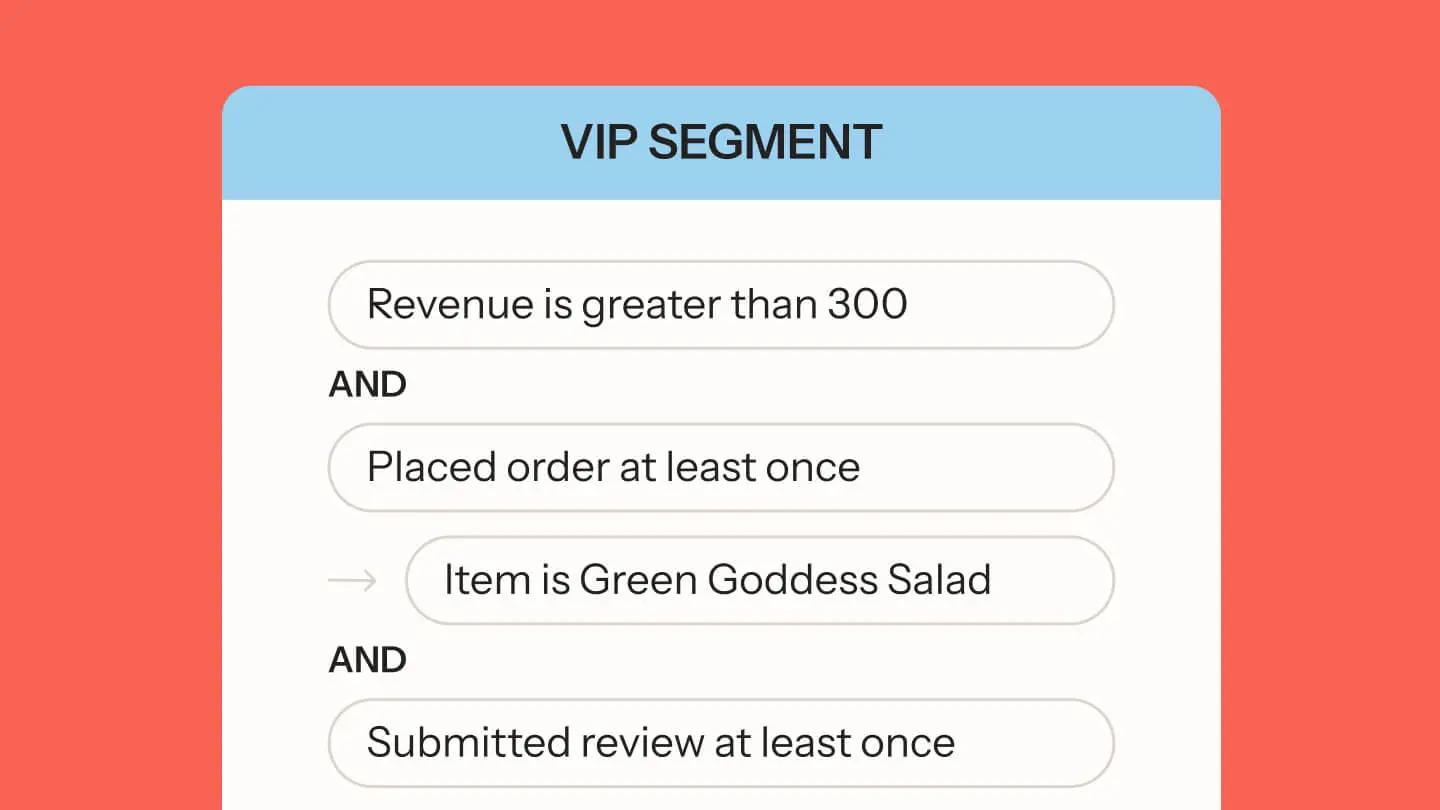

AI-powered personalization that scales

No more guesswork. No more generic sends. With over 40 AI-powered features built into Klaviyo B2C CRM, sending the right message, with the right product, at the right time, on the right channel—to each and every customer—is effortless.

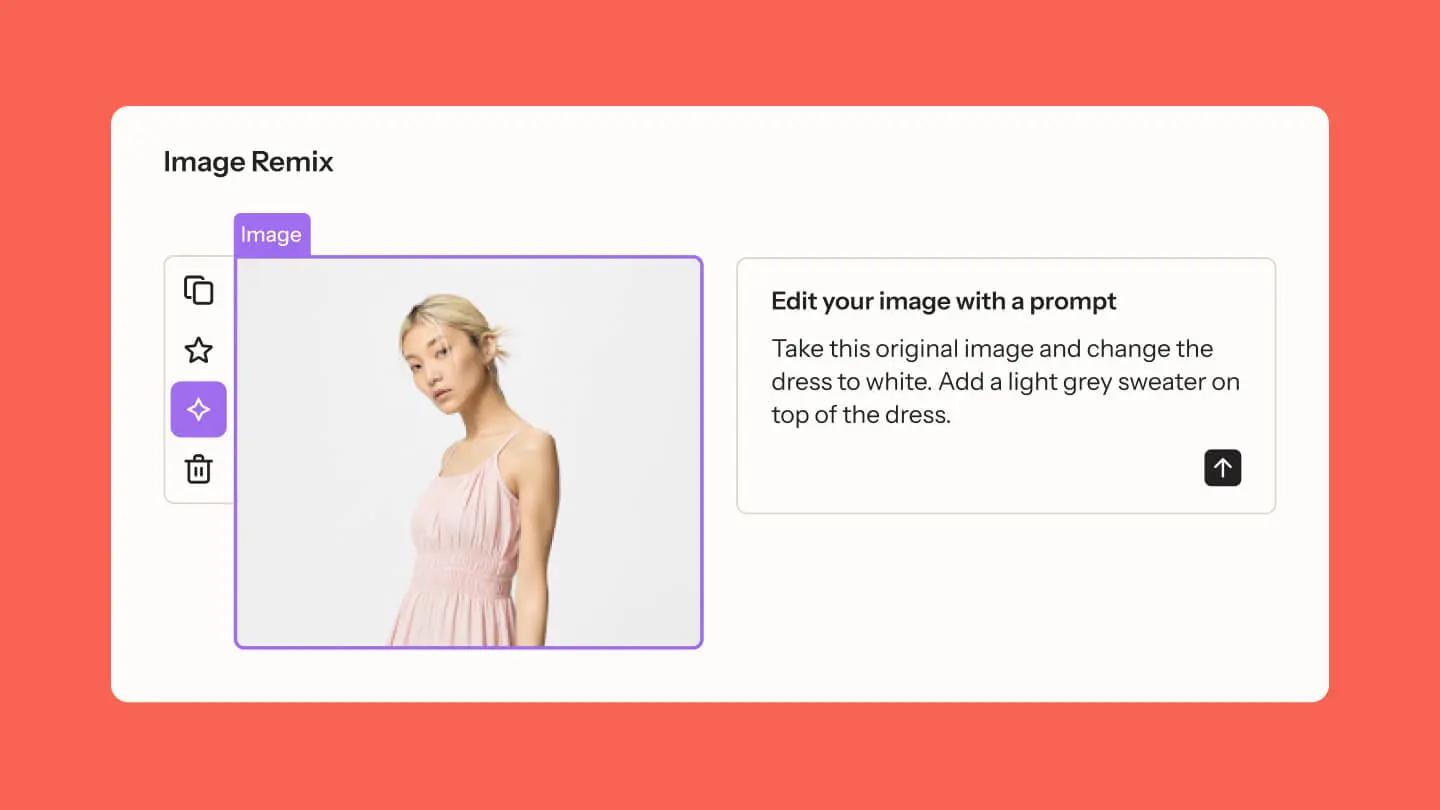

Personalize faster with built-in AI tools

“Klaviyo, supercharged by its powerful AI features, enables us to easily and effectively build complex automated flows that deliver the right message to the right customers, in the right region, at the right time.”

-Jarrod Hinvest, Head of ecommerce, Culture Kings

Why K:AI?

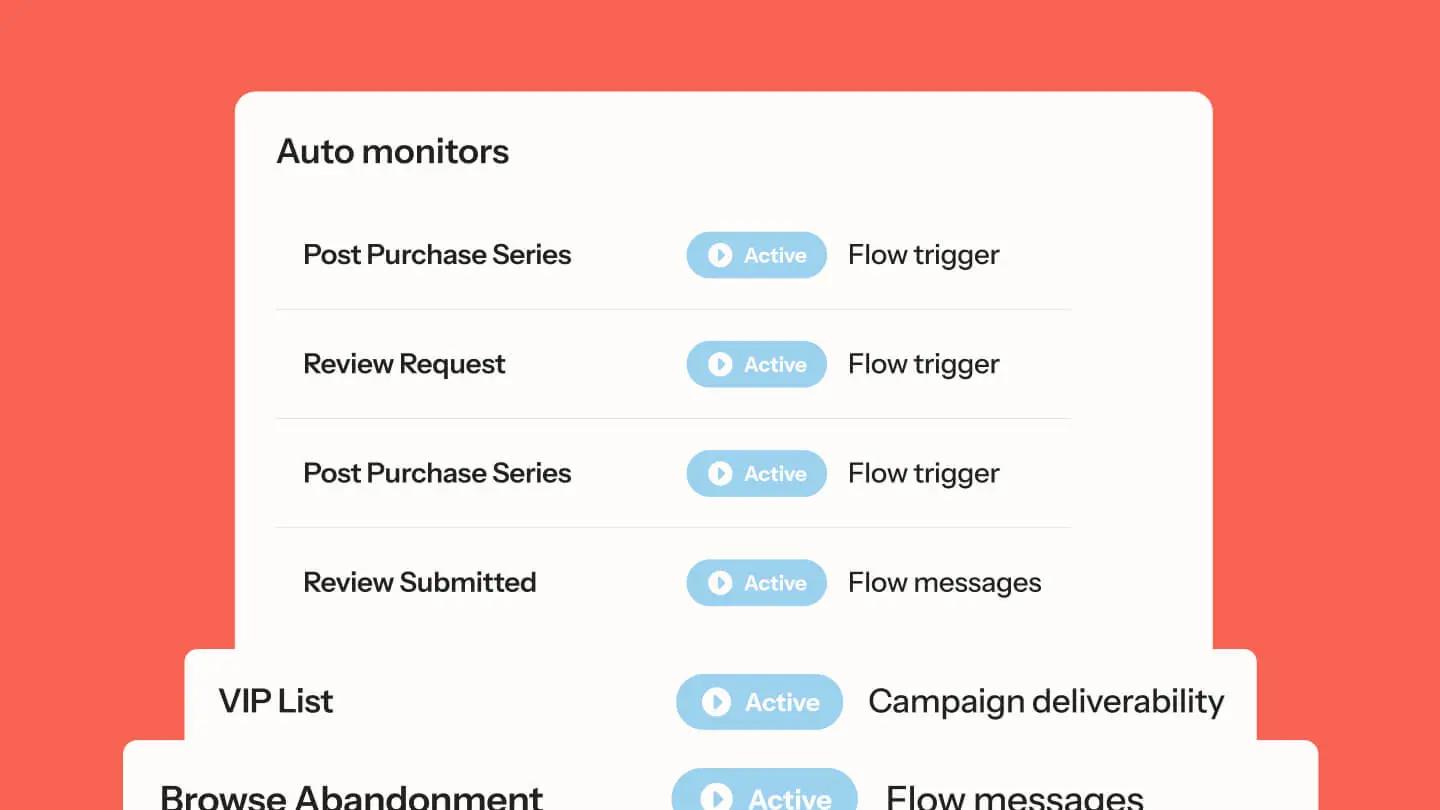

Works where you work

K:AI is embedded in every workflow and acts on your behalf across marketing, service, and analytics—and with agents, there are no prompts needed.

Data you own and trust

K:AI is trained on your brand, website, catalog, and profiles—because AI is only as good as your data.

Continuous innovation

We’ve been building AI features since 2017, with over 40 features available today—and counting.

Open by design

Our remote MCP server allows you to connect Klaviyo B2C CRM with your preferred AI tools.

AI your way

With K:AI, you have the power to use AI your way—from predictive AI for insights and speed to assistive AI for co-creation—and now, K:AI agents that act autonomously.

Klaviyo AI tools and resources

Klaviyo AI FAQ

K:AI is AI powering built-in agents that use your real-time customer profile to plan and launch marketing, personalize every send, and resolve customer requests – on one platform, with humans in the loop. Learn more about Marketing Agent and Customer Agent.